Most-Bought European Stocks of Top Investors

- By Holly LaFon

On Tuesday, two noted value investors appeared on CNBC to discuss investing in European stocks as the U.S. market treads ever higher.

David Herro (Trades, Portfolio), chief investment officer of international equity at Harris Associates, and Sarah Ketterer (Trades, Portfolio), CEO of Causeway Capital, both focus on international stocks at their firms. Herro said Europe is an overlooked pocket of value that many investors are wrongly avoiding.

Warning! GuruFocus has detected 4 Warning Sign with XTER:VOW. Click here to check it out.

The intrinsic value of XTER:VOW

"I think specifically when you look at European equities, they've been kind of held back as a result of some of the macro issues that I would argue have held back their share prices but we still see good value creation and as a result we still see good investable opportunity in European stocks," Herro said.

Herro told CNBC that macro fears of slower growth, Brexit and low interest rates were misplaced because that had little impact on the value-creation abilities of many of the companies, many of which are multinational, with exposure to other economies. The euro's low level compared to the dollar, too, benefit their sales into dollar-denominated markets, he said.

Ketterer, whose funds have wide exposure to European countries, described the kinds of companies investors should seek.

"This isn't necessarily an argument to investor only abroad, even though stocks are generally cheaper offshore than they are in the U.S., but rather to emphasize those shorter-duration stocks, the stocks delivering income now, that deliver cash flow now," she said.

As an example, Ketterer cited Germany's Volkswagen AG (XTER:VOW), which exited its diesel-gate crisis with a net cash position and is generating increasing amounts of free cash flow through cash conversion.

GuruFocus data shows that, of all developed markets, Spain has the third-highest projected annual return at 9.0%, following Singapore at 11.9% and Australia at 11.9%. The U.K. has the fifth-highest projected annual return at 8.2%, and Italy has the sixth-highest at 8.1%.

The GuruFocus All-in-One Screener shows which stocks in European markets are the most popular among investors it tracks who invest abroad. Among 177 top investors and funds, the European stocks with the greatest buy consensus were: Bollore SA (BOL.PA), Nestle SA (NESN.SW), Cie Financiere Richemont SA (CFR.SW), Roche Holding AG (ROG.SW) and Novartis AG (NOVN.SW).

Bollore SA (BOL.PA)

Seven investors GuruFocus tracks own shares of infrastructure company Bollore SA, with the Yacktman Fund (Trades, Portfolio) having the largest position at 2.47% of outstanding shares. Its managers increased the holding by 50.94% in the first quarter.

Bollore SA has a market cap of 12.57 billion euros; its shares were traded around 4.31 euros Wednesday with a price-earnings ratio of 26.94 and price-sales ratio of 0.68. The trailing 12-month dividend yield of Bollore SA is 1.39%. The forward dividend yield of Bollore SA is 1.39%. Bollore SA had an annual average earnings growth of 12.60% over the past 10 years. GuruFocus rated Bollore SA the business predictability rank of 2.5-star.

Nestle SA (NESN.SW)

Nestle SA, the largest food and beverage manufacturer in the world, has six investors GuruFocus tracks. The largest, Tweedy Browne (Trades, Portfolio) Global Value, owns a 0.12% stake. The five other investors decreased their positions in their most recent reporting quarter.

Nestle SA has a market cap of 289.09 billion Swiss francs; its shares were traded around 97.19 Swiss francs Wednesday with a price-earnings ratio of 28.93 and price-sales ratio of 3.20. The trailing 12-month dividend yield of Nestle SA is 2.52%. The forward dividend yield of Nestle SA is 2.52%. Nestle SA had an annual average earnings growth of 2.40% over the past 10 years. GuruFocus rated Nestle SA the business predictability rank of 3-star.

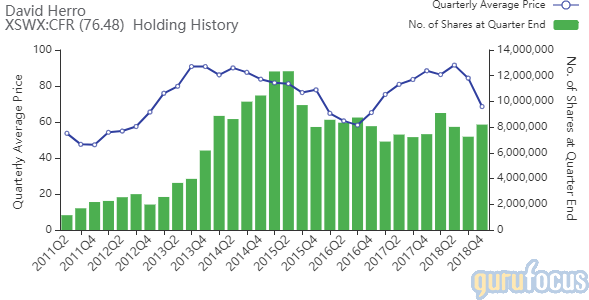

Cie Financiere Richemont SA (CFR.SW)

Luxury goods maker Cie Financiere Richemont has six investors GuruFocus tracks, with the largest position, at 1.45% of outstanding shares, belonging to David Herro (Trades, Portfolio). He increased the holding by 12.97% in the fourth quarter.

Cie Financiere Richemont SA has a market cap of 43.18 billion Swiss francs; its shares were traded around 76.48 Swiss francs with a price-earnings ratio of 15.24 and price-sales ratio of 3.37. The trailing 12-month dividend yield of Cie Financiere Richemont SA is 2.48%. The forward dividend yield of Cie Financiere Richemont SA is 2.48%. Cie Financiere Richemont SA had an annual average earnings growth of 3.20% over the past 10 years.

Roche Holding AG (ROG.SW)

Roche, a biopharmaceutical and diagnostic company, is held by six investors GuruFocus tracks. With 0.90% of outstanding shares, Primecap Management has the largest position, after it reduced it by 3.76% in the fourth quarter.

Roche Holding AG has a market cap of 228.61 billion Swiss francs; its shares were traded around 268.00 Swiss francs Wednesday with a price-earnings ratio of 21.83 and price-sales ratio of 4.03. The trailing 12-month dividend yield of Roche Holding AG stocks is 3.25%. The forward dividend yield of Roche Holding AG is 3.25%. Roche Holding AG had an annual average earnings growth of 1.10% over the past 10 years.

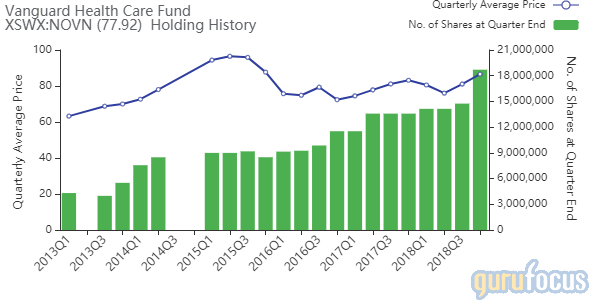

Novartis AG (NOVN.SW)

Six investors GuruFocus tracks hold shares of Novartis AG, a drug and health care products company. Vanguard Health Care Fund (Trades, Portfolio) has the largest position with 0.79% of outstanding shares after increasing the holding by 26.82% in the fourth quarter.

Novartis AG has a market cap of 180.09 billion Swiss francs; its shares were traded around 77.92 Swiss francs Wednesday with a price-earnings ratio of 14.76 and price-sales ratio of 3.52. The trailing 12-month dividend yield of Novartis AG is 3.66%. The forward dividend yield of Novartis AG is 3.66%. Novartis AG had an annual average earnings growth of 3.90% over the past 10 years.

See more European stocks held by investors GuruFocus tracks here.

Read more here:

5 Worst-Performing Health Insurance Stocks of 2019

Yacktman Focused Fund Adds to Samsung and State Street, Axes Goldman Sachs

FPA Capital Fund Buys 5 Stocks in 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Sign with XTER:VOW. Click here to check it out.

The intrinsic value of XTER:VOW