How Much Did GrafTech International's(NYSE:EAF) Shareholders Earn From Share Price Movements Over The Last Year?

GrafTech International Ltd. (NYSE:EAF) shareholders should be happy to see the share price up 25% in the last week. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 41% in one year, under-performing the market.

View our latest analysis for GrafTech International

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

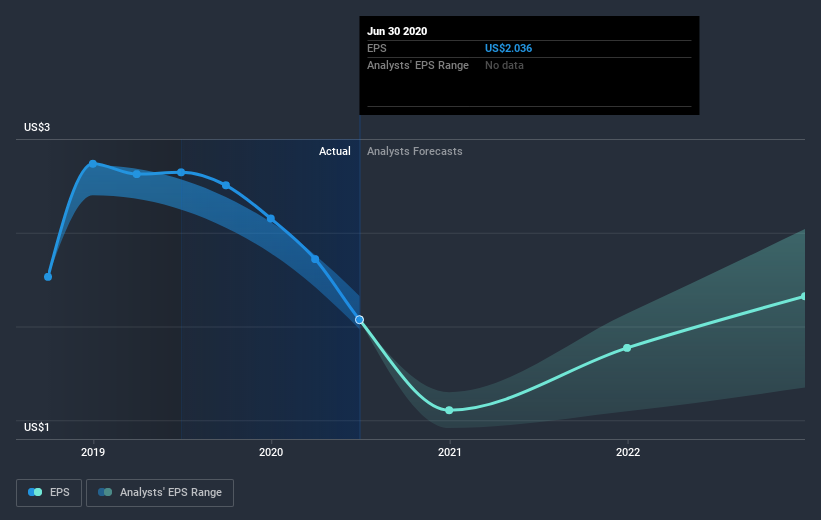

Unfortunately GrafTech International reported an EPS drop of 28% for the last year. The share price decline of 41% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business. The P/E ratio of 3.87 also points to the negative market sentiment.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on GrafTech International's earnings, revenue and cash flow.

A Different Perspective

While GrafTech International shareholders are down 39% for the year (even including dividends), the market itself is up 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 0.4%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand GrafTech International better, we need to consider many other factors. Take risks, for example - GrafTech International has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.