News Flash: Analysts Just Made A Substantial Upgrade To Their WidePoint Corporation (NYSEMKT:WYY) Forecasts

WidePoint Corporation (NYSEMKT:WYY) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects. The market may be pricing in some blue sky too, with the share price gaining 13% to US$0.58 in the last 7 days. Could this upgrade be enough to drive the stock even higher?

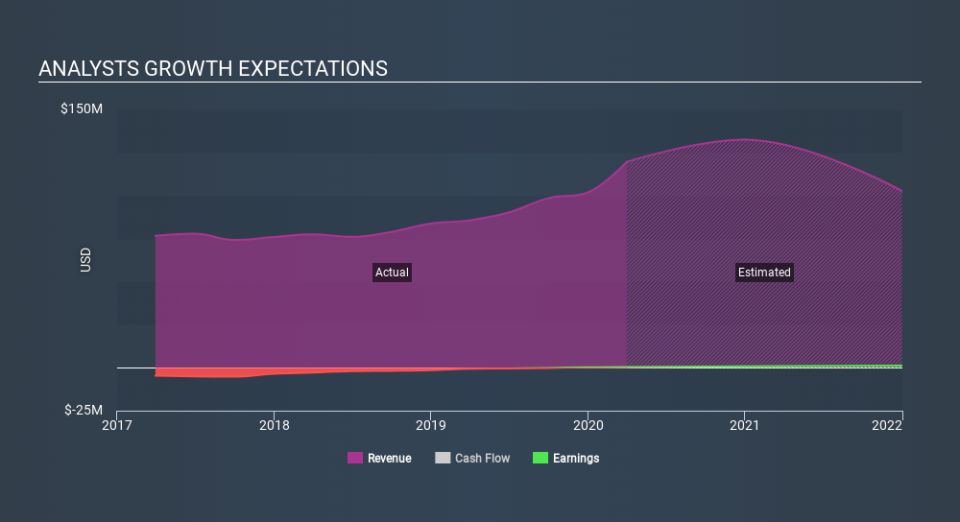

Following the upgrade, the current consensus from WidePoint's twin analysts is for revenues of US$132m in 2020 which - if met - would reflect a solid 11% increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$107m in 2020. It looks like there's been a clear increase in optimism around WidePoint, given the very substantial lift in revenue forecasts.

Check out our latest analysis for WidePoint

We'd point out that there was no major changes to their price target of US$0.88, suggesting the latest estimates were not enough to shift their view on the value of the business. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on WidePoint, with the most bullish analyst valuing it at US$1.00 and the most bearish at US$0.75 per share. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting WidePoint is an easy business to forecast or the underlying assumptions are obvious.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's clear from the latest estimates that WidePoint's rate of growth is expected to accelerate meaningfully, with the forecast 11% revenue growth noticeably faster than its historical growth of 8.9% p.a. over the past five years. Other similar companies in the industry (with analyst coverage) are also forecast to grow their revenue at 11% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that WidePoint is expected to grow at about the same rate as the wider industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for WidePoint this year. The analysts also expect revenues to grow approximately in line with the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at WidePoint.

But wait - there's more! At least one of WidePoint's twin analysts has provided estimates out to 2021, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.