What You Must Know About Sinotruk (Hong Kong) Limited’s (HKG:3808) Financial Health

Small-caps and large-caps are wildly popular among investors, however, mid-cap stocks, such as Sinotruk (Hong Kong) Limited (HKG:3808), with a market capitalization of HK$32.9b, rarely draw their attention from the investing community. Despite this, the two other categories have lagged behind the risk-adjusted returns of commonly ignored mid-cap stocks. 3808’s financial liquidity and debt position will be analysed in this article, to get an idea of whether the company can fund opportunities for strategic growth and maintain strength through economic downturns. Don’t forget that this is a general and concentrated examination of Sinotruk (Hong Kong)’s financial health, so you should conduct further analysis into 3808 here.

View our latest analysis for Sinotruk (Hong Kong)

How does 3808’s operating cash flow stack up against its debt?

3808 has shrunken its total debt levels in the last twelve months, from CN¥5.1b to CN¥4.0b . With this debt payback, the current cash and short-term investment levels stands at CN¥15.9b for investing into the business. Additionally, 3808 has generated CN¥4.8b in operating cash flow during the same period of time, leading to an operating cash to total debt ratio of 118%, signalling that 3808’s debt is appropriately covered by operating cash. This ratio can also be a sign of operational efficiency as an alternative to return on assets. In 3808’s case, it is able to generate 1.18x cash from its debt capital.

Can 3808 meet its short-term obligations with the cash in hand?

At the current liabilities level of CN¥40.5b liabilities, the company has maintained a safe level of current assets to meet its obligations, with the current ratio last standing at 1.23x. Generally, for Machinery companies, this is a reasonable ratio since there is a bit of a cash buffer without leaving too much capital in a low-return environment.

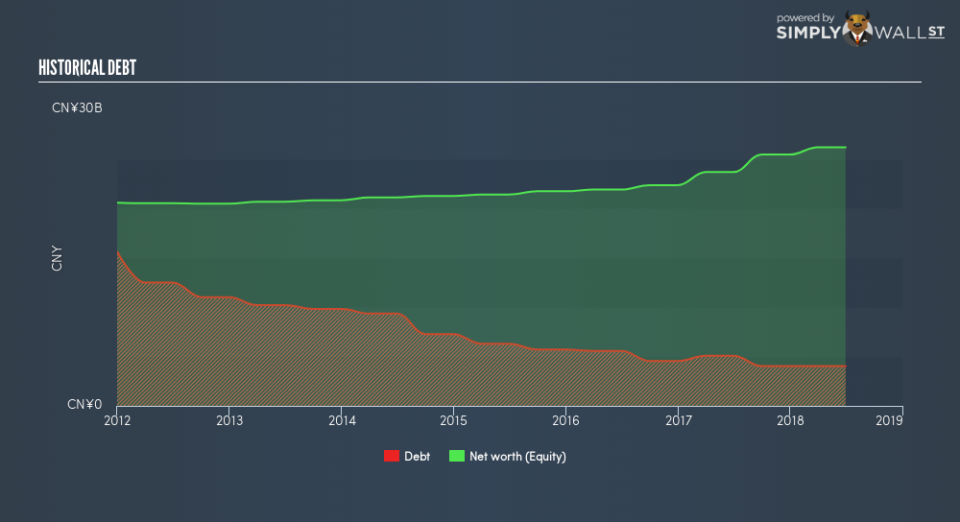

Is 3808’s debt level acceptable?

3808’s level of debt is appropriate relative to its total equity, at 15%. This range is considered safe as 3808 is not taking on too much debt obligation, which can be restrictive and risky for equity-holders. We can check to see whether 3808 is able to meet its debt obligations by looking at the net interest coverage ratio. A company generating earnings before interest and tax (EBIT) at least three times its net interest payments is considered financially sound. In 3808’s, case, the ratio of 62.89x suggests that interest is comfortably covered, which means that lenders may be inclined to lend more money to the company, as it is seen as safe in terms of payback.

Next Steps:

3808 has demonstrated its ability to generate sufficient levels of cash flow, while its debt hovers at a safe level. In addition to this, the company exhibits an ability to meet its near term obligations should an adverse event occur. This is only a rough assessment of financial health, and I’m sure 3808 has company-specific issues impacting its capital structure decisions. I suggest you continue to research Sinotruk (Hong Kong) to get a better picture of the stock by looking at:

Future Outlook: What are well-informed industry analysts predicting for 3808’s future growth? Take a look at our free research report of analyst consensus for 3808’s outlook.

Valuation: What is 3808 worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether 3808 is currently mispriced by the market.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.