How Much Did Macquarie Infrastructure's (NYSE:MIC) Shareholders Earn On Their Investment Over The Last Five Years?

While it may not be enough for some shareholders, we think it is good to see the Macquarie Infrastructure Corporation (NYSE:MIC) share price up 13% in a single quarter. But if you look at the last five years the returns have not been good. After all, the share price is down 54% in that time, significantly under-performing the market.

See our latest analysis for Macquarie Infrastructure

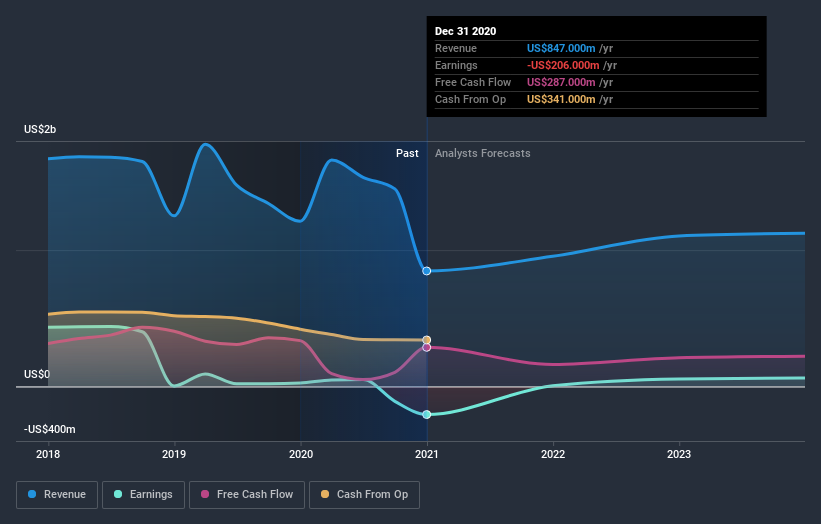

Given that Macquarie Infrastructure didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Macquarie Infrastructure reduced its trailing twelve month revenue by 5.2% for each year. That's not what investors generally want to see. The share price decline of 9% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Not that many investors like to invest in companies that are losing money and not growing revenue.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think Macquarie Infrastructure will earn in the future (free profit forecasts).

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Macquarie Infrastructure's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Macquarie Infrastructure shareholders, and that cash payout explains why its total shareholder loss of 9.5%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

It's nice to see that Macquarie Infrastructure shareholders have received a total shareholder return of 91% over the last year. There's no doubt those recent returns are much better than the TSR loss of 1.8% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Macquarie Infrastructure that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.