Chinese turbines in North Sea ‘threaten security of Europe’

Germany has been warned that a deal for Chinese wind turbines in the North Sea puts Europe’s energy security at risk.

Hamburg-based asset manager Luxcara agreed a deal earlier this month with Ming Yang Smart Energy Group to supply 16 wind turbines at its Waterkant project.

The turbines, which are the biggest on the market, are due to be installed in 2028 and will generate clean electricity for about 400,000 households.

However, energy groups have warned that the agreement with a Chinese company is a security risk as turbines typically have around 300 sensors, which can be used to transmit important data.

Giles Dickson, chief executive of lobby group WindEurope, warned the performance of the infrastructure — such as the angle of the blades — could be controlled by a foreign party.

“The European offshore wind supply chain was ready — is ready — to deliver a turbine made in Europe to this project,” he told Bloomberg.

“The European Union and Germany and any other countries building offshore wind farms have got to decide if wind energy is a strategic sector before it’s too late.”

Mr Dickson added that Chinese manufacturers are benefiting from subsidies, but also deferred payments of up-to three years, giving them an unfair advantage on global markets.

European manufacturers can only offer such a benefit for one year under OECD rules.

Luxcara and Ming Yang Smart Energy Group have been contacted for comment.

Read the latest updates below.

06:05 PM BST

Tune in ahead of the Alphabet and Tesla results

Thanks for joining us on the Markets blog today.

We will be back here just before 9pm to cover the financial results from two of the so-called Magnificent Seven businesses - Tesla and Google-owner Alphabet.

05:58 PM BST

Treaty to prevent over-fishing fails at World Trade Organisation

Countries and environmental groups voiced concern and disappointment on Tuesday after a draft treaty to cut fishing subsidies failed to pass, with China calling for major changes in how countries negotiate at the World Trade Organisation.

The talks, seen as critical to helping over-fished stocks recover, have been going on for more than 20 years at the WTO with an initial package approved in 2022.

The second phase tackling some of the toughest remaining issues had been drafted for approval at a WTO meeting this week but was blocked by India which criticised what it called the treaty’s “significant shortcomings” while seeking deeper carve-outs for developing countries.

As a result, the talks were downgraded from being up for adoption to merely being “discussed” by the WTO’s 166 members, any one of which can block a deal under the body’s rules.

“We are deeply concerned for our future work here in the WTO on these negotiations,” said U.S. Ambassador Maria Pagan. On India’s proposals, she said: “We find it difficult to understand the objectives of these papers when they re-introduce topics that have been debated and discussed repeatedly.”

China, a major subsidiser, voiced deep disappointment that it had not been adopted. “The fish and this planet cannot wait any longer,” said Ambassador Li Chenggang, who did not name India but referred to multiple failures of these talks “due to the same or similar reasons”.

“We need to think about how to get out of this dilemma ... Let’s change. No reform, no success,” he said.

Environmental groups also expressed regret.

05:35 PM BST

Megacaps buoy Wall Street ahead of Big Tech results

Wall Street’s main indexes rose on a boost from megacaps ahead of Alphabet and Tesla results later today, as investors assessed if the recent rally had fuel enough to sustain the charge.

Apple, Microsoft, Meta Platforms and Amazon.com all rose.

Tesla and Alphabet are set to kick off results from the so-called Magnificent Seven stocks after markets close. While the Google parent’s shares were up 0.5pc, the EV maker’s dropped 1.7pc.

The S&P 500 Information Technology and Consumer Discretionary indexes were the top sectoral gainers.

Earnings from technology giants will be key in determining if 2024’s record rally can be sustained, or if American stocks are overvalued.

Phil Blancato, boss of Ladenburg Thalmann Asset Management, said of Big Tech shares:

Their valuations are expensive and we could run into a problem if they don’t meet expectations.

05:29 PM BST

Virgin Atlantic passengers to pay green levy on every flight

Virgin Atlantic is to charge passengers a green levy on every flight as it seeks to cover the costs of using sustainable aviation fuel (Saf). Christopher Jasper reports:

Shai Weiss, the chief executive of the UK airline, confirmed plans for the environmental surcharge, which he said will come into force over the next 18 months.

It comes as airlines gear up for the mandated use of Saf, which costs three times as much as kerosene.

Mr Weiss told The Telegraph: “Prices will have to go up to account for the fact that flying with Saf in greater and greater volumes is materially more expensive.”

British Airways owner IAG has also warned that prices will increase owing to the costs of Saf, though it hasn’t yet decided whether to introduce a specific levy.

Saf, which is made from used cooking oil, is viewed as the most practical route towards reducing the aviation sector’s emissions.

Mr Weiss said Virgin favours the introduction of green surcharges so that travellers are aware why prices are rising.

05:28 PM BST

London markets weaken as oil prices slip

London’s stock market weakened on Tuesday as oil prices slipped, weighing on top mining and energy stocks.

The price of Brent crude oil dropped by nearly 2pc. By the time European markets closed, it was down about 1.7pc to $81 per barrel.

The FTSE 100 was dragged lower - down 0.4pc - with the likes of Anglo American and Glencore, and Shell and BP losing ground.

05:17 PM BST

Boost for Novo Nordisk as UK approves Wegovy for new use

Britain’s Medicines and Healthcare Products Regulatory Agency (MHRA) has give the green light for Wegovy to be used to reduce the risk of serious heart problems in obese or overweight adults.

The move is a boost to Wegovy’s maker, Novo Nordisk. It is the first time UK regulators have said a weight loss drug can be prescribed to prevent cardiovascular events for overweight or obese patients with established heart issues.

Professor Bryan Williams, of the British Heart Foundation, said:

Nearly two thirds of adults in England are living with excess weight or obesity. Those that also have an established cardiovascular disease live with a very high risk that a serious event like a heart attack or stroke could happen.

Several recent studies have shown us that semaglutide [Wegovy] is an effective tool that can improve the quality of life for those with cardiovascular disease, including by lowering the risk of serious cardiac events.

Novo Nordisk shares are up 0.7pc today.

05:05 PM BST

Profits at French luxury giant LVMH drop

The world’s largest luxury group, LVMH, said today that its half-year net profit slid 14 percent amid an uncertain geopolitical and economic environment.

The drop in profit to €7.26bn (£6.1bn) was accompanied by a one percent dip in sales to €41.68bn by the group whose brands include Louis Vuitton, Dior, Celine and Moet Hennessy.

05:01 PM BST

Global stocks diverge as eyes turn to tech giant profits

Global stock markets diverged Tuesday as the focus turned to tech company earnings following a strong start to a week dominated by the spellbinding US presidential race.

Wall Street opened flat but pushed higher in afternoon trading as investors were also awaiting key US inflation data due on Friday.

Europe’s main stock markets finished the day mixed after Asia’s major indexes closed lower. Germany’s Dax rose 0.8pc but France’s Cac 40 fell 0.3pc. The FTSE 100 was also down, by 0.4pc.

Attention turned to corporate earnings, with Google parent Alphabet and electric carmaker Tesla due to report results after Wall Street closes.

They are part of the Magnificent Seven tech firms that have driven a rally that pushed all three main New York indices to multiple record highs this year, thanks also to expectations the Federal Reserve will cut borrowing costs.

Fawad Razaqzada, a market analyst at City Index, said:

This month, the Magnificent Seven have experienced a sharp decline in total return. Therefore, tonight’s results from Alphabet and Tesla will significantly influence whether the rally resumes.

04:58 PM BST

Footsie closes down

The FTSE 100 fell 0.4pc today. The biggest riser was catering giant Compass, up 4.3pc, followed by Rolls-Royce, up 4.8pc. The biggest faller was Glencore, down 2.2pc, followed by Anglo American, down by a similar amount.

Meanwhile, the mid-cap FTSE 250 fell 0.2pc. Exhibitions and information business Ascential was the biggest riser, up 20.4pc, followed by cruise operator Carnival, up 3.6pc. Renewi, a waste management group, was the biggest faller, down 4.1pc, followed by industrial business Dowlais, down 3.9pc.

04:54 PM BST

Employees at Musk’s brain impant company itching to cash out

Some of the staff at Elon Musk’s Neuralink are making preparations to sell the brain implant company’s stock in the wake of its valuation jumping following its first human trial, according to sources spoken to by Reuters.

Employee shares are a big incentive for employees at startups such as Neuralink.

Now some of Neuralink’s employees and investors are preparing for Musk’s company to launch a tender offer as early as next month to buy back shares from staff that wish to sell, according to two sources.

Neuralink has been approached for comment.

The jump in Neuralink’s valuation following the launch of its first human trial in January is evident in secondary market trades. While these trades are thin in volume and do not provide a reliable number for Neuralink’s current valuation, they all point to a rise in value - some to as much as $8bn (£6.2bn), more than double what the company was worth last year.

Neuralink has called its first human trial a success. It said it remedied an initial problem of the implant’s threads retracting from its first patient’s brain and is preparing for more trials in Britain and Canada. Musk recently said the company plans to implant a second patient soon.

04:49 PM BST

Apple working on foldable phone, report says

Apple is reportedly working on a foldable iPhone model that could be released as soon as 2026, according to a report.

The Information said that the tech giant had contacted suppliers in Asia to make components for the device. The phone would reportedly fold in a similar way to the Samsung Galaxy Z Flip.

The Telegraph has approached Apple for comment.

04:36 PM BST

Houthi threat to Red Sea shipping is growing, says UN envoy to Yemen

The threat to international shipping from Yemen’s Houthis is growing, UN special envoy to Yemen Hans Grundberg told the UN Security Council on Tuesday.

In a briefing on the situation in Yemen, Mr Grundberg warned of a real danger of a devastating regional escalation following new Houthi attacks on commercial shipping and the first Israeli air strikes on Yemen in retaliation for Houthi drone and missile attacks on Israel.

He said:

I remain deeply concerned about the continued targeting of international navigation in the Red Sea and its surrounding waterways. Recent developments suggest that the threat against international shipping is increasing in scope and precision.

The Houthi attacks on Israel and July 20 Israeli retaliatory strikes on Yemen’s port of Hodeidah and its oil and power facilities represent “a new and dangerous level” of violence, he said.

Commercial ships have been sunk and damaged, disrupting trade, civilians have died, the Houthis still detain the crew of the Galaxy Leader, a cargo ship they hijacked in November, and the United States and Britain continue airstrikes on military targets in Houthi-controlled areas of Yemen, he said.

“It is alarming that there are no signs of de-escalation, let alone a solution,” Grundberg continued.

04:32 PM BST

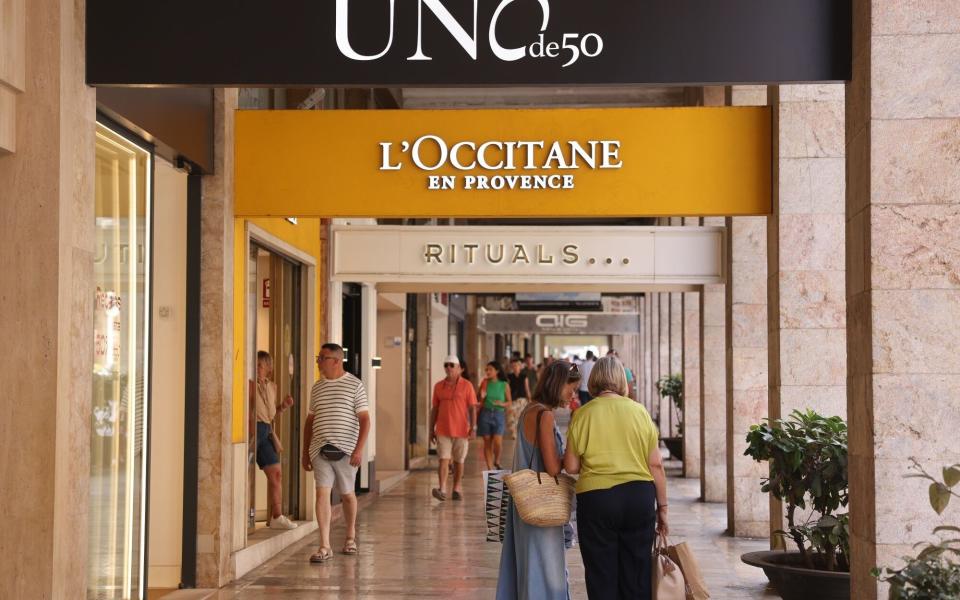

L’Occitane to exit Hong Kong stock exchange

French luxury beauty products firm L’Occitane said Tuesday its shares would be removed from the Hong Kong stock exchange after a public offer had received sufficient support.

The company’s main shareholder, Reinold Geiger, launched in April a €1.7bn (£1.5bn) offer to acquire the 28pc of the company he did not already own with the support of US private equity firm Blackstone.

The offer valued the firm, founded in 1976 in France’s southern Provence region, at roughly six billion euros.

Mr Geiger said:

This transaction will provide our group with the flexibility to make longer-term business decisions.

L’Occitane listed its shares in Hong Kong in 2010, raising more than $700m, thanks to optimism over the booming Chinese consumer market.

04:13 PM BST

Facebook owner hits out over EU red tape

Meta, the company behind Facebook and Instagram, has warned that the EU’s approach to regulating AI services risks cutting off the bloc from accessing the latest AI services.

It follows a reported by Axios that Meta plans to withhold a new AI model from customers in the EU because of a lack of clarity over regulation.

Meta told the FT that this was in order to give European regulators time to “get their arms around the issue of generative AI”.

The EU’s approach, according to Meta, was causing a “gap in the technologies that are available in Europe” compared with the rest of the world. Future and more advanced releases of AI services “could be impacted”.

Meta’s vice president of policy, Rob Sherman, told the FT:

If jurisdictions can’t regulate in a way that enables us to have clarity on what’s expected, then it’s going to be harder for us to offer the most advanced technologies in those places ... it is a realistic outcome that we’re worried about.

04:04 PM BST

Oil prices signal ‘fresh trouble’ for the Footsie

Oil prices are at six-week lows - a sign that could signal trouble for the Footsie, according to one analyst.

Chris Beauchamp, chief market analyst at online trading platform IG, said:

Recent history has shown that oil prices tend to decline over the summer and early Autumn, and worries about demand growth have sparked off fresh losses this afternoon.

This spells fresh trouble for the FTSE 100, which has been desperately seeking a catalyst for a new rally. With oil and metals prices suffering it seems the index’s rangebound period has some way to go.

03:59 PM BST

Coke posts boosted revenues as it continues price hikes

Coca-Cola raised its annual sales and profit forecasts today, as the beverage maker expects to benefit from price hikes and an advertising blitz.

Shares of Coca-Cola rose nearly 0.7pc as the company also posted a surprise increase in second-quarter revenue.

Revenue rose 3pc to $12.4bn for the April-June period. That was higher than Wall Street anticipated. Analysts polled by FactSet were expecting revenue of $11.8bn.

Coke, which hiked prices 13pc in the first quarter, raised them 9pc in the April-June period. The company said that was partly due to hyperinflation in some markets, like Argentina. Coke has raised prices every quarter since the end of 2020.

The company announced ernings per share of 84 cents, which was above market expectations of 81 cents.

Adam Vettese, analyst at investment platform eToro, said:

Coca-Cola has delivered a solid, if not particularly sparkling, set of results for its second quarter, beating expectations for both the top and bottom line ...

A strong marketing push as part of its long-established history with the Olympic Games bodes well for the summer and beyond, and the company has lifted its full year outlook to forecast organic revenue growth of 9pc to 10pc, which is at the upper end of the company’s long-term growth model.

03:46 PM BST

Results due tonight from Tesla and Alphabet will help steer the markets

Investors are now looking towards quarterly financial results from technology giants. These will be key in determining whether 2024’s record rally can be sustained, as investors assess if US stocks are overvalued or have room to rise further.

Bob Savage, head of markets strategy and insights at BNY Mellon, said:

Second-quarter earnings remain at the center stage ... Equity expectation misses are more dangerous now than in the first quarter, as shown by the harshness of the price action.

Google owner Alphabet and Tesla, two of the so-called Magnificent Seven companies, are set to report quarterly results after markets close this evening.

Alphabet shares are up 0.4pc, while Tesla is down 0.9pc.

The results will test whether a rotation away from megacap tech stocks in favour of underperforming sectors can continue. The Russell 2000 index of American small cap companies is up 0.9pc today.

Kim Forrest, chief investment officer at Bokeh Capital Partners, said:

Investors always reward growth, and if those smaller companies who’ve been overlooked for the first six months can show outperformance against their peers on a percentage basis, they’re going to get the love.

03:40 PM BST

Qatar orders 20 Boeing jets in boost to aviation giant

Qatar Airways today ordered 20 Boeing 777X long-haul aircraft, boosting the US aviation giant at Britain’s Farnborough International Airshow.

Badr Mohammed Al-Meer, chief executive, said:

Qatar Airways is proud to announce an expansion to the existing Boeing 777X aircraft order with an additional 20, totalling 94 Boeing 777X aircraft.

We ... are an industry leader and operate one of the youngest fleets, offering unparalleled innovation and quality. Keeping an eye on the future, we continue to ensure that all Qatar Airways passengers are only met with the best products and services available in the industry.

The order was worth $8.8bn (£6.8bn) at catalogue prices although major aviation customers typically secure big discounts from aircraft manufacturers.

Boeing’s 777X began test flights earlier this month in preparation for certification to enter service. That is expected in 2025, which is five years behind schedule.

The news came on the second day of the biennial Farnborough Airshow, which traditionally features a dogfight between Airbus and Boeing for multi-billion-dollar orders.

03:32 PM BST

US housing market slumps amid high mortgage rates

The US housing slump deepened in June as sales of previously occupied homes fell to their slowest pace since December, hampered by elevated mortgage rates and record-high prices.

Sales of previously occupied US homes fell 5.4pc last month from May to a seasonally adjusted annual rate of 3.89m, the fourth consecutive month of declines, the National Association of Realtors said Tuesday.

Existing home sales were also down 5.4pc compared with June of last year. The latest sales came in below the 3.99m annual pace economists were expecting.

Despite the pullback in sales, home prices climbed compared with a year earlier for the 12th month in a row. The national median sales price rose 4.1pc from a year earlier to $426,900, an all-time high with records going back to 1999.

With that I will say thanks for following our live updates to this point as I hand over to Alex Singleton, who will keep posting the latest news.

Existing Home Sales MoM in the United States decreased to -5.40 percent in June from -0.70 percent in May of 2024.https://t.co/enTCGmSnrb pic.twitter.com/GZ2G4se2Pc

— TRADING ECONOMICS (@tEconomics) July 23, 2024

03:12 PM BST

UPS shares suffer worst drop since 2008 as profits miss expectations

UPS shares suffered their worst decline since 2008 after the parcel deliverer missed Wall Street estimates for second-quarter profits and lowered its 2024 operating margin target.

Shares of the world’s biggest package delivery company, seen as a bellwether for the global economy, tumbled 13.1pc in early trading and pulled shares of rival FedEx down 2.9pc.

Chief executive Carol Tome said customers shifted to slower, lower-profit delivery services as they began “balancing the need for speed with cost”.

UPS said adjusted profit was $1.79 per share for the quarter, below analysts’ estimates of $1.99.

The company also lowered its full-year adjusted operating margin forecast to 9.4pc, from a range of 10pc to 10.6pc.

OUCH! #UPS tumbles most in 15yrs on worse-than-expected earnings amid pressure from wage inflation and soft package demand. The share has now lost almost all of its gains from the online retail boom during the coronavirus crisis. pic.twitter.com/W3AVlDLaf3

— Holger Zschaepitz (@Schuldensuehner) July 23, 2024

02:55 PM BST

Spotify surges as it makes record profit after cutting 1,500 jobs

Spotify jumped in early trading after it raked in record quarterly profits as sweeping job cuts at the music streaming giant paid off.

Our reporter James Warrington has the details:

The Swedish company’s shares rose as much as 16.2pc after it posted an operating profit of €266m (£224m) in the second quarter, up from a loss of €247m in the same period last year. Revenue rose by a fifth to €3.8bn.

Spotify cited lower spend on staff and marketing after chief executive Daniel Ek last year launched a heavy programme of cost-cutting.

The company laid off 1,500 workers – or around 17pc of its global workforce – in December. That was the third round of job cuts in 12 months.

Spotify has also cashed in on higher subscription costs after raising its prices twice in a year, most recently in June.

Spotify added 7m paid subscribers in the second quarter. Total monthly active users also rose to 626m, though this was behind its own forecasts.

Mr Ek said: “It’s an exciting time at Spotify. We keep on innovating and showing that we aren’t just a great product, but increasingly also a great business.”

02:50 PM BST

Rolls-Royce redesigning engines for smaller holiday aircraft

Rolls-Royce is building prototype engines for a return to the smaller holiday aircraft market, with test flights expected as soon as 2027, the company’s chief executive has revealed.

Our industry editor Matt Oliver has the details:

Tufan Erginbilgic said engineers in Derby are working to scale down the experimental Ultrafan engine to make it suitable for the wings of narrow-bodied planes such as the Boeing 737.

They are building two of these smaller engines, along with two larger ones for wide-bodied aircraft used for longer-haul flights.

Mr Erginbilgic told journalists the company is expecting to carry out test flights with the engines in roughly three to five years’ time.

Rolls quit the narrow-body market in 2012, a move that has left it unable to tap into a surge in demand for short-haul flights over the past decade.

Speaking at the Farnborough Airshow, Mr Erginbilgic said: “We are now progressing to demonstrate a small engine on Ultrafan. That work is underway.

“Two engines small, two engines wide-body. The time horizon for the industry is for the next generation [aircraft] to run to 2036-37, and so our plans are in line with that.”

02:40 PM BST

Wall Street muted as investors wait for Tesla and Google results

The main US stock indexes were subdued at the open amid a mixed bag of corporate results.

The Dow Jones Industrial Average rose 28.29 points, or 0.1pc, at the open to 40,443.73. The S&P 500 was flat at 5,565.30.

The Nasdaq Composite dropped 24.83 points, or 0.1pc, to 17,982.74 at the opening bell as investors awaited Big Tech earnings from Alphabet and Tesla after markets close later.

02:21 PM BST

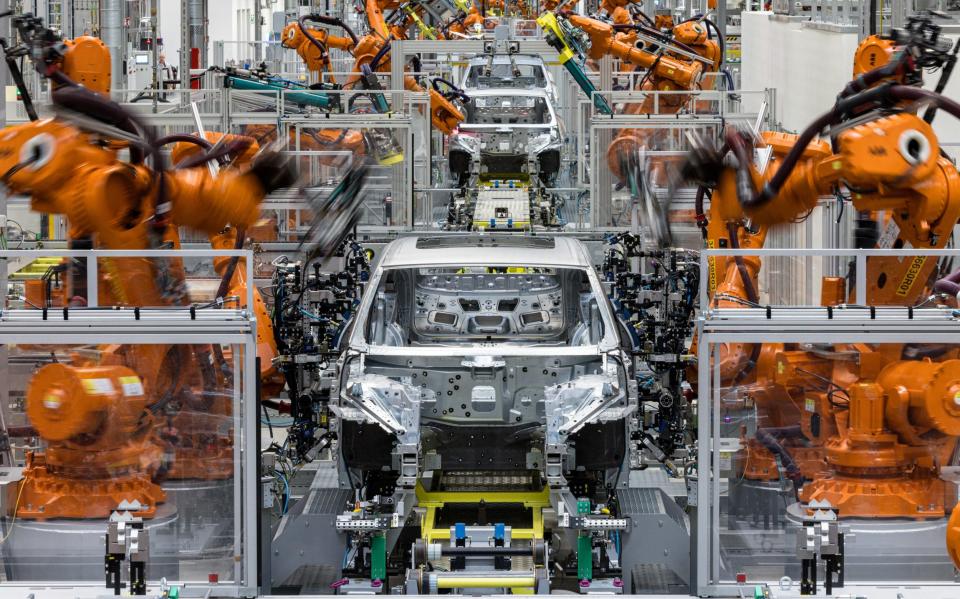

Germany warned China wind turbine deal in North Sea risks energy security

Germany has been warned that a deal for Chinese wind turbines in the North Sea puts Europe’s energy security at risk.

Hamburg-based asset manager Luxcara agreed a deal earlier this month with Ming Yang Smart Energy Group to supply 16 wind turbines at its Waterkant project.

The turbines, which are the biggest on the market, are due to be installed in 2028 and will generate clean electricity for about 400,000 households.

However, energy groups have warned that the agreement with a Chinese company is a security risk as turbines typically have around 300 sensors, which can be used to transmit important data.

Giles Dickson, chief executive of lobby group WindEurope, warned the performance of the infrastructure — such as the angle of the blades — could be controlled by a foreign party.

He told Bloomberg:

The European offshore wind supply chain was ready — is ready — to deliver a turbine made in Europe to this project.

The European Union and Germany and any other countries building offshore wind farms have got to decide if wind energy is a strategic sector before it’s too late.

02:08 PM BST

Oil prices fall ahead of US stockpile data

Oil prices have fallen for a third trading day in a row as investors hold back ahead of data on US stockpiles.

Brent crude, the international benchmark, was down 0.8pc below $82 a barrel after losing 3pc during the previous two sessions.

The American Petroleum Institute publishes later its estimate for shifts in US crude stocks. Its inventory has shrunk for the past three weeks.

01:48 PM BST

General Motors suspends production of self-driving vehicle

General Motors has “indefinitely” suspended the production of a self-driving vehicle as it faces regulatory hurdles with the nascent technology.

The US car giant’s Cruise subsidiary, which is developing self-driving cars, will stop working on its Origin vehicle, which features no steering wheel or pedals.

It said the move would remove “regulatory uncertainty we faced with the Origin because of its unique design”.

Cruise faces a number of investigations - including by NHTSA, the Justice Department and Securities and Exchange Commission - after an October accident in which one of its robotaxis struck a pedestrian and dragged her 20 feet.

Cruise will instead focus production on its next-generation Chevrolet Bolt electric car, as “per-unit costs will be much lower”.

A GM spokesman said: “GM and Cruise are optimizing resources to focus development of our next autonomous vehicle on the next generation Bolt instead of the Origin.”

GM in November said it had temporarily halted production of its fully autonomous Cruise Origin, telling employees it has produced hundreds of the vehicles already, and that it is “more than enough for the near-term when we are ready to ramp things back up”.

01:30 PM BST

Hungary cuts interest rates to 6.75pc

Hungary’s central bank has cut interest rates to 6.75pc - continuing a cycle of reductions in borrowing costs that began last year.

The MNB has been cutting rates since October last year from a peak of 13pc.

The forint strengthened 1.6pc against the euro in the past month, making it the second-best performer among 23 emerging-market currencies.

01:16 PM BST

Wall Street subdued ahead of Tesla and Alphabet results

US stocks were little changed in premarket trading amid a flurry of mixed corporate earnings.

With investors returning to megacap growth stocks on Monday, the S&P 500 and the Nasdaq logged their biggest one-day gain in more than a month.

It snapped a three-day losing streak triggered by investors exiting megacap tech stocks in favour of underperforming sectors.

Google-owner Alphabet and Tesla, two of the so-called Magnificent Seven companies, are poised to report quarterly results after markets close today.

In a largely mixed premarket session for the group, their shares were up 0.3pc and 1.2pc, respectively.

Amid a slew of corporate earnings, Spotify leapt 13pc after its second-quarter results were broadly in line with analysts’ estimates, while General Motors gained 4.6pc after beating forecasts for profit and revenue.

United Parcel Service slumped 7.8pc in premarket trading after missing earnings estimates amid subdued package delivery demand.

Ahead of the opening bell, the Dow Jones Industrial Average and S&P 500 were flat and the Nasdaq 100 was down 0.1pc.

01:02 PM BST

Modi announces billions for new jobs in new budget

India’s prime minister Narendra Modi has unveiled spending of billions of dollars to create new jobs in the first budget of his new coalition government.

Among a host of tax changes were an increased levy on equity investments to allay concerns of an overheating market.

He also announced lower taxes for foreign companies in a bid to lure investment.

Finance Minister Nirmala Sitharaman said the outlays included $32bn (£24.8bn) for rural programmes, spending of $24bn over five years to create jobs, and more than $5bn for two states ruled by coalition partners.

She said: “In this budget, we particularly focus on employment, skilling, small businesses, and the middle class.”

Despite the new spending, India cut its fiscal deficit target to 4.9pc of gross domestic product in 2024-25, from 5.1pc in February’s interim budget, helped by a large surplus of $25bn from the central bank.

12:22 PM BST

Lockheed Martin prepared to build hypersonic missiles in UK before US

The US defence giant Lockheed Martin has said it is prepared to choose the UK as the location to develop a jet-fired hypersonic missile before making it in America.

Our industry editor Matt Oliver has the details:

The company pointed to the Mako, a prototype, manoeuvrable missile named after the fastest shark in the seas, as an example of the type of versatile weapon it is willing to pioneer with the UK.

It is capable of reaching speeds exceeding Mach 5 and was designed to be fired from fighters such as the F-35 stealth jet, used by the Royal Navy, on missions such as air-to-sea strikes, anti-air defence strikes and other air-to-ground strikes.

Developing this type of advanced weapon outside the US, which helped to fund the initial work on Mako, would be a departure from the norm for Lockheed.

Read what Tim Cahill, president for missiles and fire control at Lockheed, told the Telegraph.

11:57 AM BST

UPS shares drop as charges hit profits

UPS shares slumped as profit and revenue fell short of Wall Street expectations, partly due to a hefty charge.

The parcel delivery business dropped 7pc in premarket trading in New York despite boosting its volume in the US for the first time since 2022 during its second quarter.

For the three months to June, UPS earned $1.4bn (£1.1bn), or $1.65 per share.

Stripping out one time costs, earnings were $1.79 per share, which was well below the $1.98 per share that analysts predicted.

UPS said that the quarter included a charge of $120m, or 14 cents per share, made up of of a one-time payment of $94m to “settle an international regulatory matter”.

11:49 AM BST

General Motors profits move up a gear amid strong US demand for trucks and SUVs

Chevrolet maker General Motors has reported higher profits amid strong North American car sales that compensated for continued weakness in China.

The big US carmaker increased profits by 14pc to $2.9bn (£2.3bn) as revenues rose 7pc to $48bn (£37.3bn).

GM increased some of its full-year projections based on the results as its domestic sales were boosted by demand for truck and sport utility vehicles.

Chief financial officer Paul Jacobson said pricing “held up pretty consistently longer than many of the analysts have projected”.

11:30 AM BST

China shares suffer worst day in six months as rate cuts fail to inspire

Chinese shares suffered their worst day in six months as investors showed scant enthusiasm for Beijing’s latest monetary policy moves.

The Hang Seng in Hong Kong lost 0.9pc to 17,469.36, while the Shanghai Composite index shed 1.7pc to 2,915.37 in its biggest single-day loss since February.

The domestic focused CSI 300 index slipped 2.1pc.

Chinese markets turned lower as investors remained sceptical after China’s central bank cut two key interest rates by 10 basis points on Monday.

The People’s Bank of China also reduced collateral required by its medium-term lending facility and also reduced the interest rate for its standing lending facility by 10 basis points to 2.7pc for its seven-day loans and 3.05pc for its one-month loans.

But the recent moves following a major policymaking meeting of the ruling Communist Party have not boosted markets. In a note to clients, Mizuho Bank said:

Size matters. And obviously, a 10 (basis point) cut is not particularly inspiring.

Certainly, nowhere in the vicinity of ‘big gun’ stimulus, which is arguably what the economy needs.

11:11 AM BST

Spotify misses growth target amid layoffs and cost-cutting

Spotify failed to meet its own target for user growth as it reported quarterly results broadly in line with analyst expectations.

The Swedish audio-streaming giant sought to reduce costs through layoffs and cuts to its marketing budget last year, while trying to grow its user base through promotions and new investments in podcasts.

Revenue rose to €3.8bn (£3.2bn) for the second quarter of the year, as analysts expected.

Spotify previously said it aimed to reach 631m monthly active users but fell short of this target, attracting 626m over the period.

The company said it had seen user numbers grow across all regions, but that it had not met its monthly active users goal due to “continued recalibration” of marketing activities.

Shares were up 9.3pc in premarket trading in New York.

10:57 AM BST

British Airways to spend £21m on training new pilots next year

British Airways has announced it will fully fund up to 200 places on its pilot training programme next year.

The airline said it is making the £21m investment to boost social mobility and diversity within its pilot community.

Many prospective pilots are unable to self-fund training, which usually takes around two years and costs in the region of £100,000.

Funding was initially in place for 100 places in 2025, but the airline announced at the Farnborough Airshow in Hampshire that this has been doubled to 200.

British Airways chief executive Sean Doyle said:

I’m incredibly proud of the Speedbird Pilot Academy and the opportunity it provides to those talented individuals who have held a lifetime ambition of becoming a commercial airline pilot but have perhaps found it difficult to independently fund their training.

The standard of applicants we see for this programme is consistently high so as part of our commitment to attracting the very best candidates from right across society, we’ve increased the 2025 cohort to give as many people as possible the chance of realising their dream.

10:53 AM BST

Fewer new homes in pipeline in blow to Labour building plans

The number of new homes registered in Britain has fallen by a fifth, industry figures show, outlining the scale of the challenges as it aims to build 1.5m properties within five years.

Some 29,281 new homes were registered to be built from April to June, a fall of 23pc from 37,861 a year earlier, the National House Building Council (NHBC) said.

The NHBC has a 70pc to 80pc share of the UK warranty market.

Its figures indicate the stock of new properties in the pipeline because homes are registered with the NHBC before being built.

Labour made housebuilding a key part of its policy plans in the run-up to the general election.

In the King’s Speech, the Government said the Planning and Infrastructure Bill will reform the system to help meet the goal of building 1.5m more homes over the course of the Parliament - deciding “how, not if” properties are built.

The NHBC said 33,847 new homes were completed in the second quarter of this year, down by 6pc on the same period in 2023, when 36,145 homes were completed.

Despite the annual falls, the NHBC said that, when compared with the previous quarter, new home registrations and completions are tracking positively, having increased by 34pc and 29pc respectively.

09:56 AM BST

Tesla to use ‘genuinely useful’ humanoid robots from next year, says Musk

Tesla boss Elon Musk has said the car maker hopes to have “genuinely useful” humanoid robots deployed internally next year.

Posting to X, formerly Twitter and the platform he owns, Mr Musk said the electric car maker then hoped to expand production and start offering the robots to other companies in 2026.

Tesla has been working on a humanoid robot, known as Optimus, to use in its factories and on production lines.

Mr Musk said:

Tesla will have genuinely useful humanoid robots in low production for Tesla internal use next year and, hopefully, high production for other companies in 2026

— Elon Musk (@elonmusk) July 22, 2024

A number of other firms, including US firm Boston Dynamics, are working a range of robots in different forms designed to aid humans in manual work.

When Tesla’s humanoid robot was first announced in 2021 during a company event, it did not appear on stage but a person wearing a white outfit and a black helmet walked robotically on before starting to dance.

09:45 AM BST

Pound falls as Harris poised to become Democrat nominee

The pound has fallen in relatively subdued trading ahead of the release of US personal consumption expenditure (PCE) inflation figures for June on Friday.

Sterling was down 0.1pc against the dollar today to $1.293, having gained slightly on Monday after Joe Biden exited the US presidential race.

The dollar strengthened as Kamala Harris received the support of enough Democratic delegates to win her party’s presidential nomination late on Monday night.

The pound was flat against the euro at €1.188 or 84.2p.

09:28 AM BST

Google ditches plan to remove third-party cookies from Chrome

Google is dropping its plans to remove third-party advertising cookies from its Chrome web browser, around five years after launching a scheme looking for ways to carry out the process.

The search giant said it plans to keep the user-tracking pieces of code, which are used by advertisers to serve people targeted ads on the web.

Instead of irradiating them, it will introduce an opt-in system that “elevates user choice”.

Anthony Chavez, the vice president of Privacy Sandbox, which was launched in 2019 to find new ways to improve online privacy by restricting cookies, said:

Instead of deprecating third-party cookies, we would introduce a new experience in Chrome that lets people make an informed choice that applies across their web browsing, and they’d be able to adjust that choice at any time.

We’re discussing this new path with regulators, and will engage with the industry as we roll this out.

Google has worked particularly closely with regulators in the UK on the scheme, including the Competition and Markets Authority (CMA) and the Information Commissioner’s Office (ICO).

09:13 AM BST

Fuller sales rise as inflation crisis eases

Pub group Fuller, Smith & Turner revealed growing sales as Britain recovers from its inflation crisis.

Like-for-like sales has grown by 5.3pc during the first 16 weeks of the financial year.

The company added that it has sold 37 pubs to Admiral Taverns for £18.3m and completed the sale of The Mad Hatter in Southwark for a total consideration of £20m, helping to reduce its net underlying debt to £92m.

Chief executive Simon Emeny said:

I am delighted to see our sales growth momentum continue, particularly against the backdrop of easing inflation, which will help us to grow margins and profit, as well as revenue.

You can feel the positivity across the business, with our team members working energetically to drive our continued success.

We have had a strong start to the financial year, and we look forward to the opportunities the future will bring.

Mr Emeny also urged Sir Keir Starmer to “stand by his commitment to overhaul our archaic business rates system”.

08:50 AM BST

FTSE 100 dragged down by falling copper prices

The FTSE 100 inched down on the last day before the start of the school summer holidays as copper miners weighed heavily on the market.

The blue-chip FTSE 100 index was down 0.34pc, after logging its best session in more than a week on Monday. The mid-cap FTSE 250 was up 0.2pc.

Industrial metal miners led declines, dropping 1.7pc to their lowest level since early April, as heavyweights like Rio Tinto and Glencore slipped more than 1pc each.

They were dragged down by falling copper prices, which have come under pressure from growing concerns about prolonged weakness in Chinese demand after the country’s latest policy announcements disappointed investors.

Car and parts stocks also fell 1.6pc after German carmaker Porsche cut its sales and profitability outlook.

Investors will focus later on Wall Street giants like Alphabet and Tesla that will report quarterly earnings after the closing bell.

Politics continued to make headlines in the US after Vice President Kamala Harris secured support from enough delegates to become the Democrat nominee after President Joe Biden abandoned his reelection bid.

In corporate news, Compass gained 3.2pc to lead gains on the FTSE 100 after the catering group raised its 2024 profit and revenue forecasts for the second time this year despite easing prices.

08:27 AM BST

Mitie doubles contract work to £2bn after deals with British Airways and Aldi

Mitie has nearly doubled the value of its security and cleaning work since this time last year after winning new contracts with the likes of British Airways, Aldi and the Home Office in recent months.

The outsourcer said its total contract value was £2bn for the three months to June 30, up from £1.1bn the year before, with new contracts and extensions with Lloyds Bank, NHS Property Services and insurer Royal London.

Mitie is one of the UK’s largest outsourcing companies and specialises in so-called facilities management. It also carries out work including deportation, waste removal and maintaining parts of the electrical grid.

In a first quarter update, Mitie said revenue jumped 10pc year-on-year to £1.2bn, while net debt more than doubled to £182m, “as we pay our supply chain for the increased volume of project works”.

It also won a military contract to maintain the British Army’s estate of military bases in Germany, helping boost its central government and defence arm’s revenues by 4.3pc to £217m.

Mitie said its revenue growth was also partly down to having bought a slew of smaller companies during the period, most recently picking up electrical engineering firm ESM Power for £8.5m.

Mitie said earlier this month that the deal will boost its profile in the “growing high-voltage power connections market” amid continued “significant capital investment” as the UK moves towards net zero.

Shares were down 0.5pc.

08:18 AM BST

Severn Trent wins top environment status despite sewage fines

Severn Trent Water has boasted that it has been awarded the highest-possible environment status by regulators just months after it was fined for dumping sewage in rivers.

The utility company was given four-star status in its 2023 Environmental Performance Assessment by the Environment Agency, a report designed to assess and compare the performance of water companies in England.

Severn Trent said it was now the only supplier “to have achieved five consecutive years of ‘industry-leading’ environmental status” and said it was on track to repeat the feat for a sixth year.

However, it comes after the company was handed a £2m fine in February for allowing huge amounts of raw sewage to be discharged into the River Trent.

The case was brought to Cannock Magistrates Court in Stafford by the Environment Agency after the discharges from its Strongford Wastewater Treatment Works (WTW) near Stoke-on-Trent, Staffordshire, between November 2019 and February 2020.

District Judge Kevin Grego concluded that there was a “reckless failure” by the company to have in place and implement a proper system of contingency planning.

The company had pleaded guilty at a previous hearing to two charges of illegally discharging raw sewage.

Severn Trent said it remains on track to deliver “the most ambitious storm overflow improvement plan in the sector”.

08:08 AM BST

UK markets mixed as Harris poised to secure Democratic nomination

Stock markets in London were subdued as trading began following the effective confirmation that Kamala Harris will be the Democratic nominee in the US presidential race.

The FTSE 100 fell 0.3pc to 8,175.23 while the midcap FTSE 250 was little changed at 21,149.12.

07:49 AM BST

TSB profits slump as mortgage market struggles

High street lender TSB has revealed that profits dropped by almost a quarter for the past half-year due to weakness in the mortgage market.

The bank, which is part of Spain’s Banco Sabadell, reported a pre-tax profit of £111.6m for the six months to June, down 24.5pc against the same period a year earlier.

TSB said this was due to lower income, which fell by 6.1pc to £548.7m for the half-year.

Income was impacted by lower mortgage margins due to “challenging” market conditions in the face of high interest rates, while the company also paid out significantly more interest to its savings customers.

TSB’s chief executive officer Robin Bulloch said:

Our focus in 2024 is making TSB simpler and easier to bank with, and I’m delighted to see more customers choosing TSB.

We continue to make good progress against our strategy and I’d like to thank everyone at TSB for their continued efforts to support our customers and communities, helping them feel more money-confident.

07:33 AM BST

Porsche cuts revenue forecasts after supplier hit by floods

Porsche has warned its revenues will be lower than expected this year as a shortage of aluminium parts risks halting production on some models.

The luxury car maker said revenues would be between €39bn and €40bn (£32.9bn and £33.7bn) this year, down from an earlier forecast of €40bn to €42bn.

It comes after one of its European suppliers suffered flooding at its manufacturing site, impacting aluminium components which are used in all Porsche vehicles.

It comes a day after the Volkswagen-owned car maker abandoned its electric vehicles sales goals after lower than expected sales in Europe and China.

07:20 AM BST

Shoppers face ‘travesty’ of losing British berries as growers at risk of going out of business

Two in five British berry growers are at risk of going out of business within three years due to rising costs and squeezed supermarket prices, according to a report.

British Berry Growers (BBG), which represents more than 95pc of locally-grown berries sold in the UK, found almost half of growers (47pc) reported not making a profit, suggesting that 40pc could go out of business by the end of 2026.

Some 37pc of growers polled were considering reducing their production or moving out of berry farming entirely.

Concerns about the future of the sector came as shoppers spent a record £847.5m on strawberries over the last 12 months.

But 89pc of growers who were no longer profitable said they stopped making a profit after 2020, due largely to the rise in the cost of production, BBG said.

BBG chairman Nick Marston said: “We must take this survey as a wake-up call and a sign to take urgent action. The future of this great sector hangs in the balance. It would be a travesty to lose British berries.”

07:19 AM BST

Pound will surge in stable Britain, predicts French finance giant

The pound will surge through the rest of this year, Europe’s largest asset manager has predicted, as Britain’s stable economy and government contrasts with the rest of the world.

Sterling will rise as high as $1.35 by the end of the year, France finance giant Amundi has forecast, from $1.293 today and $1.273 at the start of 2024.

Amundi, which as $2.3 trillion (£1.8 trillion) in assets under management, joins a rush into the pound by major banks including Goldman Sachs after Labour’s landslide election victory.

By contrast, the US presidential race has been thrown into uncertainty by the decision of Joe Biden to quit the race and the emergence of Kamala Harris as the expected Democratic nominee.

Meanwhile, France is in political turmoil as it grapples with a hung parliament.

The Bank of England is also expected to begin cutting interest rates later than its peers, boosting sterling.

Amundi’s head of global FX Andreas Koenig said: “You have an improvement in the economic environment, and you have a relatively stable government, so you have a lot of arguments in favour of sterling.

“It might be less risky and it might be a diversifying alternative in the portfolio, which is supportive.”

The pound is up nearly 1.5pc since the start of the year, outperforming all Group-of-10 peers versus the dollar and breaching $1.30 last week.

Against the euro, it is the strongest since August 2022 at around 84p. Amundi sees it eventually rallying further to make a euro worth 82p.

07:12 AM BST

Good morning

Thanks for joining me. The pound is expected to surge for the rest of the year as Britain becomes a beacon of political and economic stability compared to the US and Europe, according to a French finance giant.

Amundi, which is Europe’s largest asset manager, expects sterling to rally to $1.35, having already gained 1.5pc to $1.293 so far this year.

5 things to start your day

1) Benefits fraud costs taxpayer record £7.3bn as society becomes more criminal | Offences jump 11pc in each of last two years amid changing attitudes since pandemic

2) Bosses urged to sack underperforming staff ahead of Labour’s workers’ rights overhaul | Businesses are already responding to plans to extend staff entitlements to day-one employees

3) Former chancellor Nadhim Zahawi assembling £600m Telegraph takeover bid | Reuben family among investors approached to help finance potential deal

4) Heathrow is losing out to EU rivals, says boss of British Airways owner | High passenger costs and lack of investment ‘strangle growth’ of UK’s largest airport

5) Why Kamala Harris’s economic project would be the most Left-wing in decades | The Democrat’s track record gives some clear hints of how she would run the world’s biggest economy

What happened overnight

Shares were mostly higher in Asia after US stocks closed broadly higher, as Big Tech stocks took back some of their recent sharp declines.

Tokyo’s Nikkei 225 recovered from early losses, edging 0.1pc higher to 39,621.28.

Chinese markets declined, with the Hang Seng in Hong Kong down 0.1pc to 17,620.16. The Shanghai Composite index shed 0.6pc to 2,946.63.

China’s central bank cut two key interest rates by 10 basis points on Monday, moving to ease credit and pep up the economy, following a major policymaking meeting of the ruling Communist Party that focused on longer-term reforms.

But both so far have done little to boost the markets, where investors are looking for more ambitious short-term action to spur faster growth.

South Korea’s Kospi advanced 0.5pc to 2,777.98, while the S&P/ASX 200 jumped 0.7pc to 7,987.90.

Taiwan’s Taiex surged 2.3pc as Taiwan Semiconductor Manufacturing Co. gained 3.4pc, rebounding from recent losses.

In Bangkok, the SET fell 0.7pc.

On Wall Street, all three major indexes finished higher, led by gains in technology and communication services stocks.

Nvidia ended up nearly 5pc, buoyed by news it is working on a new AI chip for the Chinese market.

The Dow Jones Industrial Average rose 0.3pc to close at 40,415.44, the S&P 500 gained 1.1pc to 5,564.41 and the Nasdaq Composite gained 1.6pc to 18,007.57.

US Treasury bonds were little changed as markets assessed the uncertainty surrounding the race for the White House, with yields on benchmark US 10-year bonds adding 1.7 basis points to reach 4.26pc.