How much revenue has Columbus failed to collect? The estimates vary widely

What’s the difference between $45.1 million and $2.5 million?

It’s the $42.6 million difference in the estimated shortfall in Columbus’ revenue collections over the past few years, when delinquent notices for city business licenses were not mailed or payments were not banked.

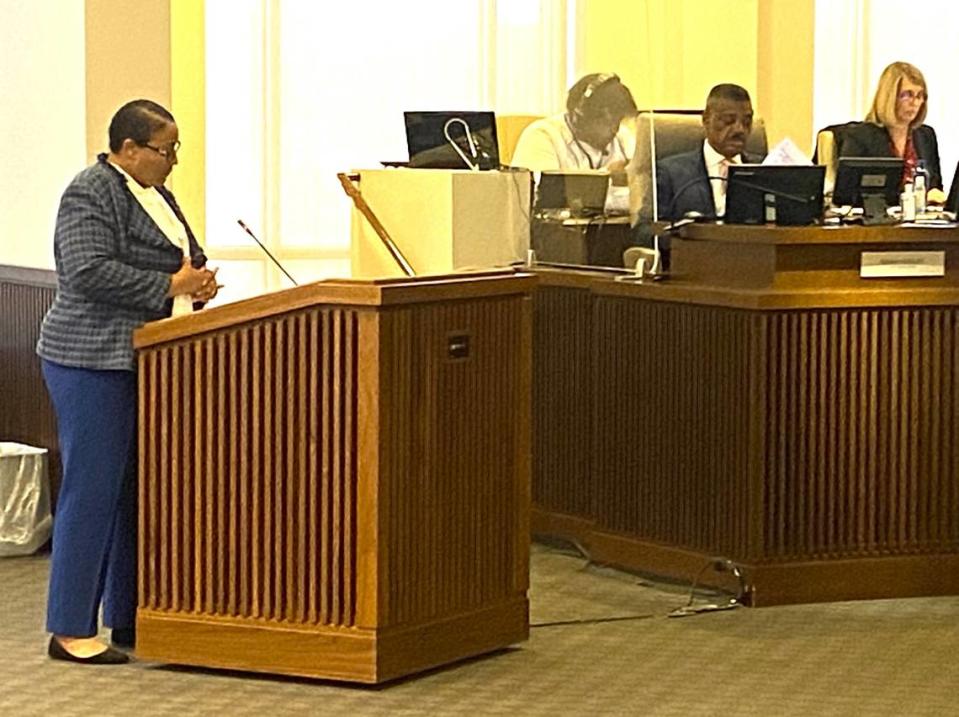

The backlog in revenue collections since 2019 came to $45.1 million, said the city’s internal auditor, Donna McGinnis, in a report presented Tuesday to Columbus Council.

No, that’s incorrect, said the city finance department in its response to that audit. The backlog came to only $2.5 million from about 500 delinquent accounts, Finance Director Angelica Alexander told council.

That discrepancy in the estimated revenue the city failed to collect stood out as councilors received reports on a finance department audit it requested July 25.

The city’s revenue division afterward tried to catch up on sending out delinquent notices, in a wave of mailings in August.

On Sept. 13, it gave lists to those behind on licensing to the city’s special enforcement division, to send officers to visit those merchants.

Councilors said this led to a crescendo of complaints, from their constituents, and they demanded City Manager Isaiah Hugley provide an “executive summary” of the problem at their last October meeting.

That’s when Hugley said a combination of staff shortages, COVID-19, extended deadlines, software issues and delayed enforcement led to the backlog in business license renewals.

The occupational taxes the revenue division collects through business licensing generates millions for the city government’s general fund, growing from $15 million in 2019 to $18.8 million this year.

An outline of the city’s operating fund for fiscal year 2024 estimated that revenue at $19.2 million, or 6% of the total.

The problems with licensing were examined not only in the finance department audit, but also an investigation conducted by the law firm Troutman Pepper, which gave councilors a private update on its probe during an executive session Tuesday, after the audit presentation.

McGinnis told council her staff’s audit revealed that businesses had submitted payments to renew licenses, but those payments had not been deposited. Sometimes checks or credit-card authorizations were set aside to be handled later, she said.

“We have checks that have never made it to the bank,” she said, noting banks typically consider checks invalid after 90 days. “The bulk of these are stale checks.”

She noted also that some payments were deposited, but the licenses were not issued. Some businesses that had paid up were sent delinquent notices.

District 4 Councilor Toyia Tucker wanted to know whether the city still could collect the money it was owed, or would have to write it off as a loss.

“There’s no easy solution,” McGinnis said, explaining that some business owners made a concerted effort to pay their occupational taxes for previous years and clear their accounts, while others did not.

Were the city to give up on the rest, it could discourage those who paid, she said. “I don’t know what message we send to them if everyone gets a pass,” she said.

Citywide Councilor Judy Thomas asked McGinnis flatly: “Are we missing $45 million?”

McGinnis said it isn’t money that was stolen or misplaced. “It’s not that kind of missing cash.”

She instead called it “an opportunity lost,” in failing to collect or bank payments. “It is still the reality of checks that you can’t take to the bank,” she said.

District 2 Councilor Glenn Davis said he felt McGinnis was too generous in her description of the problem.

“Gross negligence comes to my mind,” he said, calling the money the city failed to collect “an absolute loss.”

Finance department responds

Alexander repeatedly disputed the $45 million figure, as she addressed council after McGinnis.

“There is no missing money,” she said, arguing the $45 million McGinnis cited included money the city had collected, and should not be counted in the backlog.

“That’s why I say it’s inaccurate to state that we’re missing $45 million,” she said. “It’s money that we already have in the bank.”

The internal auditor’s estimate resulted from a “misunderstanding” of how the finance department tracked those funds, she said.

The revenue division currently is catching up on the remaining backlog, which she reiterated was $2.5 million, not $45.1 million.

In October, Alexander told council the finance department’s revenue division typically handles 7,000-8,000 business license renewals a year, and needs four to five months to process that many.

The deadline for renewals usually is April 1. But the city for four years has extended that deadline to ease the pressure on businesses during the COVID-19 pandemic.

The deadline went to June 1 for the years 2020, 2021 and 2022, and this year was extended to May 1. Because businesses often wait until the deadline to file, extended deadlines push the months-long processing time into October or November, Alexander said.

These are the annual totals she cited for licenses issued and delinquent.

2020: 7,892 and 874.

2021: 7,933 and 836.

2022: 7,387 and 1,084.

2023: 6,791 and 763.

That left a total of 3,557 delinquencies, but it was narrowed to 2,196 after removing pending renewals, closed businesses, out of county owners, and those already cited, she reported.

The reports council got Tuesday can be found on the city’s website at www.columbusga.gov.

Here’s a rundown of revenue from occupational taxes since 2019, as Alexander reported in October.

2019: $15,080,345.

2020: $15,508,938.

2021: $15,982,421.

2022: $16,448,269.

2023: $18,857,803.