Netflix Bounce Sparks Bullish Options Trading

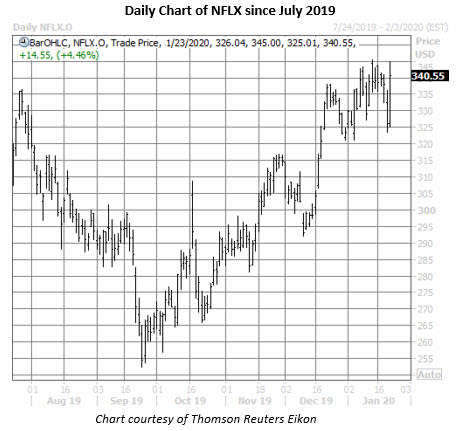

A negative earnings reaction weighed on Netflix Inc (NASDAQ:NFLX) shares Wednesday, but today, the FAANG stock is trading up 4.5% at $340.55. Sparking the bounce is a bull note from Guggenheim, which raised its NFLX price target to $420 from $400. The brokerage firm waxed optimistic on subscriber growth in international markets.

NFLX options traders are taking a bullish stance, too, with roughly 255,000 calls traded so far -- three times what's typically seen, and volume pacing in the 99th annual percentile. The weekly 1/24 340-, 345-, and 350-strike calls are most active, and it looks like new positions are being purchased here. If this is the case, call buyers expect Netflix stock to continue its rebound through week's end.

Options bulls have already been more bullish than usual toward the streaming stock. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), NFLX stock's 10-day call/put volume ratio of 1.68 ranks in the 92nd percentile of its 12-month range, meaning calls have been bought to open over puts at an accelerated clip.

And with earnings in the rearview mirror, it's an attractive time to purchase premium on short-term Netflix options. The stock's Schaeffer's Volatility Index (SVI) of 31% registers in the 6th annual percentile. In other words, near-term NFLX options have priced in lower volatility expectations just 6% of the time over the past year.