A month of inflation does not a crisis make

The United States economy is in much better shape than it was in April 2020, when we lost 6.1 million jobs in a week. Indeed, demand for certain things — particularly durable goods — has been so strong it has created significant inflation for the first time since 2008 (6 percent on an annual basis as of October).

That's fueling calls for the Federal Reserve to start hiking interest rates: "Fed faces fresh pressure to raise interest rates," reads a headline at Fox Business. "I increasingly think the right thing to do is declare victory and raise interest rates," prominent Substacker Matt Yglesias recently tweeted. Policymakers' "focus on the challenges of the last crisis has fueled some of the challenges of this crisis," writes Neil Irwin at The New York Times.

We've too much economic stimulus, the argument goes, and now it's time for austerity.

But that would be a grave mistake. America has a real chance to experience a genuine economic boom over the next couple years, one that might heal some of the lasting economic scars of the lost decade that followed the 2008 crash. Some moderate — and likely temporary — inflation is an acceptable risk to give that boom its best possible chance of happening.

First, some quick background. As I've previously written, it seems inflation is coming from three sources. One, because of the COVID-19 pandemic, there has been a huge shift in spending, with expenditures moving away from services and into goods. Instead of going to gyms, restaurants, and hair stylists like they did in 2019, people are staying home and spending more on TVs, computers, and dishwashers. Two, lots of people are still cash-rich thanks to pandemic rescue bucks, cheap credit, and appreciating home values. And three, because business under-invested in capacity for a decade during the weak post-2008 recovery, the global supply system is brittle and struggling to handle the surge in spending.

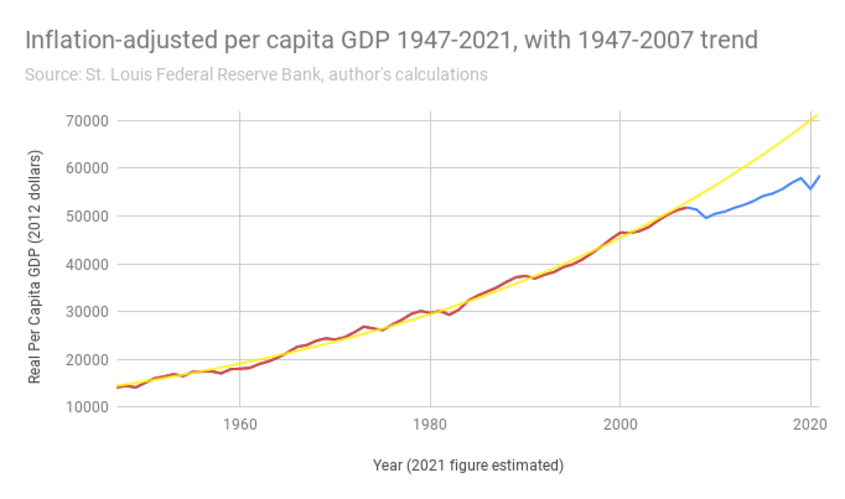

Now back to growth. An easy way to see the scale of the economic disaster after 2008 is by updating this chart I produced last year, inspired by economist J.W. Mason. The 1947-2007 data is in red, the trend line from that period is in pink, and the 2008-2021 data is in blue. (We only have three-fourths of 2021 data so far, but I'll be optimistic and assume the economy keeps growing in the last quarter at roughly how it's been going, giving an approximate yearly figure of $58,500 per capita GDP.)

Ryan Cooper

If America had followed the pre-2007 trend, per-person GDP would be around $71,240 this year. When I first made this chart in 2019, the gap between the trend and reality was about 15 percent. Now it is something like 22 percent. That is $12,740 in lost production per American — or $4.2 trillion total, which is more than the GDP of California and Florida put together — and that's for one single year. That doesn't mean that every person would have made exactly that much, but it does mean we could have had a lot more jobs and income than we did have.

More fundamentally, the GDP figures here are important less in themselves and more for what they indicate about other things, particularly the labor market. The 2008-2018 period of chronically weak demand and growth was devastating for the working class both in and out of jobs. Wages were stagnant, and unemployment was high — especially for African Americans, whose unemployment rate has reliably been about twice that of whites.

Conversely, a really tight labor market and fast-growing economy are best for people at the bottom of society. As Mason and Andrew Bossie outline in another paper, the ultra-fast growth during World War II created ultra-low unemployment that was a terrific boon for workers — particularly Black workers. With labor in extremely short supply, employers were forced to employ absolutely everyone who could work, even if that meant hiring ex-cons, women, or disfavored minorities, or having to do a lot of on-the-job training. That in turn meant rapid equalization of wages: "The difference in average wages between Black and white men fell by a staggering 50 points during the 1940s ... a much faster convergence than in any subsequent decade," Mason and Bossie write. (There's a reason full employment has been one of the primary demands of trade unions and socialist movements since the 19th century.)

All this demonstrates that the mainstream, orthodox position on growth and economic health is a sham. Whenever Sen. Bernie Sanders (I-Vt.) proposes raising taxes on the rich to support the poor and working class, thus increasing demand, we hear a great hue and cry about how it will supposedly dent growth and impoverish us all. Sanders' "myriad tax hikes would cut GDP growth by 9.5 percent, reduce the nation's capital stock by 18.6 percent, and result in 6 million fewer full-time equivalent jobs," howls John Merline at Investor's Business Daily, citing an analysis from the Tax Foundation. And today, when inflation is moderately high for one month, a similar freakout ensues.

Yet when we flush trillions and trillions of dollars in production down the toilet and hence leave millions jobless for no reason, for a decade, few aside from heterodox economists paid close attention.

Now, I'll admit I didn't anticipate inflation getting this high. But 6 percent annualized price increases for one month is not even close to what happened in the 1970s, when inflation averaged over 6 percent for half a decade between 1973 and 1978, and over 10 percent between 1979 and 1981. And that 70s inflation, while a big problem for many, was still a much, much better economic performance in terms of growth, jobs, and incomes than what we saw between 2008 and 2018. (Gas shortages are better than a decade-long mild depression.)

What's more, unlike the 1970s, present price increases are certainly being caused by transitory, pandemic-linked factors that will likely fade out as more and more of the world is vaccinated. Today, we don't have mass unionization with cost-of-living adjustments written into contracts. We don't have a gigantic surge in the labor force as Baby Boomers and women enter the workforce at the same time. And while we do unfortunately still burn a lot of gasoline, we are much less dependent on foreign carbon fuels for energy than we were 40 to 50 years ago.

Indeed, it's not even clear that hiking interest rates would do much at all to lower prices. Higher rates are supposed make credit harder to obtain, slowing spending in sectors like home construction and automobiles, and, in the process, killing a lot of jobs. But a rate change wouldn't do anything about the biggest single factor behind inflation: the pandemic. It also wouldn't do anything about Saudi Arabian dictator Mohammad bin Salman cutting oil production out of spite over not getting a meeting with President Biden, as Ryan Grim and Ken Klippenstein write at The Intercept, which is a big factor behind gas price inflation.

And even if hiking rates did ease supply bottlenecks — by impoverishing the American people so they couldn't afford to buy as many goods — we'd still run a serious risk of landing the economy back into a 2010-style depressed sandpit. Consumption of goods is high, but consumption of services hasn't at all recovered to its previous trend. If the Fed knocks the wind out of spending on goods, only for the pandemic to ease and people to turn back to a normal balance of spending, we might easily create a shortfall of demand in both sectors.

There's good reason to think a few months of unusually high price increases are the effect of the pandemic plus lingering results of the gruesome policy errors committed after 2008. The challenge now is not to repeat those errors and consign ourselves to another decade of slumping growth and an even larger gap between where our economy is and where is should be. The pandemic will end, and inflation will likely calm down soon. This is not the time for the Federal Reserve to panic. It's time to keep easy credit flowing so we finally get a shot at a boom.

You may also like

FBI email server hacked; attackers pin blame on cybersecurity consultant

Catholic bishops meet Monday to discuss whether Biden should receive communion

Chris Christie is happy to spar with Trump and call out his election lies, may support him in 2024