EPIC consumption tax Nebraska petition falls short, will have to find another way

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

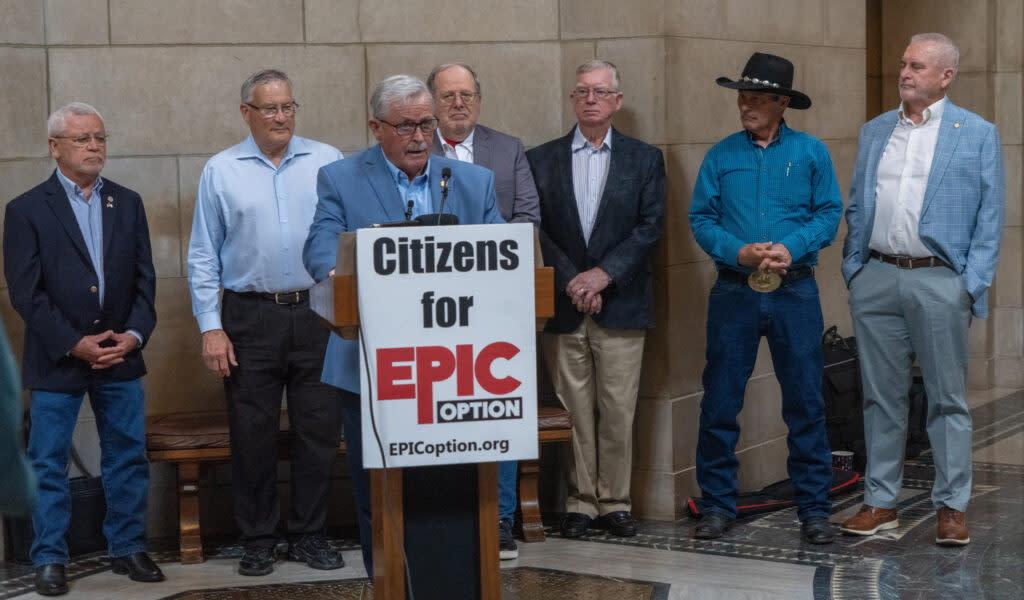

EPIC Option advocates lead a morning news conference regarding their proposal to eliminate all taxes besides consumption and excise taxes and put the decision to a vote of the people in 2024. State Sens. Steve Erdman of Bayard, center, and Steve Halloran of Hastings, left, have been leading advocates. State Sen. Dave Murman of Glenvil joins, at right. May 21, 2024. (Zach Wendling/Nebraska Examiner)

LINCOLN — The longshot petition to let voters replace property, income and corporate taxes with a consumption tax fell short of a bulk signature-gathering hurdle that often stops ballot initiatives that lack paid circulators.

That higher hurdle is securing signatures from 10% of the state’s registered voters to amend the state constitution, or about 123,000 signatures. EPIC Option Consumption Tax petition organizers said the group’s more than 250 volunteer signature gatherers ran out of time to finish the job. The group had until end-of-day Wednesday to collect and turn those signatures in. It started gathering in January 2023.

State Sen. Steve Erdman of Bayard and other leaders of the effort celebrated clearing a first hurdle for petition drives in mid-May. They announced collecting legally required signatures from at least 5% of registered voters in 38 counties.

Erdman said the group began its efforts like many of the paid petition circulators, by focusing on the lowest population counties where reaching 5% would be simpler. Its focus shifted more toward urban and suburban areas in late May, he has said.

“Our current tax system continues to drive retirees and many working families to move out of Nebraska because they cannot afford to pay their property taxes,” said Steve Jessen, president of the petition campaign. “Our EPIC Option Team is NOT going away.”

Group told supporters it needed paid help

In a Tuesday email to its petition circulators, leaders thanked the people who gathered signatures at Husker Harvest Days, the Nebraska State Fair, county fairs and spread the word about the proposal Gov. Jim Pillen and business groups opposed.

The group’s email, obtained by the Nebraska Examiner, said this year’s preliminary spike in property valuations of more than 9% came too late to help them get the signatures needed. It argued that three more months would have been enough to reach the group’s goal.

“We needed paid circulators to collect the balance of the 123,190 needed signatures from the larger populated counties,” the email said. “Therefore, we are disappointed to report that our EPIC Option team was unable to collect the total required.”

The group blamed its difficulties fundraising on “misinformation and half-truths” shared by opponents arguing that the tax risked increasing the prices of everyday goods from relying too heavily on sales or use taxes and the threat to local retail sales.

Erdman and others have said state, local and school spending needs could be met with a 7.5% consumption tax. Some of the proposal’s critics disagreed, saying it could require a rate as much as three times higher to make it workable.

Former GOP gubernatorial candidate and former State Sen. Brett Lindstrom of Omaha, a spokesman for the anti-EPIC tax group No New Taxes, had warned of creating new taxes on health care, legal bills, prescription drugs and home repairs. He said Nebraskans know the idea was ‘too good to be true.”

“Keeping the EPIC Option from the ballot protects hardworking Nebraskans from the loss of local control, sky high tax rates and higher health care and housing costs,” Lindstrom said. “The EPIC Option would have been an EPIC mistake for Nebraska.”

Erdman: Status quo unacceptable

Erdman and EPIC tax supporters have said the state’s current tax system is unsustainable. Pillen has spent much of the summer trying to find a way to rebalance the state’s tax system away from what he calls its over-reliance on property taxes.

Erdman and Pillen could clash during Pillen’s likely end-of-summer special session from late July to mid-August. Erdman has said he will propose the EPIC tax and said his approach will be cleaner and clearer than the governor’s yet-to-be finalized proposal.

The email to EPIC volunteers said the group planned to organize a video conference meeting to thank volunteers and so supporters could apply pressure to state senators during the expected special session.

“I have never been involved with volunteers who have spent more money, time and effort, all on their own dime,” Erdman said.

The petition received some organizational backing from the Nebraska Republican Party, which sent supportive tweets and helped connect the group to county GOP volunteers. In a statement Wednesday, the GOP said it wants to hear what plans for addressing property taxes that opponents of the EPIC tax proposal support.

Organizers started gathering signatures in December 2022.

Critics of both the EPIC tax and the governor’s previous proposals have said both share similar problems, shifting too much of the burden of agricultural, commercial, industrial and residential real estate taxes onto people purchasing goods.

Pillen has since said he would consider having the state pay most if not all of the costs of public K-12 education. But critics of that approach echo criticisms of the EPIC tax with concerns about the potential loss of local control.

The post EPIC consumption tax Nebraska petition falls short, will have to find another way appeared first on Nebraska Examiner.