The Monterey Car Week Auctions Could Bring in a Record $398 Million in Sales

As the US teeters on the brink of a possible recession yet enjoys healthy jobs growth and dropping fuel prices, it’s becoming trickier than ever for prognosticators to get a bead on collecting trends. These mixed-up moments are like a double-rating on the Face Pain Scale: “No hurt” with a dash of “hurts a whole lot.”

If you’re looking ahead to Monterey Car Week’s cornucopia of classic auctions during this best-of-times/worst-of-times moment, you could do worse than draw expert advice on the classic car market from the data-driven folks at Hagerty.

More from Robb Report

Car of the Week: This One-of-12 Jaguar E-Type Raced at Le Mans and Is Gearing Up for Auction

How Kindred Motorworks Transforms Derelict Cars Into Reliable Objects of Rolling Automotive Art

Porsche and Pixar Teamed Up to Create a Real-Life Version of Sally Carrera From 'Cars'

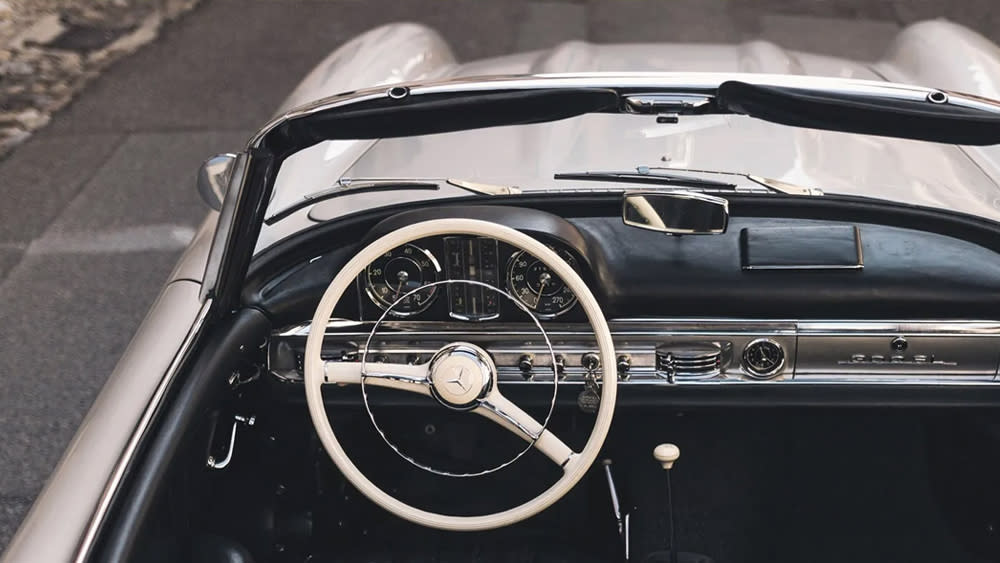

First off, while the company’s market rating has observed 15 straight months of gains through June, the metric finally slipped a tad in July. That said, Hagerty notes that there’s no shortage of “big” cars this year, with more million-dollar vehicles for auction than ever. That includes the vaunted McLaren F1 #059, which will be sold using RM Sotheby’s first proprietary sealed-bid formats and could exceed the $20 million range established by earlier F1s. Of course, demand is heavily reliant on supply, and this year’s unprecedented twelve Mercedes-Benz 500K/540Ks should test the outer edges of interest in that premium but rather niche market.

RM Sotheby's

Given the vagaries of these multifarious times, Hagerty takes three potential scenarios that cover most eventualities among the approximately 1,200 auctions throughout the week. The first is a perfect storm of everything working in favor of the market, with total sales approaching $500 million, which would beat the prior record by $100 million. The second recalls 2019, in which there’s a significant disconnect between greedy sellers and realistic bidders. The third sees consignors stick with reasonable reserve prices and buyers bid strongly thanks to the high-quality nature of the goods on hand. For all their hedging, Hagerty ultimately contends that the third scenario is the likeliest outcome, and commits to a rather specific forecast of $398 million in sales, edging the last market peak of 2015 only slightly.

However, despite the depth of numbers, data, and market-driven analysis available to industry pundits everywhere, there’s nothing like the vagaries of the human heart (and the realities of the bank account) to gauge a potential acquisition. May the best buyers win.

Click here to see highlights of the Monterey Car Week Auctions.

Best of Robb Report

The Chevy C8 Corvette: Everything We Know About the Powerful Mid-Engine Beast

The 15 Best Travel Trailers for Every Kind of Road-Trip Adventure

Sign up for Robb Report's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.