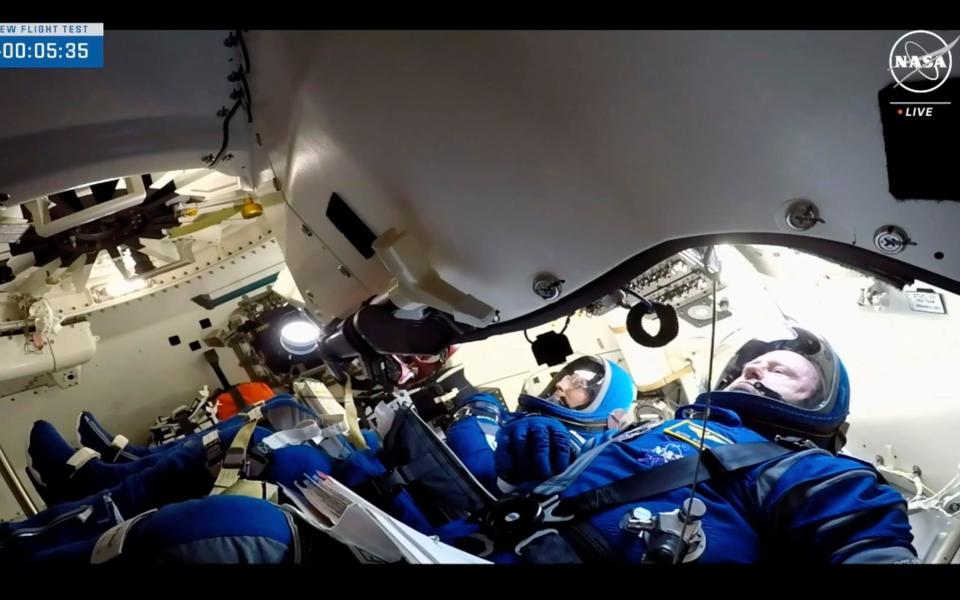

Boeing Starliner launches first crewed space flight

Boeing has launched its new Starliner astronaut capsule in a much-delayed first test flight with a crew as the company steps up the pressure on Elon Musk’s Space X.

The CST-100 Starliner lifted off from Cape Canaveral Space Force Station in Florida with two NASA astronauts aboard today.

The spacecraft is heading for the International Space Station and is expected to arrive on Thursday after a 25-hour flight.

The crew will spend just over a week on the ISS before returning on the Starliner. They’re due to touch down in a remote desert location in the US on June 14.

The successful launch comes after two previous attempts were called off due to technical issues.

An attempt on May 6 was halted two hours before liftoff over three issues that required weeks of extra scrutiny. Another try last Saturday was halted less than four minutes before liftoff because of a glitch with a launchpad computer.

Read the latest updates below.

06:44 PM BST

Wrapping up

That’s all from us for today, folks. Thanks for following along. We’ll be back first thing tomorrow for more live updates.

I’ll leave you with this big story from our energy editor Jonathan Leake:

Development of the “best remaining oil field in UK waters” has been delayed because of Labour’s threats to impose new levies and strip the industry of key tax breaks.

Jersey Oil and Gas has told investors that the work on the Buchan field will be postponed for at least a year because of the political uncertainties around the future of the North Sea.

Chief executive Andrew Benitz told shareholders at Jersey’s annual shareholder meeting that the company and its partners needed “fiscal clarity”.

The future of the project has been cast into doubt by the general election.

06:24 PM BST

Ocado drops out of FTSE 100

Ocado has dropped out of the FTSE 100 following a collapse in the online supermarket’s share price.

FTSE Russell, which operates the index, confirmed that Ocado will be relegated to the FTSE 250 after its market value tumbled from a peak of £22bn during the pandemic to just £3bn on Wednesday.

Founder and chief executive Tim Steiner has been pushing for investors to view the company as a technology stock rather than a loss-making retail company.

Ocado has also been hampered with difficulties at its joint venture with Marks & Spencer, fuelling tensions between the two companies.

The crisis has fuelled speculation that Ocado could look to shift its stock market listing from London to New York, where its valuation could be higher.

Embattled fund manager St James’s Place has also been relegated from the FTSE 100 alongside electrical products maker RS Group.

Tech giant Darktrace, housebuilder Vistry and real estate firm LondonMetric Property will be promoted to the blue-chip index.

The changes will take effect at the start of trading on Monday June 24.

05:57 PM BST

Reform just two points shy of Tories after Farage return

Support to Reform UK has surged to within just two points of the Tories after the return of Nigel Farage.

The latest YouGov poll showed Reform is on 17pc, just two percentage points shy of the Conservative Party on 19pc.

Labour is still well in the lead on 40pc, though this has narrowed by six percentage points.

It follows Farage’s surprise announcement on Monday that he was taking over the leadership of Reform and standing for re-election.

05:30 PM BST

FTSE 100 closes higher

A quick update on the FTSE 100, which has closed the day higher after the latest US data reinforced predications of Fed interest rate cuts in September.

The blue-chip index was up 0.2pc after two days of falls. The domestically-focused FTSE 250 also gained 0.2pc.

The gains were led by automobile and pharmaceutical stocks, while retail stocks fell into the red.

Discount chain B&M weighed with a 7.3pc drop and ended at the bottom of the FTSE 100 after preliminary full-year results.

British Gas owner Centrica fell 4.8pc after saying profitability will be strongly weighted towards the first half of the year.

The FTSE 100 was also buoyed by signs of cooling in the US jobs market, which reinforced predictions of a September rate cut.

05:05 PM BST

Ban fossil fuel ads to prevent climate hell, warns UN chief

Adverts for fossil fuel companies should be banned to prevent “climate hell”, the head of the UN has said.

António Guterres, UN Secretary General, branded oil and gas companies the “godfathers of climate chaos” and called for urgent action to cut emissions more quickly.

In a special address at the American Museum of Natural History in New York, Mr Guterres said the fossil fuel industry should face an advertising ban, similar to the ones rolled out on tobacco companies.

He also called on media and big tech firms to stop accepting adverts from highly-polluting companies.

Mr Guterres said: “Many in the fossil fuel industry have shamelessly greenwashed, even as they have sought to delay climate action — with lobbying, legal threats, and massive ad campaigns.”

The comments came as the UN chief warned time was running out to change course after global temperatures stood at record highs for each of the last 12 months.

Mr Guterres said: “We need an exit ramp off the highway to climate hell,” adding: “The battle for 1.5 degrees will be won or lost in the 2020s.”

04:36 PM BST

In pictures: Boeing launches Starliner flight

04:21 PM BST

SoftBank activist pushes for $15bn share buyback

An activist investor has reportedly built a sizeable stake in SoftBank and is pushing the Japanese conglomerate to launch a $15bn share buyback.

Elliott Investment Management, which was founded by billionaire Paul Singer, has taken a stake worth more than $2bn and engaged with executives in recent months, Bloomberg reports.

Elliott is said to be arguing that a buyback of that size would help SoftBank founder Masayoshi Son to signal his confidence in the company to the market.

It’s the second time the activist has targeted SoftBank, which is one of the world’s largest tech investors with holdings in companies including chip giant Arm.

04:10 PM BST

Former Just Stop Oil donor Dale Vince hands £5m to Labour

Green energy tycoon Dale Vince has donated £5m to Labour as he looks to bolster the Opposition’s war chest ahead of the general election, writes Eir Nolsoe.

The former Just Stop Oil donor has recently ramped up his contributions to Sir Keir Starmer’s party, handing over £1m the day after Rishi Sunak called the election on May 22.

This comes after previous instalments of £500,000 and £1m earlier in the year.

Mr Vince told the Financial Times that his latest donations mean he has now given Labour at least £5m.

As the founder of renewable energy supplier Ecotricity, Mr Vince has in recent years used his wealth to back political causes, including the environmental protest group Just Stop Oil.

The group has been heavily criticised for carrying out high-profile protests, such as blocking motorways and disrupting sports events.

03:51 PM BST

British Gas shareholders approve boss’s £4m pay rise

Shareholders in British Gas’s parent company have approved a pay rise of nearly £4m for the company’s chief executive – even after he said he couldn’t justify a smaller pay packet the previous year.

Chris O’Shea, chief executive of Centrica, took home £8.2m for 2023, consisting of an £810,000 salary, a £1.4m annual bonus and £5.9m in long-term bonus, pension and benefits.

The figure is nearly double his £4.5m pay in 2022.

Mr O’Shea has come under scrutiny for his huge pay packets as millions of households have struggled with sky-high energy bills. In January, he admitted he was “incredibly fortunate” and that there was “no point” in trying to justify his 2022 salary.

Shareholder advisory group Pirc told investors to vote against the chief executive’s 2023 pay deal at Centrica’s annual general meeting.

However, more than 90pc of shareholders voted in favour.

03:35 PM BST

Handing over

Right, I’m off to do a bit of gardening, and James Warrington will keep sending you live updates here until the evening.

Talking of green spaces, here is a striking shot of some luscious greenery in an unusual spot today.

An employee is photographed hard at work in a seedling nursery in Lianyungang, in eastern China’s Jiangsu province.

03:21 PM BST

US services sector grows in blow to summer rate cut hopes

The services sector of the US economy grew at its fastest pace in nine months, a closely-watched survey shows, in a blow to any lingering hopes of summer interest rate cuts.

The latest ISM Services PMI came in at 53.8pc, bouncing back from a contraction in April, and putting the sector above the 50 mark separating growth from contraction for the 46th time in the last two years.

It was also higher than analyst expectations of 51pc, and indicates the US economy remains resilient in spite of high interest rates.

Anthony Nieves, chairman of the Institute for Supply Management (ISM) services committee said:

The increase in the composite index in May is a result of notably higher business activity, faster new orders growth, slower supplier deliveries and despite the continued contraction in employment.

Survey respondents indicated that overall business is increasing, with growth rates continuing to vary by company and industry.

Employment challenges remain, primarily attributed to difficulties in backfilling positions and controlling labour expenses.

The majority of respondents indicate that inflation and the current interest rates are an impediment to improving business conditions.

The US ISM service sector report for May offered up a significant upside surprise of 53.8 vs 50.8 expected and 49.4 previously.

New orders jumped, employment improved (still contractionary, 47.1) and prices eased (58.1).

Looks like mkts see it as 'strong economy = Fed pause' pic.twitter.com/kkMeRFQkgJ— John Kicklighter (@JohnKicklighter) June 5, 2024

03:07 PM BST

Canada cuts interest rates to 4.75pc

Canada’s central bank has cut interest rates by a quarter of a percentage point to 4.75pc, signaling an end to its aggressive monetary policy after inflation fell to 2.7pc in April.

The Bank of Canada said:

With continued evidence that underlying inflation is easing, (the bank’s) Governing Council agreed that monetary policy no longer needs to be as restrictive and reduced the policy interest rate by 25 basis points.

Recent data has increased our confidence that inflation will continue to move towards the 2pc target.

🇨🇦Bank of #Canada cuts overnight rate 25bps to 4.75%

▶️"With continued evidence that underlying #inflation is easing.. monetary policy no longer needs to be as restrictive"

▶️"Recent data has increased our confidence..."

▶️"Inflation outlook risks remain"https://t.co/uka9w1TqZ2 pic.twitter.com/3sDr7h66BC— Gregory Daco (@GregDaco) June 5, 2024

The Bank of Canada is finally reading the macro tea leaves. Later than it should have done, the BoC has cut rates by 25bps, bringing the policy rate down to 4.75%. Supporting this decision the BoC has pointed to Canada's weak cyclicals, which are evident in nearly every indicator

— Simon Harvey (@_SimonHarvey) June 5, 2024

03:01 PM BST

eBay is limiting customer choice, says American Express

American Express said it was “disappointed” with eBay’s decision to stop accepting Amex payments from August 17.

A spokesman said:

By doing so, they will limit customers’ payment choices and take away the service, security, and rewards that customers value when paying with American Express.

Our research tells us that in the US the cost of acceptance for American Express is comparable to what eBay pays for similar cards on other networks.

We find eBay’s decision to drop American Express as a payment choice for consumers to be inconsistent with their stated desire to increase competition at the point of sale.

Additionally, eBay represents less than 0.2pc of our total network volume.

American Express Card Members can continue to use their Cards with millions of merchants around the world.

02:55 PM BST

Oil prices stabilise after Opec plans to boost supplies

Oil prices have steadied after sharp falls to a four-month low after Opec indicated it would begin ramping up production later this year.

Brent crude, the international benchmark, was last up 0.4pc below $78 a barrel, having tumbled about 5pc this week.

It comes after Opec+ said on Sunday that it would begin increasing supplies from October after a series of production cuts this year.

Meanwhile, the American Petroleum Institute reported US inventories expanded by 4.1 million barrels last week.

Bjarne Schieldrop, chief commodities analyst at SEB, said: “Rising inventories are an indication that demand may be weaker than assumed on paper.”

02:37 PM BST

Wall Street gains as jobs market weakens

The main US indexes rose as investors ramped up bets for an earlier than expected start to interest rate cuts amid signs of a weakening jobs market.

The Dow Jones Industrial Average rose 63.53 points, or 0.2pc, at the open to 38,774.82.

The S&P 500 opened higher by 23.14 points, or 0.4pc, at 5,314.48, while the Nasdaq Composite gained 117.43 points, or 0.7pc, to 16,974.48 at the opening bell.

02:19 PM BST

McDonald’s loses ‘Big Mac’ trademark battle with Irish fast food chain

McDonald’s has lost a long-running legal battle with an Irish fast food rival over the Big Mac trademark.

Our reporter Adam Mawardi has the details:

The European Court of Justice (ECJ) on Wednesday blocked the US restaurant giant from using the Big Mac brand for its chicken burgers.

The continent’s second highest court instead sided with Irish restaurant chain Supermac’s, which complained that McDonald’s had not made a genuine use of the name.

Pat McDonagh, managing director of Supermac’s, said the ruling represents a “significant victory for small businesses” across the world who stand up to global entities.

Read how the ruling is the latest twist in the long-running trademark row between Supermac’s and McDonald’s.

02:02 PM BST

Gas prices fall as connection to UK restored

Gas prices have fallen amid progress in fixing an issue with supplies from Norway to the UK.

Dutch front-month futures, the European benchmark, have dropped by as much as 1.6pc after a statement by operator Gassco.

It said problems with flows from the Nyhamma plant to the Easington terminal in East Yorkshire would be resolved by Saturday.

The UK’s equivalent gas contract was down as much as 1.5pc.

Analysts at EnergyScan said: “After the first moment of panic, the market seemed to realise that the situation was not so catastrophic.”

01:33 PM BST

US employment slows in boost for rate cut hopes

US private sector payrolls increased less than expected last month in a boost to hopes that the Federal Reserve could begin cutting interest rates in September.

Private payrolls increased by 152,000 jobs last month after rising by a downwardly revised 188,000 in April, the ADP Employment report showed. Economists had forecast private employment increasing by 175,000 in May.

The report was the latest indication that employment is not buckling under the weight of interest rates of 5.25pc to 5.5pc, which are their highest level since 2001.

On Tuesday, the Labor Department reported job openings fell in April to the fewest in more than three years and the ratio of vacancies to the number of unemployed persons had returned to levels seen prior to the pandemic outbreak in early 2020.

The ADP report, jointly developed with the Stanford Digital Economy Lab, also precedes Friday’s more comprehensive and closely watched nonfarm payrolls report for May from the Bureau of Labor Statistics.

United States ADP Employment Changehttps://t.co/LOS8b95mlz pic.twitter.com/Kr7pDMZ3yQ

— TRADING ECONOMICS (@tEconomics) June 5, 2024

01:26 PM BST

North Sea oil projects stall amid Labour windfall tax fears

Three British energy companies have decided to delay the start of oil production at a new oilfield in the North Sea amid concerns about a larger windfall tax under a Labour government.

Jersey Oil and Gas, which owns 20pc of the Buchan field, said engineering work on the project remained on track but said that the first oil target had been moved back from 2026 to 2027 after Rishi Sunak called an election earlier than expected.

It said the Buchan Field Development Plan was on course for approval by the end of the year.

But it added: “The exact timing for achieving this key milestone and enabling project sanction is naturally linked to securing fiscal clarity from the next government and ensuring that the project remains financially attractive.”

It comes as Labour, which is leading in the polls, has vowed to raise the windfall tax on oil and gas companies by 3pc to help fund its energy transition strategy, which the North Sea oil industry has complained would further deter investment.

Shares in Jersey fell 16pc, while shares in Serica Energy, which is a partner in the joint venture, fell nearly 1pc. NEO Energy also has a 50pc owner operator stake in the project.

WH Ireland analyst Brendan Long said: “We anticipate the UK government will provide fiscal clarity such that the operator of the Buchan redevelopment will have sufficient confidence in the fiscal regime to progress with project sanction.”

01:12 PM BST

Millions of customers to be stopped from using American Express on eBay

Online marketplace behemoth eBay said it will no longer accept American Express as it blamed the credit card company’s “unacceptably high fees”.

Millions of customers will be unable to use their Amex cards from August 17 as the internet auction giant said shoppers have other payment options to shop online.

It comes as eBay has increasingly been offering customers buy now, pay later options on purchases through Apple Pay, PayPal and other companies like Klarna and Affirm.

eBay spokesman Scott Overland said: “After careful consideration, eBay has decided to no longer accept American Express globally effective August 17 due to the unacceptably high fees American Express charges for processing credit card transactions.”

He added that customers have become aware of new ways to pay for items, making payments more competitive than ever before.

There were 141.2m Amex cards in force worldwide at the end of last year.

American Express has previously faced opposition to its business practices, with warehouse chain Costco walking away from a partnership nearly a decade ago.

12:44 PM BST

Wall Street poised for gains at the open

US stock indexes edged higher as investors strengthened bets on an earlier start to rate cuts by the Federal Reserve this year.

Wall Street ended Tuesday’s session slightly higher, with interest rate-sensitive property stocks leading gains.

That came after data showed US job openings in April fell to their lowest in more than three years, the latest economic report to suggest growth in the world’s largest economy is cooling. This allows the Federal Reserve more room to cut interest rates.

Market expectations for a September rate reduction now stand around 65pc, having been below 50pc last week, according to the CME’s FedWatch tool.

Rate-sensitive megacap stocks rose in premarket trading, with Nvidia, Microsoft and Amazon.com up between 0.4pc and 1.6pc.

Investors now await the nonfarm payrolls report, due on Friday, which will provide a more complete picture of the jobs market. The ADP National Employment report, as well as surveys on the services sector, are expected later.

In premarket trading, the Dow Jones Industrial Average was up 0.2pc, the S&P 500 had gained 0.3pc and the Nasdaq 100 had advanced 0.5pc.

12:25 PM BST

Consumers turn to pawnbrokers amid higher gold prices, says Ramsdens

More people have been selling or pawning their jewellery or watches amid higher gold prices and a lack of short-term credit alternatives, retailer and lender Ramsdens has said.

The company, which has 167 stores across the UK, revealed higher profits in recent months. This was partly driven by a 15pc surge in profits from its pawnbroking service.

The shift to pawnbroking, which allows people to take out a loan against the value of a piece of jewellery or a watch, comes as the value of gold has hit record highs this year.

Chief executive Peter Kenyon told PA:

Pawnbroking has grown because of the lack of alternative finance providers. If you want to borrow £200 you used to be able to get credit, which has been decimated, or payday lending when it was seen as reputable.

You’ve seen growth in the likes of Klarna, “buy now pay later”, and credit unions, but if you’ve got an asset to pledge then pawnbroking is a good solution for a short-term need.

The average loan is £180, typically amounting to a “couple of rings” that are pledged by customers in need of cash.

The loans accrue interest on a daily basis and Ramsdens charges an annual percentage rate (APR) of about 154pc for a six-month loan.

12:05 PM BST

Ocado and St James’s Place poised to drop out of FTSE 100

Ocado and wealth manager St James’s Place are on the verge of dropping out of the FTSE 100 in the latest reorganisation of the most valuable listed companies in the UK.

Online retailer Ocado would leave Britain’s blue-chip index for the first time in six years after its valuation plunged from a peak of £22bn during the pandemic to just £3.6bn as of Tuesday.

St James’s Place could also be relegated to the FTSE 250 in the latest quarterly reshuffle, due to be announced after markets close today.

British landlord LondonMetric Property is expected to join the FTSE 100 after its shares gained 8pc this year and its valuation doubled after a takeover of rival LXI REIT in March for £1.9bn.

11:51 AM BST

UK services sector ‘in relatively good shape,’ say analysts

As the latest PMI data showed cost inflation easing for the services sector Marc Cogliatti of Validus Risk Management said:

The final reading for May’s UK Services PMI remained steady at 52.9. matching both the preliminary reading and consensus forecast.

Despite its volatility, the data indicated that the UK’s largest economic sector is in relatively good shape as we move into the second half of the year.

This news aligns with our long-standing belief that the Bank of England will not reduce rates anywhere near as aggressively as the market had anticipated at the beginning of the year.

This is partly because there is no urgent need to stimulate growth and partly due to the potential risk of inflation rising again later this year.

11:41 AM BST

Electric car discounts now ‘unsustainable’ amid record price cuts

Manufacturers have warned that high levels of discounting for electric cars cannot continue “indefinitely” amid a downturn in household sales.

Our industry editor Matt Oliver has the details:

Electric vehicle sales rose overall by around 6pc in May, compared to a year earlier, taking their share of the market from 16.9pc to 17.6pc.

That represented a faster rate of growth than the entire car market but the Society of Motor Manufacturers and Traders (SMMT) warned that the majority of the sales are still to businesses and are being boosted by aggressive price-cutting.

Discounting has reached record highs this year, with the average price cut on a new electric vehicle reaching 10.6pc in April, according to online dealer Auto Trader.

Read why the SMMT boss said the latest sales figures underlined the case for introducing financial support for consumers, such as subsidies or tax cuts.

11:20 AM BST

Pound rises ahead of ECB interest rate decision

Sterling edged up against the euro ahead of the European Central Bank’s next policy meeting, where it is expected to cut interest rates for the first time in five years.

The pound gain 0.1pc against the single currency, which is worth 85p, and was broadly flat against the dollar at $1.277.

The European Central Bank is expected tomorrow to cut interest rates from their record highs of 4pc to 3.75pc.

Meanwhile, investors are currently pricing more than a 50pc chance of rate cuts by the Bank of England by September, with a 40pc chance of a second move in 2024.

11:02 AM BST

Google owner to face mass anti-competition legal action

Google parent Alphabet must face a multi-billion pound mass legal action which accuses it of abusing its dominance in the online advertising market, the Competition Appeal Tribunal has ruled.

The lawsuit seeks damages of up to £13.6bn on behalf of publishers of websites and apps based in the UK, who say they have suffered losses due to Google’s allegedly anti-competitive behaviour.

Google last month urged the Competition Appeal Tribunal to block the case, which it argued was incoherent, but the tribunal said in a written ruling that it would certify the case to proceed towards a trial.

The case centres around advertising technology, or ad tech, the system that decides which online adverts people see and how much they cost.

10:53 AM BST

‘Stage set’ for interest rate cuts as costs fall for largest section of economy

The Bank of England could cut interest rates “as soon as this month” amid falling costs for the services sector, according to a closely watched survey.

The S&P Global UK services PMI showed that input cost inflation faced by British services companies grew at its slowest pace since February 2021.

Activity in the UK’s services sector grew at a slower rate last month amid easing new business orders, with the reading falling to 52.9 in May, down from 55 in April, which was above estimates from economists.

Joe Hayes, principal economist at S&P Global, said: “Of particular interest to the immediate outlook for the UK economy will be the prices measures, with the Bank of England potentially moving to cut interest rates as soon as this month.

“The PMI surveys show prices for UK services rising at the slowest pace for over three years.

That’s now three months on the trot that selling price inflation in the service sector has eased – this will be very encouraging to the Monetary Policy Committee and suggests the trajectory of services prices is moving in the right direction.”

Thomas Pugh, economist at RSM UK, added: “The takeaway from this is that April’s sticky services inflation was probably a direct response to the increase in the minimum wage, rather than a reflection of underlying price pressures.

“Services inflation should slow over the next few months setting the stage for the Bank of England to cut interest rates this summer.”

09:24 AM BST

Google’s controversial AI chatbot released in UK

A dedicated mobile app to access Google’s Gemini, the tech giant’s generative AI assistant, has been released in the UK for the first time.

A new Gemini app has launched on Google’s own Android mobile operating system, while users of Apple’s iOS will be able to access Gemini from within the existing Google app “over the next couple of weeks”, the tech giant said.

The chatbot has caused controversy. Google was forced to apologise over an image generation tool which was incorrectly creating racially diverse images, even when doing so was inaccurate.

Users also claimed the chatbot refused to condemn paedophiles and had equated Elon Musk with Adolf Hitler.

Jules Walter, group product manager for Gemini experiences at Google, said:

With the Gemini app on your phone, you can type, talk or add an image for all kinds of help: you can take a picture of your flat tyre and ask for instructions on how to change it, or get help writing that thank you note.

It’s an important first step in building a true AI assistant - one that is conversational, multimodal and helpful.

09:11 AM BST

New car market grows for 22nd straight month

The new car market enjoyed its best May in three years as the number of new registrations grew for a 22nd consecutive month.

The recovery from the pandemic continued, with 147,678 cars sold last month, up 1.7pc, although this remains 19.6pc lower than 2019.

Demand for electrified vehicles rose, with plug-in hybrids recording the highest growth of all powertrains, up 31.5pc to reach an 8pc market share.

Battery electric vehicle (BEV) registrations also outperformed the market, rising 6.2pc over the month to claim a 17.6pc market share, up from 16.9pc in the same month last year.

SMMT chief executive Mike Hawes said: “As Britain prepares for next month’s general election, the new car market continues to hold steady as large fleets sustain growth, offsetting weakened private retail demand.”

08:44 AM BST

FTSE 100 rises amid US interest rate cut hopes

UK stocks opened higher as they were buoyed by weaker-than-expected US jobs data, which fuelled expectations of a rate cut in September.

The blue-chip FTSE 100 gained 0.3pc, after two sessions of declines. The mid-cap FTSE 250 also edged up 0.3pc.

Investors cheered signs of cooling in the US labour market, where data revealed job openings plunged to their lowest in over three years, reinforcing predictions of a rate cut by the Federal Reserve in September.

It comes as the European Central Bank is expected to announce its first interest rate cut in five years on Thursday, where it is likely to reduce its deposit rate from record highs of 4pc to 3.75pc.

Among individual stocks, Paragon Banking was the top gainer on the FTSE 250 with a 9.1pc jump after the lender reported its half-year results.

WH Smith gained 3.2pc after the retailer delivered a positive trading update ahead of its peak summer season.

B&M was the top loser on the FTSE 100 with a drop of 4.4pc after investors were underwhelmed with its outlook.

08:23 AM BST

London property slump hits flexible workspace provider

Flexible office provider Workspace has suffered deeper losses as the value of its property portfolio was sharply written down amid pressure from high interest rates.

The FTSE 250 company fell to a £192.8m annual pre-tax loss, compared to a loss of £37.5m the previous year, as the value of its properties dropped by9.5pc to £2.5bn.

However, bosses said expected cuts to interest rates would mean the worst of these declines was likely over.

Rental income from its 4,000 customers, who are predominantly small and medium-sized businesses, increased by 8.2pc to £126.2m, which was ahead of analyst expectations.

Chief executive Graham Clemett said:

Our valuation was down in the year by 9.5pc, although the reduction was significantly lower in the second half.

I would expect this valuation to be the low point of the current cycle given the forecast of interest rate reductions combined with our ability to continue to deliver pricing growth and value-add asset management activity.

Looking ahead, the future is bright for Workspace as London’s leading provider of flexible, sustainable work space to SMEs.

Our scalable operating platform, combined with more than three decades of experience in the flex space, puts us in a strong position to maintain our leadership position in this growing market and continue delivering long-term income and dividend growth for our shareholders.

Shares rose by 0.9pc in early trading.

08:04 AM BST

UK markets edge higher at open

The FTSE 100 began the day slightly higher as weaker US jobs data boosted hopes that the Federal Reserve will begin cutting interest rates in September.

The UK’s blue-chip index rose by 0.1pc to 8,267.55 while the midcap FTSE 250 gained 0.2pc to 20,762.84.

07:44 AM BST

WH Smith travel business grows ahead of peak summer period

Retailer WH Smith has said it is well set for the peak summer holiday season as buoyant sales across its travel site continued to offset slower trading in its high street arm.

The group posted like-for-like sales growth of 4pc for the 13 weeks to June 1, with a 5pc rise across global travel stores and a 1pc drop for its high street business.

But the figures showed a slowdown from the 15pc sales growth notched up in the first half across its travel shops based in train stations, airports and hospitals.

The group is coming up against strong comparatives from a year earlier, when trading was boosted by the rebound in global travel following the pandemic.

WH Smith said while sales fell overall across its UK high street business, including online, its bricks and mortar stores “performed well” with like-for-like revenues flat over the third quarter.

07:36 AM BST

B&M aims to open 1,200 UK stores as sales grow

Discount retailer B&M has revealed its sales grew over the past year as it targets hundreds of more store openings in the UK.

Total group revenues jumped by a 10th in the year to the end of March, compared with the previous year, according to the company, fully known as B&M European Value Retail.

On a like-for-like basis, which strips out the impact of new store openings, sales across the UK increased by 3.7pc compared to 2023, which B&M said was driven by a higher volume of sales.

The group said it was targeting opening at least 1,200 stores in the country over time, up from its previous target of 950. It currently has 741 stores and opened a swathe of new sites in recent months.

Chief executive Alex Russo said: “We are well set for the year ahead.”

She added: “Despite the more challenging comparatives, with continued new store openings, and a laser focus on low prices and best in class retail standards, we remain confident in our outlook for cash generation and profit growth.”

07:27 AM BST

Asda becomes UK’s most expensive supermarket fuel retailer

Asda has become the UK’s most expensive supermarket fuel retailer, according to new analysis.

Rival companies Tesco, Morrisons and Sainsbury’s sold a litre of petrol for an average of 2.1p less than Asda at the end of May, the RAC said.

The difference in average diesel prices was even steeper, at 2.5p per litre.

The RAC said that for many years Asda “prided itself on selling the cheapest fuel”, often being the first supermarket to cut pump prices.

The supermarket was taken over by the billionaire Issa brothers and private equity firm TDR Capital in 2021.

When Asda bought the UK and Irish operations of petrol station giant EG Group - owned by the Issa brothers - in May last year, Mohsin Issa said the deal would enable him to offer “Asda’s highly competitive fuel” to more customers.

The Competition and Markets Authority (CMA) published a report in July last year stating that Asda’s target fuel margin - the difference between what it paid for fuel and the pump price - was three times higher for 2023 compared with 2019.

But in January, TDR Capital managing director Gary Lindsay told the Commons’ Business and Trade Committee that Asda did not have “a particular strategy to bump the price of fuel or to make a larger profit on fuel”.

07:21 AM BST

Zara owner grows sales in battle with H&M and Shein

Zara owner Inditex grew its sales by 7pc in the first quarter of its financial year, it said on Wednesday, in line with analysts’ expectations.

The performance represented a slowdown from a year ago when it benefited from a post-pandemic shopping spree.

Inditex, which also owns Pull&Bear, Massimo Dutti and other brands, is attempting to fend off intense competition from rivals such as H&M by chasing and delivering fashion trends faster.

The company has outperformed competitors in recent quarters benefiting from investments in new in-store and online experiences.

It is also facing stiff competition from rapidly growing Chinese-owned online retailers Shein and Temu.

The world’s largest listed fashion retailer reported €8.2bn (£6.9bn) in sales during the three months to April.

Net profit rose 11pc to €1.3bn (£1.1bn) in the three months to April, in line with the €1.3bn average forecast by analysts. In the first quarter of last year, the company reported a 54pc rise in profits.

Sales at constant currencies rose 12pc from May 1 to June 3, Inditex said.

07:19 AM BST

Russia’s Gazprom suffers sharp decline from Ukraine war, report shows

Gazprom, the gas giant backed by the Kremlin, is unlikely to recover revenues lost as a result of Vladimir Putin’s war in Ukraine for at least a decade, a study for its bosses reportedly shows.

The company’s exports to Europe are expected to average barely a third of pre-war levels by 2035, equivalent to 50bn to 75bn cubic metres a year, according to the research seen by the Financial Times.

The 151-page document, which it said was commissioned by company management and written late last year, said that a new pipeline to China could help replace lost European volumes but its capacity would be only 50bn cubic metres of gas a year, while prices in Asia are lower than in Europe.

It was reported this week that Russia’s attempts to seal the gas pipeline deal with China have stalled over Beijing’s price and supply demands.

The Gazprom document reportedly said: “The main consequences of sanctions for Gazprom and the energy industry are the contraction of export volumes, which will be restored to their 2020 level no earlier than in 2035.”

Elina Ribakova, a non-resident senior fellow at the Washington-based Peterson Institute for International Economics, told the FT that the research is “very grim”.

07:16 AM BST

Good morning

Thanks for joining me. Gazprom’s exports to Europe will average barely a third of levels seen before Vladimir Putin’s decision to invade Ukraine by 2035, a document for bosses reportedly shows.

It said a new pipeline to China would also have less capacity and command lower prices than in Europe, according to the Financial Times.

5 things to start your day

1) George Osborne’s support of Standard Chartered in question after Hamas financing claims | Lender has dismissed fresh allegations from a former executive as ‘fabricated’

2) Mike Lynch stares into the abyss as jury decides fate of ‘Britain’s Bill Gates’ | After giving his side of the story, all the British tech tycoon can do is wait for a verdict

3) Airbus unveils stealth combat drone to support fighter jets | Unmanned aircraft to assist RAF pilots in reconnaissance and countermeasures

4) Tesco launches Amazon rival selling luggage and furniture | Retailer to add 9,000 products to digital marketplace in bid to become ‘one-stop shop’

5) Labour risks breaking debt rule with net zero borrowing binge | Starmer’s clean energy drive won’t boost growth enough to bring down debt, warns IFS

What happened overnight

Asian stocks broadly rose as a softening US labour market firmed up bets of a Federal Reserve interest rate cut in September.

Worries about a cooling US economy, however, kept a lid on risk appetite, while the focus in Asia remained on Indian markets.

Stocks remained volatile after the plunge on Tuesday as voting results showed a slimmer-than-expected victory margin for Prime Minister Narendra Modi.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.8pc, although the Nikkei closed down 0.9pc as the renewed strength in Japanese yen weighed.

US stocks rebounded from an early morning slump to close higher on Tuesday as new data showed that job vacancies slid in April to their lowest level since 2021.

The S&P 500 rose 7.94 points to 5,291.34. The Dow Jones Industrial Average gained 140.26 to 38,711.29 and the Nasdaq Composite added 28.38 to 16,857.05.

In the bond market, the yield on the 10-year Treasury slid to 4.33pc from 4.39pc late Monday and 4.50pc late Friday.