How Much Did Healthcare Services Group's(NASDAQ:HCSG) Shareholders Earn From Share Price Movements Over The Last Three Years?

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the last three years have been particularly tough on longer term Healthcare Services Group, Inc. (NASDAQ:HCSG) shareholders. Unfortunately, they have held through a 59% decline in the share price in that time. The falls have accelerated recently, with the share price down 10% in the last three months.

Check out our latest analysis for Healthcare Services Group

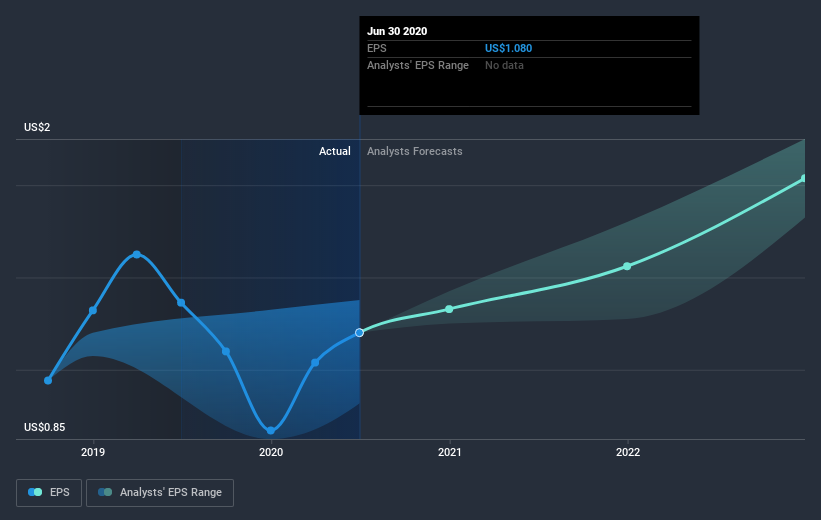

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Healthcare Services Group saw its EPS decline at a compound rate of 2.3% per year, over the last three years. This reduction in EPS is slower than the 25% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Healthcare Services Group's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Healthcare Services Group's TSR for the last 3 years was -55%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Healthcare Services Group shareholders are down 7.2% for the year (even including dividends), but the market itself is up 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4.6% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Keeping this in mind, a solid next step might be to take a look at Healthcare Services Group's dividend track record. This free interactive graph is a great place to start.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.