The Morris Holdings (HKG:1575) Share Price Is Down 82% So Some Shareholders Are Rather Upset

As every investor would know, you don't hit a homerun every time you swing. But it's not unreasonable to try to avoid truly shocking capital losses. So spare a thought for the long term shareholders of Morris Holdings Limited (HKG:1575); the share price is down a whopping 82% in the last twelve months. That'd be a striking reminder about the importance of diversification. Morris Holdings may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 44% in the last three months.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Morris Holdings

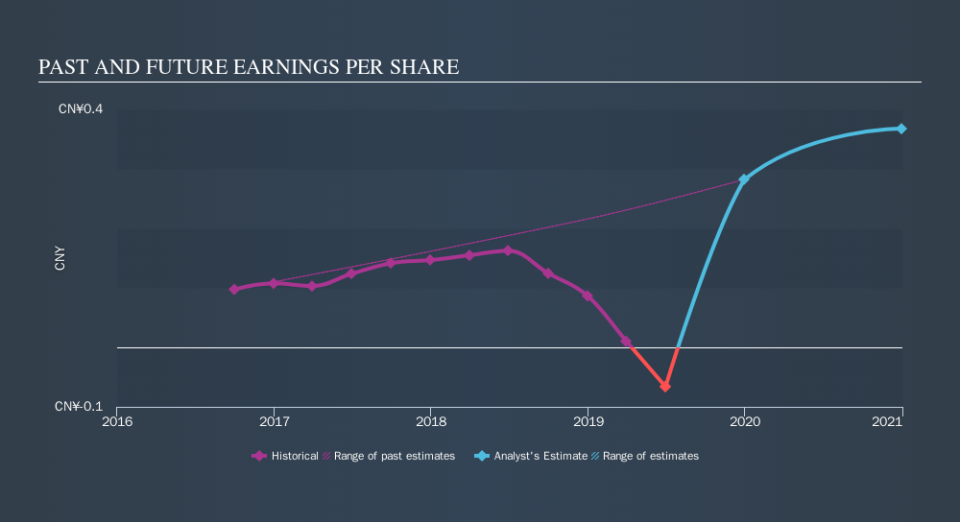

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Morris Holdings fell to a loss making position during the year. While this may prove temporary, we'd consider it a negative, so it doesn't surprise us that the stock price is down. Of course, if the company can turn the situation around, investors will likely profit.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Morris Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the market gained 0.9% in the last year, Morris Holdings shareholders might be miffed that they lost 82%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 44%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.