National Storage Affiliates Trust (NYSE:NSA) Has Gifted Shareholders With A Fantastic 160% Total Return On Their Investment

When you buy a stock there is always a possibility that it could drop 100%. But when you pick a company that is really flourishing, you can make more than 100%. Long term National Storage Affiliates Trust (NYSE:NSA) shareholders would be well aware of this, since the stock is up 111% in five years. Also pleasing for shareholders was the 22% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

View our latest analysis for National Storage Affiliates Trust

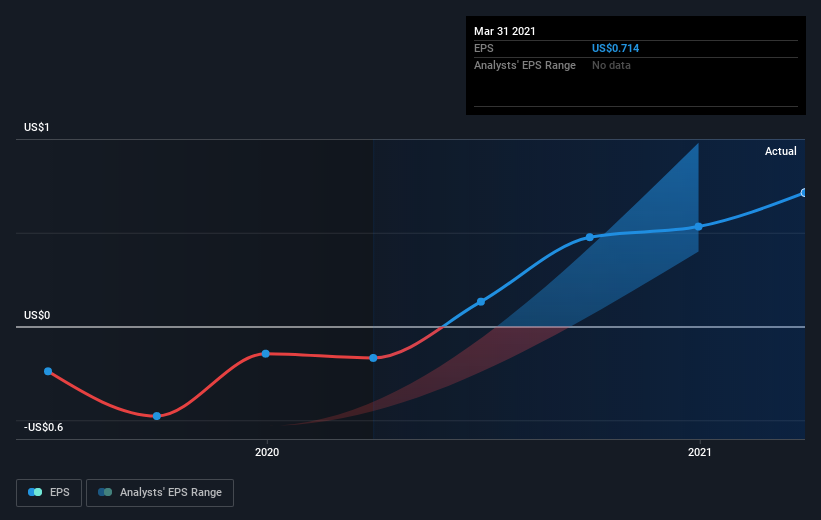

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the five years of share price growth, National Storage Affiliates Trust moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, National Storage Affiliates Trust's TSR for the last 5 years was 160%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that National Storage Affiliates Trust shareholders have received a total shareholder return of 61% over the last year. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 21% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand National Storage Affiliates Trust better, we need to consider many other factors. For instance, we've identified 3 warning signs for National Storage Affiliates Trust (1 is significant) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.