Gov. Pillen releases ‘Nebraska’s plan’ for property tax relief with few new concrete details

- Oops!Something went wrong.Please try again later.

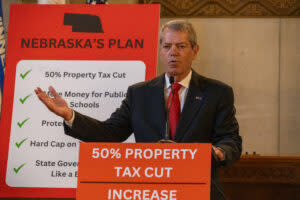

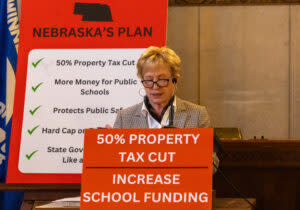

Gov. Jim Pillen is joined by State Sens. Lou Ann Linehan and Rob Clements in unveiling a proposal to reduce local property taxes in three years. July 18, 2024. (Zach Wendling/Nebraska Examiner)

LINCOLN — Gov. Jim Pillen said his official property tax relief plan released Thursday would, “without a shadow of a doubt,” receive more than enough bipartisan support during a legislative special session.

“It’s a crisis that has been accelerating at warp speed, and it’s time to fix it,” Pillen told reporters.

But getting to that magic 33-vote count, in the 49-member Legislature, could hit a similar roadblock as in the spring, with a similar chorus of lawmakers continuing criticism that the proposal — dubbed “Nebraska’s Plan” — is unsustainable and would create an overall tax increase.

“A third grader can do the math with the numbers that have been leaked to know that working Nebraskans are paying more,” State Sen. Julie Slama of Dunbar told the Nebraska Examiner.

The official plan mirrors many contours of a draft version the Examiner obtained last weekend. Pillen repeatedly said it would result in a “net tax decrease” but did not provide examples to support that contention.

A 14-page brochure, which Pillen’s staff said the governor paid for with his personal funds, in many instances offered fewer concrete details than the previous draft version. Lawmakers had already said the draft raised more questions than answers.

‘Nebraska’s plan’ contours

The main contours of the plan are:

Placing hard caps on county and municipality property tax collections, either 0% (in times of deflation) or matching the consumer price index, unless voters agree to override the caps. There would be exemptions for growth and public safety needs.

Funding more than 80% of local K-12 property tax burdens by the state, about $2.6 billion. School tax rates would be reduced from a maximum of about $1.05 per $100 of valuations to 15 cents, 7.5 cents and 0 cents in a three-year period.

Retooling existing property tax relief programs, including homestead exemptions and property tax credits. A spokesperson for the governor said there would be no cuts to existing homestead exemptions.

Removing more than 100 sales and use tax exemptions. Food, medicine and raw agricultural and manufacturing materials, along with 70 more goods and services, would continue to be exempt. Most goods and services would be taxed statewide at 5.5 cents per dollar purchase; machinery and equipment would be taxed at a lower, to-be-negotiated rate, with personal property taxes on those items removed.

Raising “sin” taxes on cigarettes, candy, pop, vaping, spirits, keno gambling, games of skill and consumable hemp.

‘Time to step forward and do something’

State Sens. Lou Ann Linehan of Elkhorn and Rob Clements of Elmwood, the Legislature’s Revenue Committee and Appropriations Committee chairs, respectively, joined Pillen at the news conference Thursday and said something needed to be done.

“Every senator, if you look at their campaign material, would say property tax relief is a high priority for them,” Clements told the Examiner. “I think it’s time for senators to step forward and do something about what they’ve been promising.”

Both senators have been part of a group of 17 lawmakers working with Pillen this summer on the plan, which Linehan said represented “critical” and comprehensive reform.

Linehan said local spending was the “crux” of the problem. If there was a reason to override the cap, it would go to a vote of the people — the “most local control you can possibly have.”

“We must put a halt to local governments collecting a windfall in cash every time valuations go up,” Linehan said.

Concerns ‘have fallen on deaf ears’

State Sens. George Dungan of Lincoln and Merv Riepe of Ralston, both members of the task force, said they are still uncertain on many key parts of the plan after attending or watching the news conference.

Dungan said he’s been opposed to any plan that shifts tax burdens to middle-class and working Nebraskans and was the only Revenue Committee member to oppose Pillen’s original tax proposal, Legislative Bill 388, in the spring.

He said he voiced similar concerns this summer, which appear to “have fallen on deaf ears.”

“Sounds like all we know thus far is that Nebraskans are going to be paying more in sales and use tax,” Dungan said. “But as Natasha Bedingfield once said, ‘The rest is still unwritten.’”

Riepe said that as of Thursday, the task force still had another meeting set for next week, though it’s unclear how that meeting will go since Pillen has formally released the proposal.

“I still don’t feel because I have this little colorful brochure that I can go back and say, ‘Oh, yes, this answers all my questions, and now I’m prepared to vote,’” Riepe said, stating the brochure instead summarized task force discussions.

‘A tax plan that robs Peter to pay Pillen’

Slama said she agrees there needs to be a fix but described Pillen’s news conference as “all fluff and no substance” with no concrete examples of how Nebraskans would benefit.

An online tool released with the plan allows people to type in any address and see how that property would benefit under the plan. And while Pillen said Nebraskans would see an average of 50% fewer property taxes, Slama said it would likely be much less.

Part of that is because the plan folds in $900 million from existing relief programs.

“It’s going to be about a 25% property tax cut, at best,” Slama said. “For working Nebraskans, this will be a massive tax increase.”

Pillen said any of the dozens of exemptions that would remain on the books could also be ended. But he said that’s a decision for the Legislature, and he’ll “100% support” whatever lawmakers come up with.

Slama noted that some of the other remaining exemptions include those that Pillen’s family business stands to benefit from, such as those involving pork production.

“That’s corruption,” Slama said. “That’s corrupt, and we can’t have a tax plan that robs Peter to pay Pillen.”

Pillen told reporters if he was worried about making money, he “sure as hell” wouldn’t have campaigned for governor.

Faces similar opposition as in spring

Omaha Mayor Jean Stothert directly pushed back on the “windfall” allegation in a Thursday statement. She noted two-thirds of the city’s general fund budget is spent on police and fire protection, with another significant obligation for roads.

Thursday’s presentation didn’t provide enough specific information to anticipate how Omaha’s budget or services could be impacted, Stothert said, adding: “it certainly won’t be the only plan the Legislature will continue.”

“I certainly support property tax reform, however, I am concerned about the lack of thought, analysis or discussion with local governments as these potentially damaging plans and the unintended consequences are being considered,” Stothert said.

Ahead of the special session, Pillen is also facing pushback from Americans for Prosperity-Nebraska, which opposed his plan in the spring for similar reasons.

AFP-NE State Director John Gage, who used to work for Pillen’s administration, said the governor’s tax shift “scheme” on working and middle-class Nebraskans was already defeated once, “and this special session will be no different.”

“While other Republican governors are working to make life more affordable for their constituents facing sky-high living costs under the Biden economy, Governor Pillen is pushing a plan that would be the largest tax increase in state history,” Gage said in a statement.

School growth metrics still unclear

While the plan doesn’t explicitly state how much school district budgets would increase annually under the plan, Pillen said annual budget increases would be limited to 3%. He said if the state similarly ends some unfunded mandates on local governments, teacher salaries could increase.

He pointed to community colleges as a similar model where the state’s six colleges can receive annual 3.5% budget increases or certain metric-based increases under a new state-funding model.

Clements said the increases might be inflation plus growth, which hasn’t been defined. That might prevent the state’s 244 school districts from coming to the Legislature each year for more money.

The draft plan said a new school funding formula wouldn’t be tackled until 2025.

State Sen. Lynne Walz of Fremont said that she has yet to see any model of Pillen’s plan that shows it is beneficial and that on top of losing more local control, the plan isn’t sustainable or responsible.

“I’m hoping that he’s willing to look at another plan that doesn’t choke out schools,” Walz said.

Walz said if schools have just 3% more in operational expenses each year, that doesn’t provide a lot of flexibility, including funds to hire quality teachers.

Slama said her biggest priority is supporting rural communities, whereas the plan, as a whole, could hurt rural Nebraskans and lead to rural school consolidations, she said.

‘Shenanigans’ could prevent new ideas

Pillen told reporters that if someone has a problem with the plan, they should “get to the table and solve it.”

Other draft proposal changes

A number of tax-exempt goods and services were scheduled to begin being taxed under the draft plan obtained last weekend by the Nebraska Examiner. By Thursday, several of those did not appear on a new list, suggesting they would remain tax exempt.

Those include:

Advertising agency fees (not ad placement).

Custom meat slaughtering.

Debt counseling.

Downloaded books, movies/digital video, music and other electronic goods.

Energy used in agriculture or industry.

Family planning.

Graves, plots and other spaces for human remains

Interment of human remains.

Internet service providers — dialup and DSL or other broadband.

Materials used in manufacturing ethanol or coproducts.

Net wrap.

Pre-burial services.

Purchases by the Nebraska State Fair Board.

A new exemption targeted to come onto sales tax rolls is natural gasoline used as a denaturant by a Nebraska ethanol facility.

Pillen has indicated he’ll call senators back to Lincoln beginning July 25, but he has not issued a formal proclamation to do so. In that call, he must list which issues lawmakers are allowed to consider.

Slama and multiple other lawmakers said because Pillen has not done that yet, senators have been left in the dark as to whether their ideas would be germane to the special session’s scope.

She said she has concerns that “shenanigans” could prevent other ideas from being considered.

“He’s been the one pointing his finger and going, ‘No, it’s my plan or the highway,’” Slama said. “And now he’s structuring a special session to prevent anybody from bringing their own ideas.”

Clements said he’s been pleased that Pillen has listened to people on the task force, such as with business inputs, and said Pillen is “not stuck on 100% of what he is asking for.”

“I think he’s indicated if he gets 80% and he gets 33 votes with 80%, he’ll be satisfied,” Clements said. “I’ve been pleased that he doesn’t think his plan is set in cement and he’s willing to collaborate with people.”

A taxable ‘choice’

Linehan said the plan might increase overall taxes for some consumers, though they have choices on what they purchase, unlike with property taxes.

“Today, when you get your property tax statement in the mail, you have no choice,” she said. “You pay in full on the date it’s due, or you lose your home or your farm or your business.”

Slama and Dungan said that “choice” isn’t the same for some services — Slama pointed to a family needing to fix a vehicle’s brakes or heating system “when it’s negative 30 outside.”

“You’re acting like these are just frivolous purchases, and these are purchases that can make or break the health and well-being of a family,” Slama said.

Slama has been pushing for state spending cuts, which the plan states will be $350 million between the Education Future Fund and agency-specific cuts.

Clements said he did not have a list of such reductions but confirmed there will be at least $100 million in cuts from state agencies, in addition to $160 million being cut from the Education Future Fund. The plan also calls for $235 million from idle cash fund reserves.

Riepe said one-time cash fund transfers wouldn’t be sustainable for schools.

Without change, ‘this place shrinks’

Asked whether renters would share similar benefits of the plan, Pillen said the “free market” will correct and renters will win.

Riepe said it is “pretty presumptuous” to think landlords would pass on the benefits of reduced property taxes, but he said he believed in the free market. But he also was concerned about renters being able to go to their property owners and say, “I know you got a payday. I want some of it.”

Dungan said renters will still see rent increases and will face the brunt of more taxes on goods and services, which aren’t choices but instead necessities.

Pillen said the cost of inaction would mean that rents, and property taxes, continue to skyrocket.

“We don’t do it now, the party’s over and this place shrinks,” Pillen said. “I don’t want to be any part of that.”

The post Gov. Pillen releases ‘Nebraska’s plan’ for property tax relief with few new concrete details appeared first on Nebraska Examiner.