How Much Did Cyclerion Therapeutics'(NASDAQ:CYCN) Shareholders Earn From Share Price Movements Over The Last Year?

While not a mind-blowing move, it is good to see that the Cyclerion Therapeutics, Inc. (NASDAQ:CYCN) share price has gained 23% in the last three months. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 12% in one year, under-performing the market.

Check out our latest analysis for Cyclerion Therapeutics

Given that Cyclerion Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Cyclerion Therapeutics saw its revenue grow by 20%. We think that is pretty nice growth. Unfortunately that wasn't good enough to stop the share price dropping 12%. This implies the market was expecting better growth. However, that's in the past now, and it's the future that matters most.

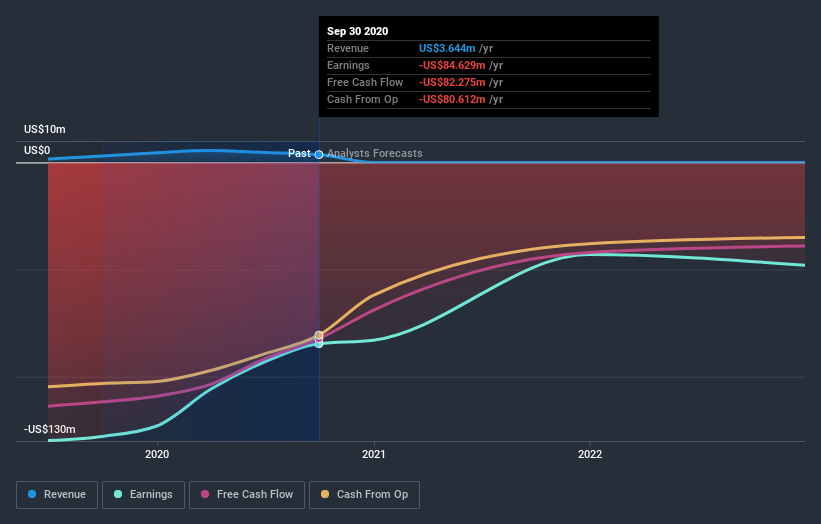

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on Cyclerion Therapeutics

A Different Perspective

While Cyclerion Therapeutics shareholders are down 12% for the year, the market itself is up 26%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 23%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 5 warning signs for Cyclerion Therapeutics you should be aware of.

Cyclerion Therapeutics is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.