Moody's economist: We'll see the markets 'tank' if the Fed doesn't cut rates

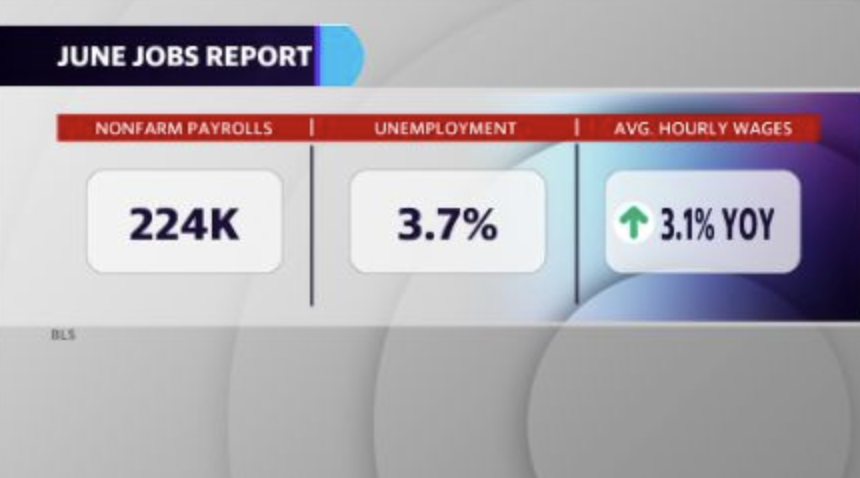

The U.S. jobs report smashed expectations on Friday with the economy adding 224,000 jobs in June, but Moody's Capital Markets Chief Economist John Lonski still sees several red flags facing the market.

“We still have very sluggish wage growth despite the fact that for a number of months, we have had an unemployment rate below 4%,” Lonski told Yahoo Finance’s “The Ticker” on Friay. “Ordinarily, we would have wage and salary income growth well above 5%, 6%. Instead, according to U.S. government numbers, it’s only at 3.5%.”

Average hourly earnings for the month of June disappointed, rising just 0.2%from May. Wages were up 3.1% year-over-year, missing estimates of 3.2%, which could be cause for alarm.

“Why are we not getting a livelier pace of wage and salary income growth, livelier growth for the average hourly wages as well as consumer spending?” Lonski asks. “What’s going to happen when the unemployment rate inevitably rises? A very low unemployment rate raises the risk of a higher unemployment rate 12 months from now… So that tells me that investors have to cast a wary eye on any forecast of continued growth for the U.S. economy.”

Fed’s Rate Decision Looms

June’s jobs report comes as Wall Street looks to the Federal Reserve, which will decide whether a rate cut is necessary later this month. But in recent weeks, Fed Chair Jerome Powell has taken a dovish tone, indicating he will not be quick to change monetary policy based on political decisions such as the U.S.-China trade dispute. And both investors and businesses are taking notice.

“You tell me how many businesses are saying,‘This trade war is a good idea. It’s really helping us out.’ No, for the most part, businesses are complaining about the trade war,” Lonski notes. “Businesses do not like government interference in the economy, government interference in their ability to plan, especially if it includes tax hikes.”

This comes amid increasing criticism from President Donald Trump, who has repeatdly criticized Powell. On Friday, he underscored his dissatisfaction with the Federal Reserve, saying, “We don’t have a Fed that knows what they’re doing.” Trump has also said the economy would “take off like a rocket ship” if rates were lowered. And markets will be watching for that decision.

“You’re definitely going to see the market tank in the event you don’t get a rate cut at the end of July without any strong reason to rule against a rate cut,” Lonski continues. “Keep an eye on what’s going on with business sales — what they sell to consumers, capital goods and exports. If that doesn’t improve significantly fairly soon, we not only get a rate cut in July but we also get one at the September 18th meeting of the FOMC.”

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.