How Much Did Highwood Oil's(CVE:HOCL) Shareholders Earn From Share Price Movements Over The Last Year?

It is doubtless a positive to see that the Highwood Oil Company Ltd. (CVE:HOCL) share price has gained some 86% in the last three months. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 49% in one year, under-performing the market.

See our latest analysis for Highwood Oil

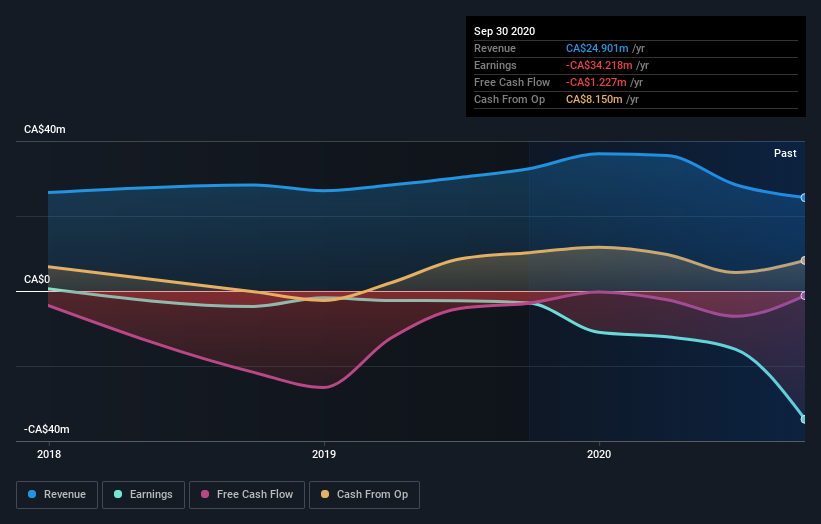

Highwood Oil isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In just one year Highwood Oil saw its revenue fall by 24%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 49% in that time. What would you expect when revenue is falling, and it doesn't make a profit? We think most holders must believe revenue growth will improve, or else costs will decline.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Highwood Oil's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the market gained 41% in the last year, Highwood Oil shareholders might be miffed that they lost 49%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 86%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Highwood Oil better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Highwood Oil (at least 3 which don't sit too well with us) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.