Mosaic (MOS) Announces Revenues and Volumes for April 2021

The Mosaic Company MOS recently announced its sales volumes and revenues for Apr 2021 by business unit.

The Potash Segment recorded sales volume of 741,000 tons in April, down from 914,000 tons in the year-ago period. Sales revenues were $198 million, down from $200 million in the prior-year quarter.

The Mosaic Fertilizantes segment witnessed a decline in sales volume to 459,000 tons from 592,000 tons last year. Sales revenues increased to $205 million from $173 million recorded last year.

The Phosphates segment recorded sales volume of 744,000 tons, down from 751,000 tons in 2020. Sales revenues in the segment were $407 million, up around 58% year over year.

Shares of Mosaic have gained 236% in the past year compared with 104% rise of the industry.

The company, in its last earnings call, noted that it expects strong fundamental trends witnessed in the last three quarters to continue through 2021. Strong crop demand, affordable inputs and favorable weather indicate strong grower economics.

Chinese phosphate exports are expected to remain low in 2021 due to high domestic demand and recent industry restructuring limit supplies available for export.

The company projects $80-$90 per ton improvement in realized prices in the Phosphates segment sequentially in the second quarter. For the Potash segment, $20-$30 per ton improvement in realized prices is expected in the second quarter.

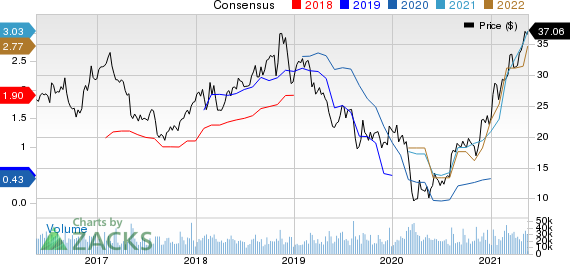

The Mosaic Company Price and Consensus

The Mosaic Company price-consensus-chart | The Mosaic Company Quote

Zacks Rank & Key Picks

Mosaic currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Dow Inc. DOW, Celanese Corporation CE and Cabot Corporation CBT.

Dow has a projected earnings growth rate of roughly 261.5% for the current year. The company’s shares have surged 93% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Celanese has an expected earnings growth rate of around 68.3% for the current year. The company’s shares have gained 101.5% in the past year. It currently sports a Zacks Rank #1.

Cabot has an expected earnings growth rate of around 126% for the current fiscal. The company’s shares have gained 92% in the past year. It currently flaunts a Zacks Rank #1.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dow Inc. (DOW) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research