How Much Will Social Security Pay Me?

Social Security is a major source of income for most U.S. seniors. In 2018, nine out of 10 people 65 or older got Social Security benefits. In general, these benefits provide around one-third of the income for elderly Americans; but a full 48% of married people and 69% of singles receive at least half their retirement income from the Social Security Administration. And 21% of couples and 44% of singles get 90% of their retirement income from Social Security retirement benefits.

Since you'll probably rely on the program for many of your retirement dollars, you need to know how much you'll likely receive in benefits. The answer can be confusing, because the amount Social Security pays you will depend on:

Average wages you earn during your working years.

The number of years you work.

Whether you claim benefits at full retirement age, before full retirement age, or after.

So, while the short answer is that you'll get benefits equal to a portion of the average wage earned over your lifetime, there's a lot more to know. This guide will explain the details.

Image source: Getty Images.

How are Social Security retirement benefits calculated?

The Social Security Administration calculates your average monthly wages over the 35 years you earned the most money, after wages are adjusted for inflation. Only wages up to the Social Security taxable limit are counted. This number is your AIME, which stands for Average Indexed Monthly Earnings.

You receive 90% of AIME in benefits up to a certain income threshold called a bend point. (Bend points are set in the year you turn 62.)

You receive 32% of AIME in benefits between the first bend point and a second bend point.

You receive 15% of AIME equal to or above the second bend point.

These percentages of AIME you receive are added together to determine your primary insurance amount (PIA). That's the amount you'd get if you claim benefits at full retirement age (FRA). FRA is between 65 and 67, depending on your birth year.

If you claim benefits after 62, wages earned after can be factored in when calculating AIME, but the bend points used to determine your benefit won't change. Your PIA will also be adjusted upward, based on cost of living adjustments, if Social Security benefits increased in any of the years after you turned 62 but before you claim benefits.

If you claim benefits before full retirement age, your primary insurance amount is reduced. The amount of the reduction is determined by how many months early you claim.

If you claim benefits after full retirement age, your primary insurance amount is adjusted upward until age 70. The amount your benefits increase is based on the number of months you wait to claim.

Using this formula, benefits equal a percentage of average wages earned over your career, with those who earn lower incomes receiving a higher percentage of total wages.

You can sign into your Social Security account to see an estimate of how much your benefit will be at age 62, at full retirement age, and at 70. These estimates are based on your current salary, so they're only rough estimates, and they can change if you earn more or less over the rest of your life.

Let's take a look at each of these steps in more detail.

How much will Social Security pay me if I retire at full retirement age?

If you retire at full retirement age, you receive your primary insurance amount. Here are the steps that the Social Security Administration takes to calculate your PIA.

Step One: Your AIME is calculated

The Social Security Administration determines your earnings for each year of your entire working life. Earnings are counted up to a certain maximum limit, based on how much of the earnings are subject to Social Security tax. In 2019, you pay Social Security tax on a maximum of $132,900 in income. So no matter how much you earn, only $132,900 in income counts when AIME is determined. The maximum income subject to Social Security tax can change annually.

Your wages are adjusted to account for inflation. This process is called wage indexing. The Social Security Administration uses the national average wage indexing series to adjust wages for inflation. The purpose is to figure out how much the wages you earned 20, 30, or 40 years ago would be worth today. The national average wage indexing (AWI) series takes time to create, so the Social Security Administration uses the AWI from two years prior to when you turned 62 when adjusting wages for inflation. If you turn 62 in 2019, the AWI from 2017 would be used.

The Social Security Administration determines your highest 35 years of earnings: After adjusting past wages for inflation, it only counts 35 years of earnings. The 35 years in which you earned the most are counted when determining AIME. If you didn't work for 35 years, some years of $0 wages are factored in. This can reduce average wages. But if you work longer than 35 years, some years of lower wages are dropped. You could potentially boost AIME by working a few extra years later in your career, when your salary is higher than at the beginning of your working life.

Your AIME is calculated: This is done by adding up 35 years of indexed earnings, dividing by 35 to get your average annual wage, then dividing by 12 to get your average monthly indexed earnings.

Step Two: You receive a set percentage of AIME based on bend points

Remember, you get benefits equal to 90% of AIME up to the first bend point, plus 32% of AIME of the amount between the first and second bend points, plus 15% of AIME greater than the second bend point.

Each bend point is an income threshold. Bend points can change annually based on the average wage index. The bend points that apply to determine your primary insurance amount are the bend points in effect the first year you're eligible to receive Social Security benefits, regardless of when you actually claim benefits. Since Social Security benefits currently become available when you turn 62, the bend points that apply in the year you turn 62 are always used.

You can find bend points for each year on the Social Security Administration website.

Let's work through an example of how this formula determines your benefit if you turned 62 in 2019. The bend points for 2019 are $926 and $5,583, so here's how the calculation looks:

After adjusting for inflation, say your average wages over 35 years were $72,000. Your AIME would be $72,000 divided by 12. That's $6,000.

You'd receive 90% of the first $926. That's $833.40.

You'd receive 32% of the amount greater than $926 but less than $5,583. That's $1,490.24.

You'd receive 15% of the amount equal to or greater than $5,583. That's $62.55.

So your primary insurance amount would be:

$833.40 + $1490.24 + $62.55 = $2,386.19

But this is NOT the benefit you'd receive at the age of 62. That's because 62 is before your full retirement age. If you were to retire at 62, your primary insurance amount would be reduced because you were retiring early. We'll talk more later about how the primary benefit is reduced if you retire before full retirement age or increased if you retire after.

Step Three: Your primary insurance amount is adjusted if you retire after 62

If you keep working after 62, wages earned later can be factored in when determining AIME. So AIME could change, even though the bend points used to calculate your benefit wouldn't.

Cost of living adjustments (COLAs) are also applied to determine your primary insurance amount. COLAs are adjustments to Social Security benefits that may occur annually if the cost of living increases. They are calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Say you retire at age 63 in 2020, instead of at 62 in 2019, and the COLA from 2019 to 2020 was 2%. If your primary insurance amount as calculated at 62 was $2,386.19, and your AIME doesn't change, you'd apply the 2% COLA to the $2,386.19 to determine your primary insurance amount: $2,386.19 x 1.02 = $2,433.91.

Of course, this primary insurance amount would then be reduced downward, because 63 is before your full retirement age. But more about that later.

How does my age affect the amount Social Security pays me?

If you retire before full retirement age, you will receive less than your primary insurance amount. If you retire after full retirement age, you will receive more. The table below shows what your full retirement age is.

Year of Birth | Full Retirement Age |

1937 or earlier | 65 |

1938 | 65 and 2 months |

1939 | 65 and 4 months |

1940 | 65 and 6 months |

1941 | 65 and 8 months |

1942 | 65 and 10 months |

1943-1954 | 66 |

1955 | 66 and 2 months |

1956 | 66 and 4 months |

1957 | 66 and 6 months |

1958 | 66 and 8 months |

1959 | 66 and 10 months |

1960 or later | 67 |

Source: Social Security Administration.

If you claim benefits at your full retirement age based on your birth year, you receive your primary insurance amount. Otherwise, you'll need to do some math to determine the amount by which your benefit is reduced or increased. We'll explain below how to do that if you retire early or late.

How much will Social Security pay me if I retire early?

If you claim benefits early, your primary insurance amount is still calculated the same way. But it's reduced if you retire prior to full retirement age, falling by:

5/9 of 1% per month for each of the first 36 months before full retirement age

5/12 of 1% for each additional month prior to 36 months before full retirement age

This amounts to around a 6.67% benefit reduction per year for up to three years, and then an additional 5% reduction in benefits for each additional year prior to FRA. So:

If your full retirement age would be 67 and you retire at 62, your benefits reduction would equal 36 months times 5/9 of 1% + 24 months times 5/12 of 1% = 0.20 + 0.10 = 0.30. Your benefits would be reduced by 30%.

If your full retirement age would be 66 and you retire at 62, your benefits reduction would equal 36 months times 5/9 of 1% + 12 months times 5/12 of 1% = 0.20 + 0.05 = 0.25. Your benefits would be reduced by 25%.

The table below shows how much your benefit would be reduced if you retired early, based on your full retirement age.

If Your Full Retirement Age Is | And You Retire At | Your Benefit Would Be Reduced By |

65 | 62 | 20% |

65 | 63 | 13.3% |

65 | 64 | 6.7% |

66 | 62 | 25% |

66 | 63 | 20% |

66 | 64 | 13.3% |

66 | 65 | 6.7% |

67 | 62 | 30% |

67 | 63 | 25% |

67 | 64 | 20% |

67 | 65 | 13.3% |

67 | 66 | 6.7% |

To determine what your benefits will be if you retire early, simply take your primary insurance amount and multiply by the percentage reduction. So if your primary insurance amount is $2,000 and you retire at 66 instead of 67, your benefit would equal $2,000 minus 6.7% of $2,000, or $1,866.

How much will Social Security pay me if I retire late?

If you retire late, you will earn delayed retirement credits, and the amount you receive will be higher than your primary insurance amount. For those born in 1943 or later, benefits are increased by 2/3 of 1% for each month you wait to claim benefits after FRA. However, no further increases occur after the age of 70. This amounts to an 8% increase in benefits each year. So:

If you retire one year after FRA, you will receive 8% more than your primary insurance amount.

If you retire two years after FRA, you will receive 16% more than your primary insurance amount.

If you retire three years after FRA, you will receive 24% more than your primary insurance amount.

If you retire four years after FRA, you will receive 32% more than your primary insurance amount.

You'll again multiply your primary insurance amount by the percentage increase. So if your primary insurance amount is $2,000 and you retire at 70 instead of 66, you would get $2,000 + 32% of $2,000, or $2,640.

What's an easy way to tell how much Social Security will pay me?

If you're overwhelmed with all these details, there is an easy way to estimate how much Social Security will pay you:

Sign up for an account at SSA.gov/myaccount if you don't already have one. You will need your Social Security number, a valid email address, and a U.S. mailing address. You also must be at least 18 years old.

Sign into your account at Secure.SSA.gov using a user name and password you create.

Verify your email address.

Enter the confirmation code sent to your email.

Click that you agree to the terms of service.

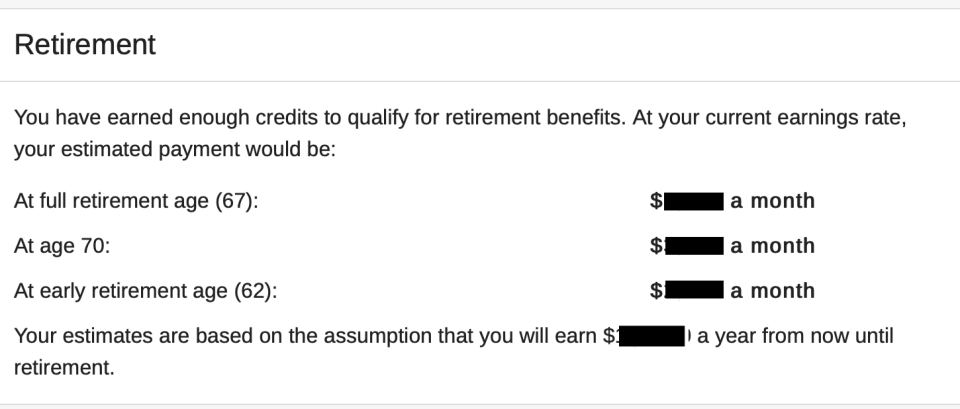

On the main page of your account, you will see a summary of your last reported earnings for the most recent year in which you worked, as well as your estimated benefit at full retirement age. You can also click on "Estimated Benefits," and it will open up a window showing you what your benefits would be if you claimed at age 62 and at age 70.

Image source: Social Security Administration.

Once you have clicked on "Estimated Benefits," here's what you'll see. Your estimated benefits at different ages will be shown where the blacked-out squares are on this image.

Image source: Social Security Administration

Remember, this gives you an estimate based on the assumption your average wages over the course of your career will stay roughly the same for the rest of your working life. This may not be true. But this can give you a rough idea of where you stand. The older you are and the closer to retirement age, the more accurate this estimate will be.

The Social Security Administration also has a quick calculator on its website. You can input your date of birth, current year's earnings, and the month and year when you plan to retire to get an idea of what your benefits are likely to be.

Now you know how much Social Security will pay you

Now you know how much your benefits will be when you retire. Your primary insurance amount is determined based on your average monthly indexed earnings, which is an inflation-adjusted average of the wages earned over your highest 35 years of earnings. Your primary insurance amount is then adjusted either up or down depending upon whether you claim benefits before full retirement age or after. If you claim benefits at your full retirement age, you will receive exactly your primary insurance amount.

As you can see, the salary you earn, the number of years you work, and the age at which you claim benefits all affect the amount you're paid. You can sign into your Social Security account to get an idea of the amount of benefits you will receive, or can use the Social Security Administration's calculator to get a rough estimate based on current earnings.

More From The Motley Fool

The Motley Fool has a disclosure policy.