Will NC make it harder for HOAs to foreclose on homeowners? Lawmakers will decide

Stronger protections against foreclosures. Better access to homeowner association records. Checks on HOA boards that try to hike dues without the consent of homeowners.

Those are among the changes that homeowners in HOA communities would see if a collection of new legislative proposals ultimately become law.

The House Select Committee on Homeowners’ Associations, a panel studying ways to improve protections for HOA members, voiced support for those recommendations this week.

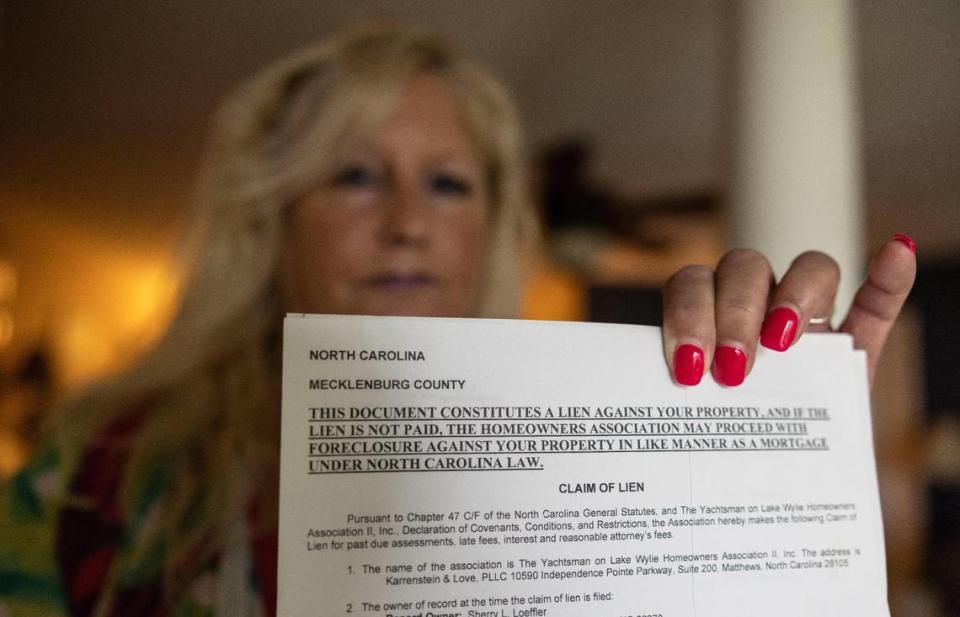

The proposals follow a litany of complaints from homeowners — and an investigation by The Charlotte Observer and The News & Observer, which found that hundreds of North Carolinians have lost their homes to HOA foreclosures, often over small debts.

Hopes Foreclosed

NC rules make it easy for HOAs to foreclose on homeowners. State law allows them to force the sale of homes for any amount of unpaid dues, no matter how small. Our investigation shows how often it's happening — and how it can be devastating to homeowners.

Hundreds in NC lose homes, equity after HOAs foreclose. Who protects homeowners?

Deceit, rigged bids and extortion: How HOA foreclosures can open the door to predators

‘Once. Twice. Sold for $4,400.’ How HOA foreclosure auctions cost owners their homes

Can an HOA sell your home? What NC law says, and how to challenge foreclosures

Charlotte HOA member learned the hard way: Fighting back can be a long, costly battle

When North Carolina HOAs want to block or pass legislation, they often get their way

One proposal would prohibit HOAs from foreclosing on homes unless owners are more than $2,500 or six months behind on dues payments. HOAs would also have to give homeowners the chance to pay the dues they owe under an installment schedule.

The newspapers’ analysis of more than 100 HOA foreclosure cases showed that about half of the homeowners had debts of less than $2,000.

“Is it fair to foreclose on a property over several hundred dollars?” said Rep. Ya Liu, a Wake County Democrat who serves as the committee’s vice chair. “It’s way out of proportion. There are so many reasons people fall behind on their dues.”

Reform hasn’t been embraced in NC

About 27% of North Carolina residents now live in HOA communities, and that percentage is expected to grow.

Following opposition from homeowners associations, some restrictions on HOA foreclosures were stripped from House Bill 542 last year.

Passing the bill would have put North Carolina in line with several other states — including Georgia, California and Arizona — that have laws to prevent HOAs from foreclosing over tiny amounts of money.

H542 was one of three bills introduced in North Carolina last year to create more oversight for HOAs and to limit their ability to foreclose on homeowners. Following opposition from HOAs, all those bills were either diluted, gutted or left to die.

Leaders of the North Carolina chapter of the Community Associations Institute (CAI), the group that advocates for HOAs, have argued that limiting foreclosures could put a financial strain on associations. But Liu said she doesn’t buy that argument.

Rep. Frank Iler, a Brunswick County Republican who co-chairs the HOA committee, said he’s optimistic that the new HOA proposals will be better received by legislators this year, thanks in part to the HOA committee’s work.

Proposed checks on HOAs

Other proposals expected from the committee would:

▪ Require approval of a majority of homeowners in an HOA community to ratify any proposed budget that would result in dues increases of more than 10%. Lawmakers have heard from homeowners who said their HOAs hiked dues sharply.

Weldon Jones, the lobbyist for the CAI’s North Carolina chapter, said the group is concerned that the proposal could lead some HOAs and condo associations to put off needed building maintenance. That, he said, could lead to expensive and potentially dangerous problems down the road. He pointed to the deadly 2021 collapse of a condo building in Surfside, Florida, where structural repairs had been delayed before the tragedy.

▪ Mandate that HOAs make records requested by a member available for inspection within 30 days of the request. HOAs would not be required to produce records that were created more than three years before the member’s request.

Iler said he has heard dozens of complaints from homeowners who have not been able to get prompt access to HOA records. “If this was a town, that would be illegal,” he said.

But Jeanne Hinds, co-chair of the North Carolina HOA Law Reform Coalition, objected to the three-year limit. “What do you do if you want to see a contract that goes back five years?” she asked.

▪ Require mediation of disputes between associations and their members before filing lawsuits — unless both parties opt to waive that requirement.

In a January committee meeting, the executive director of the Mediation Network of North Carolina told legislators that many HOAs don’t cooperate when homeowners seek to mediate problems.

▪ Require the state Department of Justice to receive complaints submitted by HOAs or their members, and then forward a copy of those complaints to the other parties. It would also require the department to collect information about the issues giving rise to the disputes and submit an annual report to lawmakers summarizing information compiled from complaints.

That would give lawmakers a better handle on what problems need to be addressed, Iler said.

But the proposal would not give the Department of Justice new power to penalize HOAs for breaking the law, Hinds noted.

Jones, the lobbyist for the CAI’s North Carolina chapter, said the group is still examining the proposals but is concerned that some of them may bring unintended consequences.

“In an effort to support owners, which CAI supports, we don’t want to create undue restrictions or burdens on other owners, the consequences of which may not be understood at this time,” he said.

Hinds said she was troubled that lawmakers have ignored one of her group’s chief recommendations: that homeowners be given low-cost ways to hold HOAs accountable for flouting the law — such as the ability to seek fines against board members in small claims court.

“It just doesn’t give us any enforcement power,” she said.

Concerns about abuse of power

The bipartisan committee is expected to vote in favor of the recommendations at its final meeting, on Feb. 28th. The proposals have been incorporated into a draft bill, which will likely be introduced this year, said Liu, the Wake County Democrat.

This isn’t the first time state lawmakers have proposed stronger safeguards for HOA members. A 2011 House select committee found there was a need for additional measures to protect homeowners from “abusive HOA practices” such as arbitrary enforcement of rules, excessive fines and abuse of the foreclosure process.

Most of that committee’s recommendations weren’t enacted.

“It got watered down pretty good,” Iler, who served on the previous select committee, said of the 2011 recommendations. “But we hope this year’s process will lead to more credibility.”

Surveys by the HOA industry’s research arm suggest that many are pleased with their homeowners associations.

But a poll conducted last year by the non-profit policy organization Carolina Forward found that 64% of North Carolinians support placing limitations on the ability of HOAs to take legal action against property owners or foreclose on property.

“Homeowners are concerned about HOAs abusing their power,” Liu said. “So we’re trying to prevent that from happening.”