More Than 2,000 British Companies Continue Doing Business with Russia

YouControl R&D Center has assessed the activity of British companies leaving the Russian market. Analysts investigated the status of Russian-British interpenetration in the equity market: the number, the most popular places of registration of subsidiaries, and the scope of their activities. They also identified the Top 20 largest Russian companies whose owners have a British residence registration. The details are in the new research.

Key conclusions:

The total number of Russian business companies whose founders are British residents is 2,370 legal entities.

British subsidiaries in Russia often serve as a cover for international financial flows leading to Russian owners.

HSBC Holdings, Unilever, GlaxoSmithKline, AstraZeneca, Linde, Legal & General Group, and LyondellBasell Industries are companies headquartered in the UK and support cooperation with Russia.

The largest share of British capital in Russia is represented in construction, wholesale trade, real estate operations, transport, logistics, and IT.

Most companies with nominal British owners are concentrated in Moscow and St. Petersburg.

Three British companies, nominal owners of Russian assets from the Top 20, turned out to be controlled by Russians: Investitsionnaya Kompaniya DENMAR-FINANCE LLC; LADOGA Group LLC; BERKSHIRE LLC.

Billionaires Pavel Durov and Yuri Milner, businesspeople of Russian origin, were investors in the early stages of the car rental startup WHEELY LTD. with an office in London.

There are almost 5 times as many Russian companies in Britain as there are British companies in Russia.

[BANNER1]

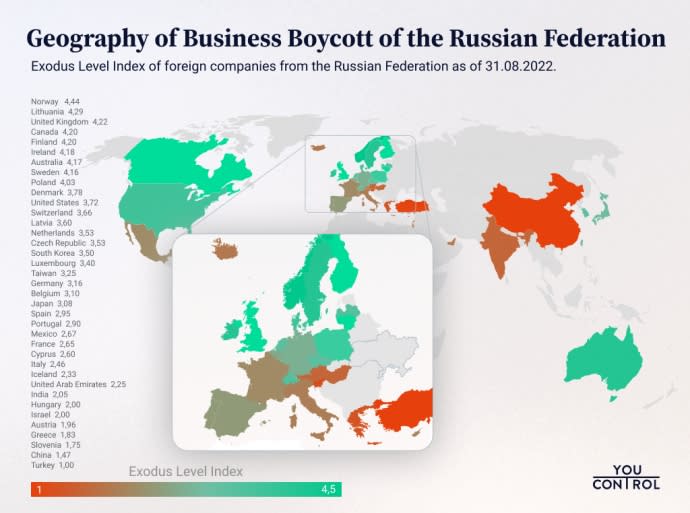

British Business Boycott of Russia

The withdrawal of companies from the Russian market or closing up operations there is called a business boycott, which is voluntary or indirect sanctions. To quantify the level of business withdrawal from Russia, YouControl has developed a unique integral index ELI (Exodus Level Index). It aggregates information on the distribution of the number of companies from a particular country across five categories of corporate reaction to the Russian-Ukrainian war. Recommendations of Yale University researchers on the classification of foreign companies were taken into account when forming the index. In a preliminary study, the YouControl R&D Center has already assessed the withdrawal rate of foreign companies from Russia by country and economic sector. According to Yale University, the number of researched and identified British companies involved in business cooperation with the Russian Federation reaches 96. The average index of business boycotting of Russia by British companies ELI = 4.3. And this is quite a high level on a scale from 1 to 5.

The main areas of business of British companies that have stopped or suspended business with the Russian Federation: Business Services, Finance, Retail trade, Food manufacturing, Heavy industry, Light industry, Engineering and construction.

Business with Russia continues in Healthcare, Chemical industry, and Finance.

Having studied the world's largest companies included in the American Forbes Global 2000 list, seven companies were found to be headquartered in the UK and maintain cooperation with the Russian Federation. In particular, HSBC Holdings, Unilever, GlaxoSmithKline, and AstraZeneca continue business without new investments, and Linde, Legal & General Group, and LyondellBasell Industries have partially reduced activity. Instead, large companies from Forbes Global 2000 as Diageo, M&G, CNH Industrial, Rolls-Royce Holdings, and JD Sports Fashion have suspended operations in Russia. The following well-known brands have entirely ceased business or withdrawn from the Russian market: Vodafone, Reckitt Benckiser Group, BP, Imperial Brands, Willis Towers Watson, London Stock Exchange, Compass Group, WPP, J Sainsbury, Mondi, Centrica, Wm Morrison Supermarkets.

[BANNER2]

British capital in the Russian market

As YouControl analysis shows, nearly one hundred British companies above, whose reaction to Russian aggression is closely monitored by Yale University scholars, are just the tip of the iceberg. Analysts have studied the Russian Unified State Register of Legal Entities and found that the total number of Russian business companies whose founders are residents of Great Britain is 2,370 legal entities. YouControl has a complete list of British companies with current and historical business connections with Russia.

A detailed analysis of the largest Russian companies with British capital has shown that a substantial part of the nominal British owners is under the control of the ultimate beneficiaries of Russian or non-British origin.

Dropped a British anchor on Russian metropolises

Most companies with nominal British owners are concentrated in the capital of Russia, Moscow (41%). More than a hundred companies with British capital are registered in the Novosibirsk region, St. Petersburg, and the Moscow region.

The high concentration of British business in the metropolises of the Russian Federation reflects a general trend characteristic of commodity-based economies. That is, the focus is on the "growth poles". On the other hand, companies focus primarily on the service sector.

[BANNER3]

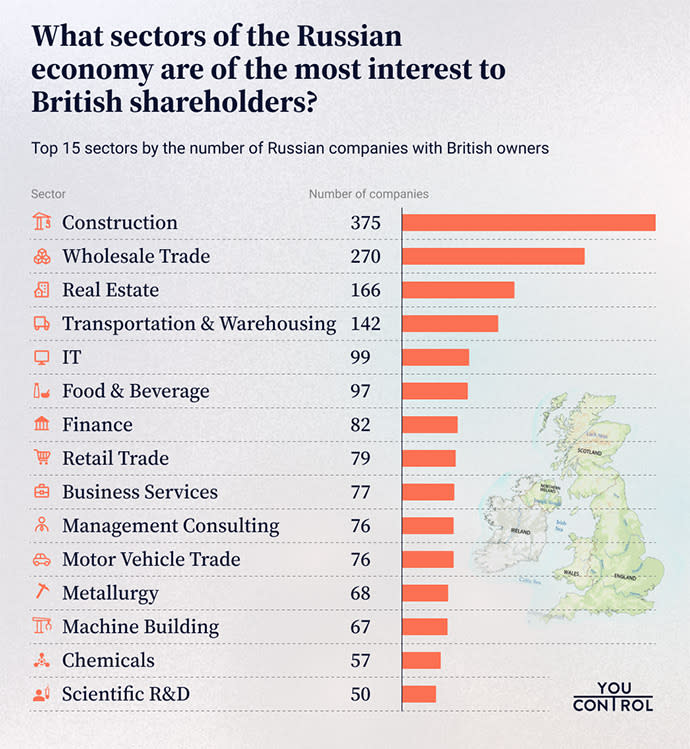

How do the British make money in Russia?

British capital in the Russian Federation in terms of the number of controlled companies is the most represented in the Construction sector (15.8% of all British enterprises), Wholesale trade (11.4%), and Real estate transactions (7%). The sectors of Transport and logistics (6%), IT (4.2%), Food industry (4.1%), and Finance (3.5%) are also prominent. Retail trade, Business services, and Management consulting round out the top ten.

Typically "industrial" sectors of the economy, such as Metallurgy, Mechanical engineering, Chemical industry, or Oil and gas, have relatively fewer companies with British shareholders. That may be due to historically high barriers to non-residents' access to strategic, highly profitable industries controlled by the pro-Kremlin oligarchic elite. Indeed, those industrial enterprises nominally under British control often have ultimate beneficiaries of Russian origin. They use British jurisdiction to structure their business within broad financial-industrial groups.

The twenty largest Russian companies whose owners have British residence registration

British equity capital in the Russian market is represented in various forms. A detailed analysis of investors indicates that a significant proportion of British subsidiaries in Russia are British only de jure because their nominal owners are residents of the United Kingdom. At the same time, these de facto shareholder companies often serve as a cover for international financial flows and complex chains of corporate rights, which ultimately lead to both Russian and various non-British beneficial owners.

Among the Top 20 companies by the amount of authorized capital with nominal British shareholder control, none was found to be 100% British. That confirms the "transient nature" of British share ownership over Russian companies. Therefore, for a more representative analysis of the presence of British shareholders in the Russian market, let us consider the Top 20 companies exclusively with majority owners having a British "residence registration".

A significant proportion of British shareholding companies have signs of so-called "shell companies". Three British companies that are nominal owners of Russian assets from the Top 20 turned out to be controlled by Russians.

The research revealed that some British companies that own Russian assets have beneficiaries from such jurisdictions as South Africa, the USA, Ireland, Austria, Italy, and Switzerland.

[BANNER4]There are also cases of registration of British shareholder companies of persons with citizenship from other countries: Latvia, Sweden, and Great Britain. Analysis of the board of directors and historical information points to signs of a Russian trace. You can see Russian business connections abroad in detail using the RuAssets international platform, which was developed by YouControl at the beginning of Russia's full-scale invasion of Ukraine. The tool is free for media professionals.

Another type of so-called "British shareholders" are startups with founders of Russian origin who have received foreign citizenship. The illustrative case of Wheely, a car rental company in London, allows users to book rides with a driver in luxury cars. The founder of the company Anton Chirkunov, the son of the ex-governor of the Perm region Oleg Chirkunov, has a Swiss passport and is also a resident of the United Kingdom. It is noteworthy that investors in such projects, as a rule, are also Russian businesspeople. In the case of Wheely, Russian-born billionaires Pavel Durov, Yuri Milner, and other investors joined certain rounds of capital raising.

Analysts also researched the number of Russian companies in the UK. There are almost five times as many Russian companies in the UK as there are British companies in Russia. There will be more details about this in the next YouControl article.

***

YouControl is a Ukrainian IT company for 8 years that develops services based on open data. YouControl analytical system profiles corporate data from more than 180 official data sources. There you can find aggregated information about every Ukrainian company, entrepreneur, and most individuals. The application tracks registration changes in public registers and visualizes links between affiliated companies and individuals. It also contains analytical data on European, British, American, and Russian companies, their corporate members, executives, and business relationships.