Palm Beach County will keep current millage rate - what it means for your property taxes

Palm Beach County taxpayers will see no increase in their millage rate in the next fiscal year. The Palm Beach County Commission voted 7-0 Tuesday to retain the current rate of 4.5000 mills for the year beginning Oct. 1.

There will be public hearings on Sept. 10 and 17 before commissioners cast a final vote. They could opt to lower or increase the rate at these hearings, but an increase is extremely unlikely because of time constraints and the expense of notifying property owners.

Even with no change in the millage rate, property owners may see modest increases in their tax bills because of rising property values — 9.2% in net taxable value in 2023, according to initial data released by County Property Appraiser Dorothy Jacks.

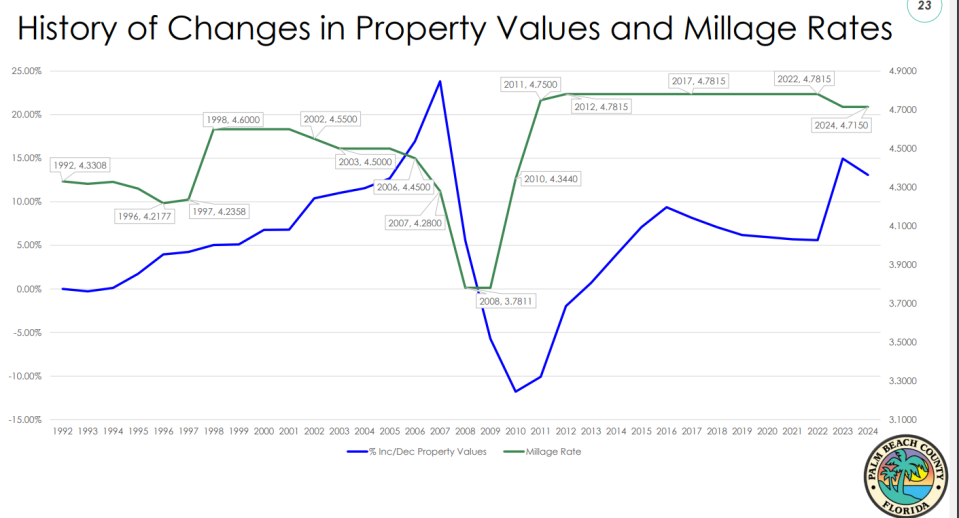

The millage rate was reduced by commissioners each of the past two years in order to mitigate the potentially stiff tax hike property owners faced because of dramatic increases in property values. (The millage rate was last increased in 2012).

State law prevents assessments from rising more than 3% on homesteaded parcels; non-homesteaded properties can increase by as much as 10% annually.

The millage rate adopted Tuesday will result in the owner of a homesteaded residence assessed at $378,000 paying $1,527.03 in property tax next year — also called ad valorem tax — for an increase of $51.03, according to county figures.

County elections: Who is running in the primaries and who has already been re-elected

The owner of a $500,000 property will pay $2,092.50, up $67.50. For the owner of a $1 million home, it will be $4,410 in property tax, or $135 more than now.

The county millage rate is applied to a tax base to raise money for the county government. Individual cities, school and water districts and other entities set their own rates.

What does the future look like for property values in Palm Beach County?

“We are doing extremely well in terms of property values in Palm Beach County,” County Administrator Verdenia Baker informed commissioners “We’re not quite sure how long that will last. It may be starting to level off.”

April’s median sales price for an existing single family home in Palm Beach County was $650,000, or 11% higher than the same time last year, according to data released by the Broward, Palm Beaches and St. Lucie Realtors Group.

MORE: County property values skyrocketed in 2023 - what drove it and what it means for your taxes

But Florida Atlantic University housing economist Ken H. Johnson has cautioned that the area “could be in for a prolonged period of home price stagnation.”

The millage rate approved by commissioners will generate $1.4 billion, an 8.7% increase, according to county data. The proposed budget spending plan includes:

Nearly $953 million for the sheriff’s office, which includes nearly $105 million the department will generate in revenue.

$124 million for capital projects which includes $75.4 million for Palm Tran operations and vehicles.

Across the board 6% pay hikes totaling $18.2 million.

Thirty-six new positions.

Mike Diamond is a journalist at The Palm Beach Post, part of the USA TODAY Florida Network. He covers Palm Beach County government and transportation. You can reach him at mdiamond@pbpost.com. Help support local journalism. Subscribe today

This article originally appeared on Palm Beach Post: County millage rate won't increase, keeping property tax increases low