Follow the money: How a tiny nation became the financial hub of the rich — and the corrupt

In 2019, an announcement appeared in the Spanish press. A major stake in Spain’s largest weapons manufacturer, Maxamcorp, which has a long history dating back to its founding by Alfred Nobel — of Nobel Prize fame — in 1872, had been sold.

The Spanish government approved the deal, and everything seemed to be proceeding normally, but for those following closely, the situation was bizarre: Nobody knew who the real buyer was.

On paper, it was Prill Holdings, a company based in Luxembourg. But who lay behind Prill?

The only available information about the company’s owners showed two firms registered in the Cayman Islands. These are linked to a U.S. private equity company, Rhone Capital, but little else is known about them. To some, the opacity was disturbing.

“It is unacceptable that the Spanish government is green-lighting a company to operate in a sector that has many human rights implications without knowing who is behind it,” said Susana Ruiz, Tax Justice Coordinator for Oxfam International, a poverty-fighting nonprofit.

Prill isn’t the only mysterious company registered in Luxembourg. Though it’s one of the smallest nations in the world, Luxembourg hosts an enormous amount of financial activity, almost all of it originating abroad. Nearly 90 percent of companies registered in the country are controlled by non-Luxembourgers. At least 266 members of the Forbes billionaire list — none of whom are locals — have companies there. And about 40 percent of Luxembourg companies were set up merely to hold assets, without generating any other economic activity.

Essentially, the country functions as an offshore hub in the heart of Europe.

Secrecy and tax advantages have made Luxembourg attractive to American sports stars with money to burn, Cuban-linked companies looking to evade the U.S. embargo and Venezuelans attempting to hide their profits, allegedly siphoned from that socialist country.

Many Luxembourg companies are in full compliance with the law and exist for legitimate reasons. But others are owned by people with political exposure, corrupt officials, and even organized criminal groups.

The biggest draw might be Luxembourg’s reputation for secrecy. This has made it a magnet for people seeking to “disconnect themselves from their holdings,” says Gabriel Zucman, an associate professor of economics at the University of California, Berkeley.

Holding assets in Luxembourg companies “is going to make it harder for authorities to link assets to their owners, which is going to make it harder for authorities to investigate cases of corruption or fraud or tax evasion,” he said. “That’s the key service that’s provided by this segment of the financial industry.”

So much Russian capital has found its way to Luxembourg — and back again — that the tiny European state is now one of Russia’s biggest foreign investors. “That is not because Luxembourg is investing to build factories in Russia,” says Benoît Majerus, a history professor at the University of Luxembourg. “It is clear that it is Russian money circulating in Luxembourg and returning to Russia.”

From Magic to Tiger to Brangelina: Why rich, famous stash assets in this speck of a country

Italian prosecutors say members of the ’Ndrangheta mafia have flocked to Luxembourg, seeing it as an “extremely attractive” place to keep ill-gotten cash out of reach.

And investigators in at least three South American countries are looking into allegations that political figures stashed bribes in Luxembourg companies.

“We are worried,” Laurent Lim, a policy officer for the European Commission’s Directorate-General for Financial Stability, told the Organized Crime and Corruption Reporting Project, a global network of investigative journalists. “Luxembourg is known for this matter of taxation, but we must also start talking in terms of money laundering.

“Until last year there was no transparency,” he added. “Until last year a company could be created and there was no way of knowing who was the beneficial owner.”

Now, there is — at least, in theory.

In 2019, to comply with a European Union directive on anti-money laundering, Luxembourg set up a registry of corporate beneficial ownership, forcing the 124,045 companies registered in the duchy to identify their ultimate beneficial owners (UBOs).

Luxembourg was one of the first countries in Europe to do this, and anti-corruption campaigners see it as a major step forward.

But as implemented, the database has some critical limitations. One of the biggest is that it is only searchable by company name, not by owner. This makes it difficult for journalists and members of the public to determine who owns what.

Last year, the French newspaper Le Monde obtained millions of documents revealing all the companies registered in Luxembourg and the newly declared names of their UBOs. OCCRP’s data and technology teams made these documents fully searchable, then opened them up to journalists from media outlets around the world, including the Miami Herald, el Nuevo Herald and their parent, McClatchy, allowing them to search by owner for the first time.

Click to read more about the Luxembourg business registry and the OpenLux project

The names they found were striking. Mingling alongside billionaires, singers, actors, and sports stars were compromised officials, leaders of criminal organizations, and friends and family members of prominent political figures from around the world.

Among the beneficial owners spotted by journalists were:

▪ An arms dealer at the center of one of the biggest corruption scandals in France;

▪ The Kremlin-connected leader of one of the largest Russian criminal organizations;

▪ An ex-son-in-law of Tunisia’s former dictator;

▪ A close confidante of Serbia’s president;

▪ The teenage children of a Russian oligarch;

▪ A Turkish businessman accused of being linked to a $511 million tax scheme;

▪ An Indonesian palm oil magnate considered responsible for the destruction of thousands of hectares of virgin forest; and

▪ Several members of the ’Ndrangheta, Italy’s most powerful criminal group.

Given the natural user base of secrecy jurisdictions, the presence of criminals and politicians should not be a surprise, Zucman says.

“Who are the users of these offshore tax havens?” he asks. “It’s a mix of tax evaders, tax avoiders, criminals, money launderers, corrupt business people or political elite.”

We can assume that these names were intended to stay hidden. Many of these companies were registered in the name of figureheads so their ultimate owners’ names would not appear in public.

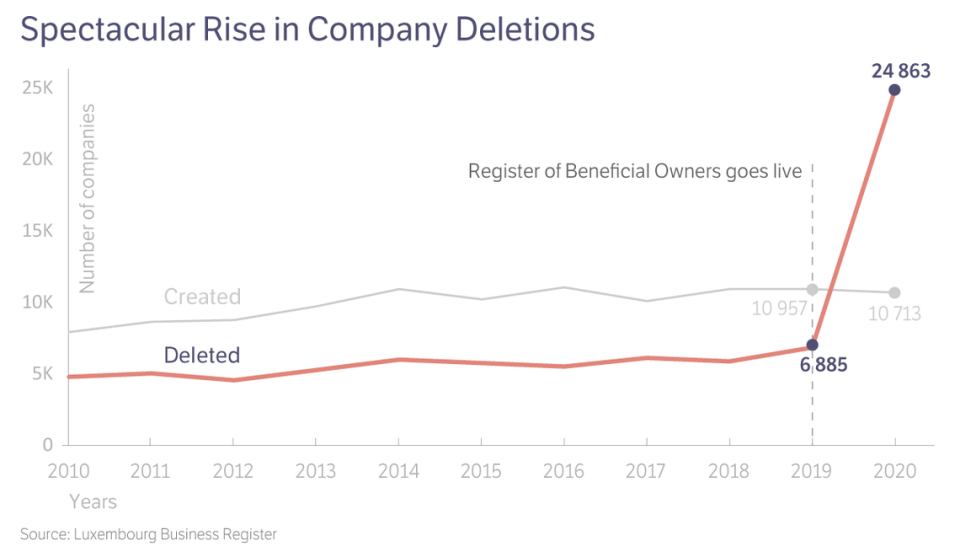

In 2020, the year after Luxembourg’s UBO register went live, there was a huge rise in company deletions. For the first time in the country’s history, more companies were deleted from the books than created.

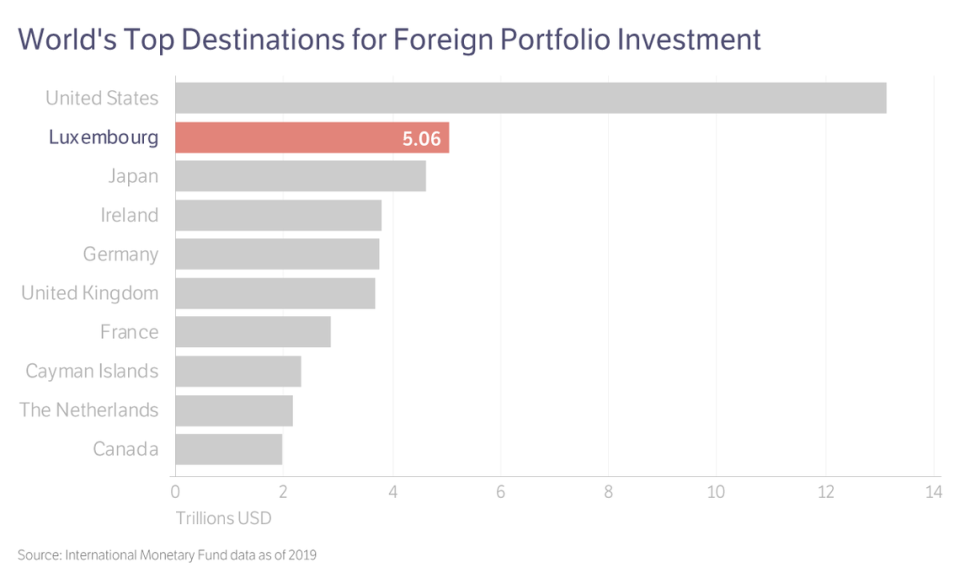

Even within Luxembourg, there is a growing realization that the country needs to reckon with the dark side of its vast foreign capital inflow, which as of 2019 amounted to over $5 trillion in portfolio investment — making it second in the world after the United States.

“The Luxembourg government is well aware that this success also involves exposure to the growing and evolving threat of money laundering and terrorist financing,” the country’s Finance Ministry said in a 2018 report. Another report, two years later, underscored that laundering of foreign criminal proceeds was “the highest threat” for Luxembourg.

The Finance Ministry told OCCRP it had “resolutely adopted tax transparency” and was in full compliance with EU standards. In a pre-emptive statement on the OpenLux project, the government of Luxembourg said it was in line with all EU rules on tax transparency and combating money laundering.

It also reserved the domain name openlux.lu and produced its own FAQ on the UBO register, based on queries made by journalists. It said the register was “a strong act of transparency” and noted that most EU countries did not yet have public databases.

“Given that Luxembourg is fully compliant with and has implemented all applicable EU and international rules and standards with regards to tax transparency, the fight against tax abuse as well as AML/CTF [anti-money laundering and countering terrorist financing] — and even gone beyond these requirements — Luxembourg rejects the claims made in these articles as well as the entirely unjustified portrayal of the country and its economy,” the government said.

By all accounts, the situation today is better than it was five years ago. But experts say there are still many problems with the way the database is being implemented, a complaint borne out by OCCRP’s own analysis.

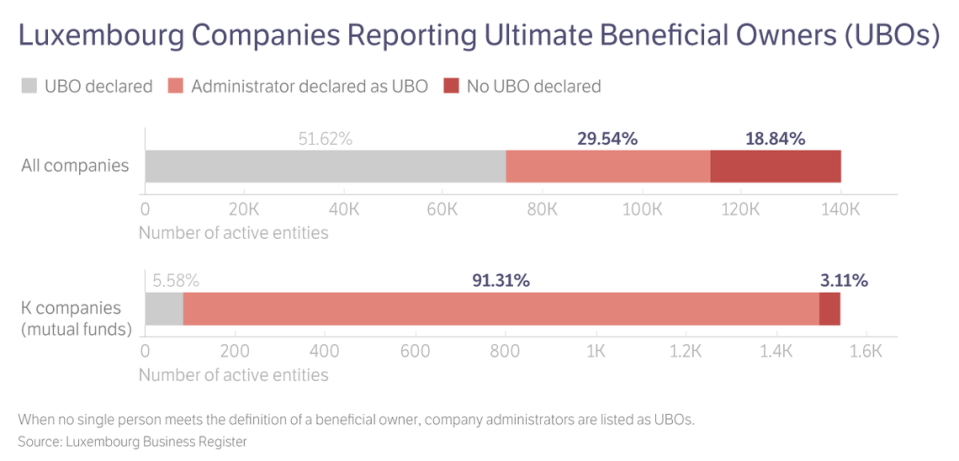

The case of Prill Holdings is a good example. The company has still not complied with the order to reveal its beneficial owners, so its corporate administrators in the Cayman Islands were marked down as UBOs by default. We found that administrators were listed as UBOs for almost a third of all Luxembourg companies in the register.

For so-called “K companies,” a kind of mutual fund, this number rose to over 90 percent, since so few of them have even a single investor who meets Luxembourg’s definition of a UBO.

Out of all investment funds, around 80 percent did not report real UBOs, according to a new analysis of OpenLux data.

Transparency International, the corruption-fighting non-governmental organization, and the Anti-Corruption Data Collective cross-referenced the data these funds provided to Luxembourg with disclosures to the U.S. Securities and Exchange Commission, and found “significant discrepancies” in the 719 funds registered in both jurisdictions. It found 112 funds that reported their beneficial owners to the U.S. government, while only 17 of these did the same in Luxembourg.

“This discrepancy suggests that either the funds are misrepresenting their ownership structure to the [Securities and Exchange Commission], or failing to abide by the rules laid out in the Luxembourg [register],” Transparency International wrote.

Either scenario, the authors said, could be grounds for penalties, illustrating the need for better verification measures and stronger enforcement.

(Luxembourg’s government said in a response that the sources were not comparable. “It is therefore not really possible to draw conclusions based on apparent discrepancies, and it is certainly wrong to infer that information in Luxembourg’s [register] is false or incomplete,” the government said in an online statement.)

“What Luxembourg has done is like they’ve removed ... the first layer of the onion,” said Ruiz. “But you have to get to the owner and find the ultimate real owner of these companies.”

“It is necessary not only that the registry exists, but also that it is effective.”

Fortress of Finance

Today Luxembourg might be a financial fortress, but it began its life as a literal one.

A well-fortified castle perched on a rocky outcropping, called Luclinburhuc, or “Little Fortress,” has existed there since Roman times to guard this strategic crossroads between Romance and Germanic-speaking regions.

In 963, a local count called Siegfried found rocky Luclinburhuc so desirable that he traded his lands to the north to acquire it, marking the beginning of Luxembourg as a political entity. Siegfried and his descendants spent the next few centuries consolidating their holdings in the region, until Luxembourg reached what would be its greatest extent in the 14th Century.

Since then, the little wedge of land at the crossroads of Europe has been buffeted and often engulfed, by its mightier neighbors: the Spanish Hapsburgs, the Netherlands Hapsburgs, the French, the Austro-Hungarians, the Prussians. Still, it has remained a distinct political unit for over 1,000 years. It finally became a fully sovereign nation in 1867, when Prussia withdrew an occupying force.

Starting in the late 1920s, Luxembourg’s government took inspiration from Switzerland, which was busy parlaying a long tradition of banking secrecy into a major international industry.

The Duchy created laws designed to attract its own share of foreign capital, setting up a stock market and created a legal framework that allowed holding companies to be exempt from income taxes.

“The 1929 law on holdings is directly inspired by the legislation of the Swiss cantons,” Majerus explained.

Between the two World Wars, tax hikes in larger European countries like Germany and France made Switzerland and Luxembourg increasingly desirable destinations for the wealthy to keep their cash, he said.

“They use Luxembourg … a bit like a colony, like a financial laboratory where they are not subject to the same rules as in [their] countries.”

For Luxembourg, which lacked the extensive lands or population bases of its neighbors, financial markets were a unique opportunity to develop a competitive advantage.

When the country’s steel industry collapsed in the mid-1970s, finance became its main economic engine. Today, this sector accounts for a quarter of the economy and around 80 percent of all foreign direct investment.

Zucman says Luxembourg has become “a kind of Swiss army knife” for financial services.

“The British Virgin Islands, for instance, they do essentially one thing — they are a place where it’s possible to create shell companies quickly, cheaply. … Panama was very much the same, is essentially known for the creation of shell companies. Switzerland specialized in the management of private wealth of offshore bank accounts, Cayman Islands … in hedge funds that are incorporated in the Cayman Islands.

“Luxembourg is present and active in all these areas: Profit-shifting by multinational firms, incorporation of mutual funds, wealth management, private wealth management, creation of shell companies, and so on, and so on. That’s what makes Luxembourg unique.”

Above all, the country has been known for offering tax breaks. While the official corporate tax rate is about 25%, the 2014 Luxembourg Leaks investigation revealed how the country allowed hundreds of multinational companies to create complex corporate structures through which they paid less than one percent of their profits in taxes.

The ensuing furor led Luxembourg officials to promise to improve the country’s record on corporate transparency. The “LuxLeaks” scandal, along with other journalistic investigations into how corporate secrecy fuels corruption, also helped spur Europe-wide efforts to tighten anti-money-laundering regulations. A major anti-money-laundering package that passed in 2015 required member states to create UBO registries for the first time.

Along with several other countries, Luxembourg was late out of the gate, with the European Commission referring it to the European Court of Justice in late 2018 for failing to enforce even the previous set of standards.

The country finally passed a law to establish its UBO register in January 2019, and the database opened that March. This made it one of just five EU countries to meet the requirements for a publicly accessible register by a January 2020 deadline, according to the transparency group Global Witness.

Promise and Reality

The very existence of public UBO registries is a major step forward for transparency.

But experts point to problems with the way Luxembourg’s is set up.

In addition to not being fully searchable, the record is incomplete. A year after its creation, only 52% of Luxembourg’s companies have reported their real owner, according to Le Monde’s analysis of the registration data. (Luxembourg authorities denied this, telling OCCRP the true figure is closer to 88%.)

Of the other 48% of companies, more than 68,000 still haven’t declared a UBO. About 40,000 aren’t required to do so, because they have no UBOs who hold more than 25 percent of the company. But in 26,000 of these cases, Luxembourg authorities say the companies are breaking the law, and have been forwarding them to prosecutors.

In these cases, and others, a company’s administrators are listed in the database instead of their UBOs.

According to Transparency International, Luxembourg’s definition of a UBO — someone who controls at least 25% of a company — is especially inadequate due to the large number of investment funds in the country.

“The concept of an investment fund is that those individuals investing in the fund, and benefiting financially from it, are not the same as those controlling the fund and making decisions on the types of investments, among others,” TI wrote in a study. As a result, “criminals are able to layer or integrate the proceeds of crime by investing dirty money across different investment funds, while remaining anonymous as long as their investment is below the reporting threshold.”

Le Monde and OCCRP also identified dozens of cases in which the declared UBOs were children, dead people, or obvious proxies.

Perhaps the most glaring example is Prestigestate, the company that owns the world’s most expensive house: Château Louis XIV.

Sprawling over 50,000 acres outside Paris and built with lavish materials to evoke a latter-day Versailles, the $300 million estate made headlines around the world when construction was completed in 2011. Its over-the-top amenities included an underwater meditation room and a nightclub filled with priceless art.

The chateau is formally owned by a company registered in Luxembourg whose ultimate beneficiary has been reported to be Saudi Crown Prince Mohamed bin Salman. However, the UBO register says the company’s beneficiaries are three Saudis close to the prince.

Officially, failing to declare a UBO or offering false information is punishable by a fine of between 1,500 and 1.25 million euros.

But in practice, enforcing the measures is a daunting task, and there has only been one case of a company being fined for failing to declare its UBO. The fine was 2,500 euros, a little over $3,000.

Luxembourg’s business register has just 59 employees, but is tasked with making sure over 120,000 companies are declaring their ownership properly and complying with all other aspects of the law.

“Luxembourg doesn’t match the responsibility of the enormous financial activity it has,” said Marcus Meinzer, a researcher at the Tax Justice Network who helps put together an annual financial secrecy index. Last year, Luxembourg ranked sixth-most secretive in the world.

Luxembourg’s Justice Ministry argued that the need for transparency must be balanced with the right to privacy.

“The rules for its public consultation have been guided by the necessary balance between safeguarding the right to privacy of those registered … on the one hand, and the principle of transparency, on the other,” the ministry said in a statement.

It emphasized that the registry could not stand alone, and that finance professionals and banks have an obligation to be careful about who they accept as customers.

The Luxembourg government also said companies themselves were responsible for submitting correct information.

“There is a procedure for verifying the accuracy of information of beneficial owners,” the government wrote in a public statement. “Determining the status of beneficial owners is the responsibility of the registered entity, which expressly commits vis-a-vis the UBO to provide adequate, accurate, and timely data.”

Thom Townsend, the director of Open Ownership, a British NGO that advocates for the creation of open UBO registries, says they can be a highly effective deterrent to would-be criminals — but only if they’re done right.

He says a fully searchable database, like the U.K.’s Companies House register, would be much better than a restricted one like Luxembourg’s.

The degree of verification is important, too. “In Denmark, they take a look at representative samples of companies to perform random checks,” Townsend said. “If Luxembourg sends a strong signal that they are verifying the data and taking this stuff seriously, it can deter people from filing inaccurate information.”

OpenOwnership also advocates for lowering the threshold to declare a UBO from 25% to 10 or 15%, which would require more companies to provide this information.

Another problem is that Luxembourg maintains no historical records on UBOs once a company is liquidated.

“It’s an enormous loophole if information can disappear from one day to another,” Townsend explains. “From an investigative perspective, historical records are critical in the chain of evidence. What we have seen in the Panama Papers is that corrupt actors change ownership fairly regularly, to avoid a person being traced,” he said, referring to the leak of offshore records from the law firm Mossack Fonseca.

The risk is that this only partially transparent registry model could set a precedent in Europe — or even farther afield.

The Cayman Islands and the British Virgin Islands, both notorious offshore financial centers, both have plans to set up UBO registers in the next few years. “They are currently looking to conform to what the average is in Europe,” Townsend said.

“Europe is seen as setting a benchmark for the rest of the world, and other governments are looking at what it does.”

Park, hide, move

What are criminals using companies in Luxembourg for?

OCCRP and its partners analyzed the activity of companies held by PEPs — that is, Politically Exposed Persons or people entrusted with a prominent public function — and found several patterns.

One is the use of Luxembourg as a gateway to the European Union for assets that had been kept in more traditional offshore tax havens, often in the Caribbean.

“Luxembourg has an important function of connecting non-European business with the European markets,” said Meinzer, the researcher at the Tax Justice Network.

“Non-EU investors can invest dirty money into the EU through Luxembourg, tax-free, in a hidden manner.”

A striking percentage of companies based in Luxembourg are subsidiaries of other companies based in tax havens.

The Cayman Islands, a British territory in the Caribbean Sea with just 70,000 inhabitants, ranks sixth on the list of number of companies in Luxembourg. This isn’t a coincidence: The British Virgin Islands ranks 10th, Panama 16th, and Cyprus 17th.

Thus, for example, the arms dealer Abdul Rahmán el Assir transferred from Curaçao to a Luxembourg company shares worth $70 million. The Bolichicos — a group of businessmen who became rich thanks to contracts with the Venezuelan government — allegedly transferred shares worth more than $250 million from Barbados to Luxembourg.

Once the assets arrive in Luxembourg, they often leave again quickly. In many of the cases analyzed by OCCRP and its partners, firms in Luxembourg are used as a vehicle for the transit of assets to other countries.

Once the assets arrive in Luxembourg, they often don’t stay long. In many cases, firms in Luxembourg are used as a vehicle for the transit of assets to other countries. For example, the Bolichicos’ Luxembourg companies moved large amounts of money, either in the form of investment or loans to other companies, to Spain and Gibraltar.

“You see that there is a huge amount of money that passes through Luxembourg and that it does not feed the local economy,” said Lim, the EU official. “In other words, it is to go to other places.”

Another common pattern is to create a company in Luxembourg to invest in real estate in other countries, especially France. This is done in part for secrecy, and in part to minimize taxes on real estate ownership in other European countries, which can have massive tax differentials with Luxembourg.

The family of Oleg Toni, chief of Russia’s railway system, controls a Europe-wide property empire through Luxembourg companies. Alleged mafia boss Maxim Lalakin and Ukrainian billionaire Rinat Akhmetov also own properties this way.

Mohamed Najib Mikati, a former Lebanese prime minister who has been implicated in several corruption cases, is the beneficiary of several Luxembourg companies whose sole purpose is to hold real estate in France.

And Sukanto Tanoto, an Indonesian tycoon who has been accused of fiscal fraud and numerous environmental crimes, secretly bought a historic building in Munich for almost 350 million euros through a Luxembourg-registered company.

Sven Giegold, spokesperson for the German Greens in the European Parliament and a member of the Committee on Economic and Financial Policy, says there are still too many loopholes that allow money to be moved out of the EU tax-free via Luxembourg: “When you structure, for instance, the ownership of property and real estate income in Europe, you very often have a holding company in Luxembourg,” he explained. “You buy property in Germany, in Spain, and you channel the money you earn locally to Luxembourg out of the EU.”

“It’s a place you want to be, also as a criminal,” he adds.

That’s true in the case of at least one organized crime group. Giuseppe Lombardo, a top anti-mafia prosecutor in Reggio Calabria, an ‘Ndrangheta stronghold, told OCCRP that Luxembourg had become a draw for the mafia due to the opacity of its financial system.

“In that country there are financial systems and discrete ‘coffers’ that are extremely attractive for those who need to stash illicit money and black funds,” he said.

‘Facilitating state’

The Italian investigator, and other prosecutors and officials in countries like Italy and Spain, say their efforts to track down criminals in Luxembourg have been stymied by less-than-enthusiastic cooperation on the part of authorities there, especially when it comes to tracking financial flows.

Italian investigators told OCCRP it is very difficult for them to follow ‘Ndrangheta money in Luxembourg, due to banking secrecy and lack of transparency. Moreover, several police sources agree that Luxembourg authorities are reluctant about investigating the presence of the ‘Ndrangheta in their country.

A Spanish official who investigates money laundering agreed.

“Luxembourg has acted as a ‘facilitating state,’ a kind of country that, with its behavior of eventual fraud or deliberate ignorance, has facilitated the money laundering of criminals and corrupt people from all over the planet,” he said.

And another Spanish prosecutor told OCCRP he found Luxembourg officials frustratingly opaque: “Luxembourgers always move on the edge of non-cooperation. You have to be very precise in what you ask, because if you do not do so, they tell you that you are conducting a prospective investigation and they do not cooperate.

“Many times, only the lawyer or the representative who has registered the company knows who the owner really is.”

Luxembourg’s Justice Ministry disputed these claims, saying that the country was “a constructive and reliable partner” and that it readily cooperated with authorities abroad.

Ultimately, experts say, no one country can end financial crime on its own, no matter how ideal its practices are. Zucman, the Berkeley professor, said the best solution would be a Europe-wide public register covering all forms of wealth.

This would allow authorities in different European countries to access information in a standardized format.

“There is a need to be more ambitious,” he said.

“One big lesson from the story of Luxembourg is that we need to make progress towards an EU financial registry. That would be a concrete embodiment of the notion of financial transparency.”