Epic Movement in Yield Curve Spreads

Yield curve spread trades turned in tremendous performance. Without doubt, some of this one way trade is explained by many trading desks being staffed by more junior traders as the long July 4th weekend was fully underway Friday.

Yield curve spreads continue to outperform outright long positions in bonds, bond futures and fixed income ETFs. The 2s5s (CME Group TUF) and 5s10s (CME Group: FYT) is rallied aggressively while turning in tremendous performance. We have seen a dramatic rise in yields for the intermediate part of the yield curve over the last 60 days. The long end has seen yields increase, but not at the same pace. This has caused 10s20s (CME Group: NOB) to flatten. Think “Operation Un-Twist.”

{jathumbnailoff}

Yield curve traders, tighten up that 5 point harness and enjoy the ride! Yield curve spreads with 2 yr (CME Group: ZT), 5 yr (CME Group: ZF) and 10 yr (CME Group: ZN) legs saw dramatic action. “No Bid Friday” saw U.S. Treasury yields rise a jaw dropping 20 bps across the curve into accelerating volume. Yield curve spread trades turned in tremendous performance. Without doubt, some of this one way trade is explained by many trading desks being staffed by more junior traders as the long July 4 th weekend was fully underway Friday.

Yield curve spreads continue to outperform outright long positions in bonds, bond futures and fixed income ETFs. The 2s5s (CME Group TUF) and 5s10s (CME Group: FYT) is rallied aggressively while turning in tremendous performance. We have seen a dramatic rise in yields for the intermediate part of the yield curve over the last 60 days. The long end has seen yields increase, but not at the same pace. This has caused 10s20s (CME Group: NOB) to flatten. Think “Operation Un-Twist.”

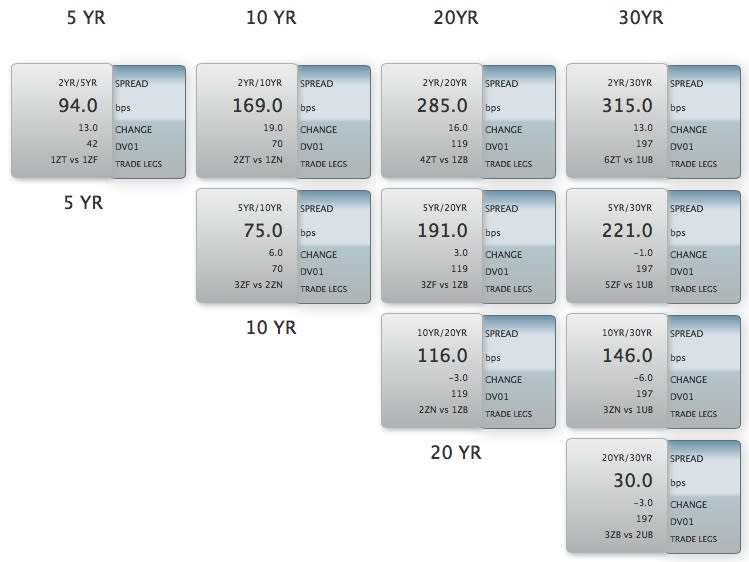

Futures Yield Curve Spread Market Summary Note the Dramatic Changes in the Top Row & Along the Diagonal

As of July 5, 2013:

Source: CurveTrades LLC

- See more at: http://www.curvetrades.com/index.php/blogs/328-epic-movement-in-yield-curve-spreads#sthash.WSlhrR96.dpuf

Yield curve traders, tighten up that 5 point harness and enjoy the ride! Yield curve spreads with 2 yr (CME Group: ZT), 5 yr (CME Group: ZF) and 10 yr (CME Group: ZN) legs saw dramatic action. “No Bid Friday” saw U.S. Treasury yields rise a jaw dropping 20 bps across the curve into accelerating volume. Yield curve spread trades turned in tremendous performance. Without doubt, some of this one way trade is explained by many trading desks being staffed by more junior traders as the long July 4 th weekend was fully underway Friday.

Yield curve spreads continue to outperform outright long positions in bonds, bond futures and fixed income ETFs. The 2s5s (CME Group TUF) and 5s10s (CME Group: FYT) is rallied aggressively while turning in tremendous performance. We have seen a dramatic rise in yields for the intermediate part of the yield curve over the last 60 days. The long end has seen yields increase, but not at the same pace. This has caused 10s20s (CME Group: NOB) to flatten. Think “Operation Un-Twist.”

Futures Yield Curve Spread Market Summary Note the Dramatic Changes in the Top Row & Along the Diagonal

As of July 5, 2013:

Source: CurveTrades LLC

- See more at: http://www.curvetrades.com/index.php/blogs/328-epic-movement-in-yield-curve-spreads#sthash.WSlhrR96.dpuf