Morgan Stanley: What to Do Following a 45% Gain

- By Nathan Parsh

Morgan Stanley (NYSE:MS) has been one of my favorite names in the financial sector as the company has delivered several strong quarters in a row. At the same time, the share price hasn't reflected this strength until recently.

Shares of the company are higher by more than 45% since the last time I looked at the company in October of 2020. Given this strong gain, should investors wait for the stock to cool off, or is there still more room to the upside for Morgan Stanley?

Recent earnings results

Morgan Stanley reported fourth quarter and full year results for 2020 on Jan. 20. The company's revenue grew almost 26% year-over-year to $13.6 billion, coming in $2.1 billion ahead of Wall Street analysts' estimates. GAAP earnings per share of $1.81 were a 48% improvement from the previous year and $0.55 better than expected. Net income increased 51% to $3.4 billion.

For the year, revenue grew 16.3% to $48.2 billion while GAAP EPS improved 24.5% to $6.46. Net income was higher by 21.6% to almost $11 billion. Both revenue and net income for the year were a company record.

Institutional Securities finished off a record year with 39% revenue growth in the fourth quarter. This segment benefited from gains in nearly every business. Investing banking was especially strong, as IPOs and follow-on offerings helped equity underwriting revenues improve 137% year-over-year. Fixed income underwriting was slightly weaker, but advisory revenues benefited from higher merger and acquisition transactions. Sales and trading improved 32%, mostly due to an increase in trading revenues due to higher client activity. Equity trading revenues reached $2.5 billion, once again topping rival Goldman Sachs' (NYSE:GS) total of $2.39 billion.

The Wealth Management segment had quarterly revenue growth of 24%. This business now includes E*TRADE, which helped transactional revenues grow 37%. Higher assets levels due to market appreciation and an increase in fee-based flows drove a low double-digit gain in asset management. Even though average interest rates declined, net interest revenues actually increased almost 17%, as the E*TRADE acquisition positively impacted results, but so did higher deposits and bank lending.

Revenues for Investment Management decreased 19%. Asset management benefited from record assets under management and positive net flows. This business grew 18.1%, but was offset by a 62% decrease in investment revenues. This business faced tough comparisons from the previous year due to the gains made from an investment's initial public offering. Investment Management is the smallest component of Morgan Stanly (just 8% of fourth quarter revenues), so the decline from the previous year wasn't enough to slow the company down in the quarter.

Morgan Stanley's provisions for credit losses was just $5 million in the fourth quarter, down from $111 million in the third quarter of 2020 and $57 million in 2019. The company doesn't offer much in the way of credit card or business lending, so it has been fairly well insulated from PCLs compared to other names in the financial sector.

Valuation analysis

Analysts surveyed by Yahoo Finance expect the company's business to slow some in 2021. Revenue is expected to be $48.8 billion for the year, up slightly from 2020, but EPS is expected to decline 15% to $5.52. Even with the decrease, the expected EPS for the 2021 would be the second-best result since the Great Recession.

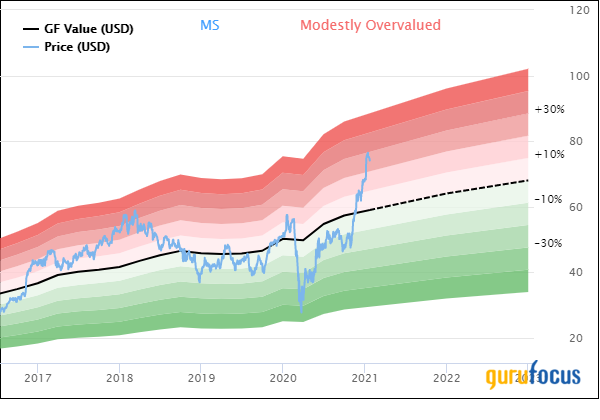

The issue I now have with Morgan Stanley is not its business, which I have been high on over the last couple of quarters, but the valuation of its stock. Shares had a price-earnings ratio of less than 10 the last time I looked at the stock, which was a discount to the 10-year average price-earnings ratio of 12.4. The stock also traded well below its GF Value. Following the rise in share price since my last look at the stock, Morgan Stanley is now expensive compared to its own historical valuation and its GF Value.

Using Friday's closing price of $74.13 and expected EPS for the year, Morgan Stanley trades with a forward price-earnings ratio of 13.4. This is still cheap compared to other names in the sector and the market as a whole, but it is at the very high end of the stock's range since 2010.

GuruFocus also finds that the stock has gotten a bit ahead of itself:

With a GF Value of $58.45, Morgan Stanley has a price-to-GF value ratio of 1.27, earning a rating of modestly overvalued.

Final thoughts

The fourth quarter was the icing on the cake for Morgan Stanley's 2020. The company generated record numbers for both revenues and net income for the year. Nearly every business showed signfnicant improvements and the E*TRADE acquisition is proving to be a solid investment.

While the company has maintained the same dividend for seven consecutive quarters, Morgan Stanley announced a share repurchase authorization of up to $10 billion, or 7.5% of the current market capitalization, on Dec. 18, 2020. The company remains very shareholder friendly even if it is not currently allowed to increase its dividend.

That being said, the stock has had an incredible run over the past few months and has surpassed even my bullish estimates of where the share price could reach. Therefore, I am moving to the sidelines on Morgan Stanley and would look for a pullback before purchasing the stock.

Author disclosure: the author has no position in any stock mentioned in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.