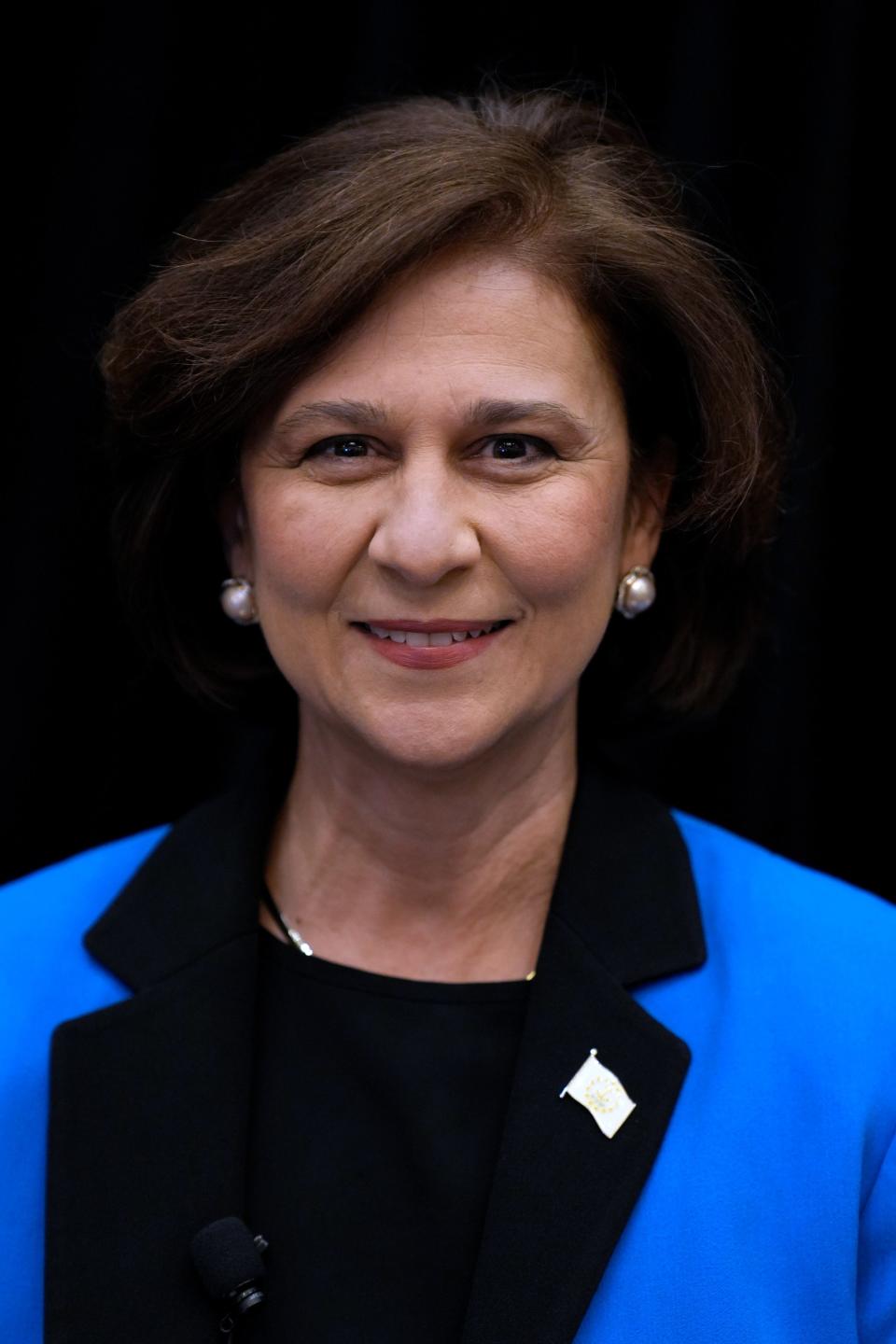

Nellie Gorbea says she would raise taxes on corporations if elected governor

Secretary of State Nellie Gorbea wants to raise taxes on Rhode Island corporations if she becomes governor.

The Democrat launched her first television campaign spot Tuesday and said if elected she would "raise taxes on big corporations so we can fix this housing crisis, expand pre-k to every child and reward small businesses that create jobs here."

Election 2022 Updates: The latest news in the highest-profile races in Rhode Island

Taxes Gorbea would raise

The ad didn't specify what taxes Gorbea would raise, or by how much, but in a follow-up email her campaign said she would:

-Raise the state corporate tax rate from 7% to 8% to raise an estimated $39 million a year. She added that 8% would match Massachusetts' corporate tax rate.

-Raise the tax on financial institutions from 9% to 10.5% to raise an estimated $6 million.

-End "several exemptions in state law that benefit particular industries or businesses, including hedge funds and dividends received from shares of stock that benefit a wealthy few and pass along expense to everyday Rhode Islanders."

-And prevent companies from using offshore tax havens to bring in an estimated $43 million in additional annual tax revenue.

What other candidates think about a tax hike

Her Democratic primary rivals mostly attacked the idea.

"I think that kind of brings us backwards talking about raising taxes right now," Gov. Dan McKee told The Journal at the State House on Tuesday. "I think we should be talking about lowering taxes as long as we are able to manage the budget and provide surpluses as I have managed to do. At the moment this is a very risky strategy. ... We need to make sure that businesses that are here stay here."

Former CVS executive Helena Foulkes called a corporate tax hike "a proposal to drive jobs out of Rhode Island."

"If the next governor targets Rhode Island businesses with new taxes, the reality is that many will leave and they will take thousands of jobs with them," she said. "We already have a difficult enough time recruiting and retaining businesses in this state – that's why we need a governor who understands the new economy."

A.J. Braverman, spokesman for former Secretary of State Matt Brown, said Gorbea's plan would also raise taxes on some small businesses.

"That makes no sense," Braverman wrote. "Local small businesses – many of which are struggling – should not face tax increases while giant corporations reap billions in profit," he wrote in an email. "Matt supports a graduated corporate tax so that giant corporations like Amazon and Walmart pay higher tax rates than our small businesses.”

Not all of the Democratic candidates are opposed to raising the corporate tax rate.

Luis Daniel Muñoz said he would raise the corporate rate to 7.5%, "which still keeps us competitive against Massachusetts."

But Muñoz said he would look at wealthy individuals as well as companies and raise income taxes on the top 1% of earners.

"The additional tax revenues can be used to effect programmatic changes to how Rhode Island supports its microbusinesses (1-9 employees), by creating a tangible property tax exemption modeled after the car tax phaseout, and by modifying the passthrough income tax law to apply only to operating microbusinesses," Muñoz wrote in an email. "These policies will create greater economic opportunity for individuals looking to start their own business, and will help us hedge against future economic recessions by reducing our dependence on a small group of large businesses for employment."

Crunch time on Smith Hill: What to watch for in the final week of the General Assembly

A priority of then-Gov. Lincoln Chafee, Rhode Island cut its corporate tax rate from 9% to 7% in 2014 and paid for the reduction by requiring companies to include profits from their subsidiaries in their income.

Republican candidate for governor Ashley Kalus said the 7% corporate rate is "one of the only competitive taxes our state offers regionally," and she would not raise it.

"These sorts of failed policies from career politicians like Nellie Gorbea have made Rhode Island the 46th-worst state in the country to do business, and this move will all but guarantee we are once again dead last," Kalus wrote.

In her television ad, Gorbea said, "Rhode Island and I are a lot alike. We're small. We're sometimes underestimated, but we are full of hope and determination."

panderson@providencejournal.com

(401) 277-7384

On Twitter: @PatrickAnderso_

More: How do you get a low-numbered license plate in Rhode Island these days?

This article originally appeared on The Providence Journal: Nellie Gorbea: Raise RI taxes on corporations to pay for housing