Questions remain as Gov. Pillen doubles down on taking over K-12 public school funding

- Oops!Something went wrong.Please try again later.

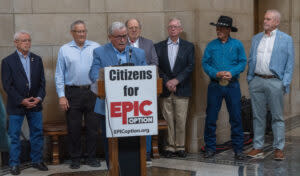

Gov. Jim Pillen listens to a local farmer discuss possible impacts of proposed property tax reform ideas at a town hall in Pillen's hometwon hometown of Columbus at the Columbus Area Chamber of Commerce on Wednesday, June 26, 2024. In front of Pillen is State Sen. Mike Moser of Columbus. State Treasurer Tom Briese, left, also watches during the event. (Zach Wendling/Nebraska Examiner)

COLUMBUS, Nebraska — Gov. Jim Pillen confirmed Wednesday he is asking the State of Nebraska to take on most or all public K-12 school spending, instead of funding schools through local property taxes. The shift would be a national standout.

Speaking Wednesday in his hometown of Columbus, Pillen said having the state take on an additional $1.65 billion to fund K-12 schools, instead of funding schools through local property taxes, would be a win-win.

He is also seeking to cap local political subdivisions’ year-to-year spending increases, either at 0% or the level of the consumer price index, a measure of inflation. CPI for May 2024 was at 3.3%.

“Having the state fund our children will do nothing but strengthen our education,” Pillen told reporters after the town hall event.

School advocates and multiple state senators told the Nebraska Examiner their understanding of Pillen’s plan was that the state would take over the general expenditures for schools, minus special building projects or bond levies that would be left up to local school boards.

However, Pillen confirmed at the town hall and with reporters he is eyeing all K-12 funding, which would be a dramatic shift from the state’s current model.

Local control concerns

Ryan Loseke, a former Lakeview Community Schools board member who served from 2011 to 2023, expressed concern the idea would remove local control for the state’s 244 public school districts, which have their own culture and priorities.

“I’m concerned about how this looks and a little more comfortable with foundation aid,” Loseke told Pillen.

Pillen said the model would be similar to how the state has assumed funding of community colleges. Legislation passed in 2023 shifting the source of funding for community colleges, from property taxes to state funds. Still, the colleges retained a limited “backstop” to return to funding via property taxes if state funding dried up.

The governor also pointed to his previous political office on the University of Nebraska Board of Regents, on which he served for about 10 years. The board is in charge of delegating state funds for university spending.

“You know how much authority the Board of Regents has on getting money? Zero,” Pillen said.

NU leaders publicize their two-year state funding request every other August and then testify alongside all other agencies before the Legislature’s Appropriations Committee each spring. The committee forwards its spending recommendations to the full Legislature.

In 2023, Pillen’s first year as governor, NU requested a 3% increase in state aid, for example. Pillen had included a 2% increase in his initial budget, and the Legislature landed in the middle. About 60% of NU’s state-aided $1.1 billion budget is from the state, while the rest is funded by tuition revenue.

Community colleges also set tuition levels. Local K-12 school boards have bond authority, but they do not charge tuition.

The Nebraska State Education Association did not immediately respond to a request for comment Wednesday on Pillen’s ideas.

Nation-leading idea

In Nebraska, for the 2022-23 school year, about 60% of the state’s $5.3 billion in property taxes went to K-12 schools — about $2.8 billion in direct taxes and $318 million in bonds, according to the Nebraska Department of Revenue.

A report from the Institute of Education Sciences National Center for Education Statistics states Nebraska property tax revenues were about 48% of total revenue sources for schools during the 2020-21 academic year. On average, about 36% of total school revenue sources came from property taxes.

Vermont’s total revenue from property taxes rounded to 0% because it had a state-administered property tax, which Nebraska voters outlawed in the 1960s.

Other states with the least total school revenue coming from property taxes were: Alaska, at 11%; New Mexico, at 14%; Alabama, at 15%; and Kansas, at 17%.

Hawaii, which has only one school district, does not fund public education through property taxes.

In Nebraska, a competing tax plan that is the subject of a petition initiative would eliminate the state’s current tax model and replace it with consumption and excise taxes alone. The so-called EPIC Option has a July 3 deadline to submit enough signatures to qualify for the November ballot.

Both the Pillen and EPIC proposals would change how the state funds K-12 education. Pillen has said he would work “day and night” to defeat EPIC if it qualifies for the November ballot.

Changing the ‘status quo’

Under Pillen’s proposal, which has not been formally outlined ahead of a special session expected to begin July 25, most school funding could be centralized at the Legislature, another line in the state budget. Pillen would wield the line-item veto pen, but he said local school boards and taxpayers could trust that the model would improve schools.

“I’ve not met a Nebraskan, anybody, who’s against our kids,” Pillen said.

Pillen is also seeking to end unfunded mandates in county, city and school governments. One superintendent in attendance Wednesday said that includes training and other staff requirements.

“We’re going to clear them out and not do them and save a bunch of money instead of continuing to do things status quo,” Pillen said of unfunded mandates, without offering specifics.

Pillen said that with hard spending caps would help simplify a complicated state aid formula that lawmakers have perennially tweaked since 1990.

He argued this would allow schools to increase teacher pay and hire fewer administrators.

But the “how” behind Pillen’s plan has not yet materialized, and it’s unclear whether spending levels would be frozen, and at what level, should the idea take root. It’s also unclear how schools would go about requesting spending increases, such as at the level of inflation or by a vote of their residents.

Asked whether the change would mean the state’s school districts would need to go to the Appropriations Committee every other year to seek state funding, Pillen said there would be exceptions to that rule. He gave no further explanation.

“Funding our schools is the highest priority for all Nebraskans,” Pillen said. “It’s one thing we agree on: We never give up on a kid.”

Between the 2022-23 and 2023-24 school years, statewide school taxes (excluding bonds) went up 3.17%.

Of 244 school districts, 88 districts brought in less tax revenue in 2023-24 than the year before; and 70 had an increase of at least 3% in collected taxes — 59 rose more than 4%, 48 rose more than 5% and 16 went up by double digits.

‘Nobody pays attention to sales tax’

State Sen. Jana Hughes of Seward, a former school board member, said she backs the state taking a larger role in financially supporting schools. She said it is time to modernize the state’s tax code, joining Pillen in calling for allowing taxes on more services as the economy has diverted from being goods-based to being more dominated by services.

“I think finding sustainable funds to support 100% of school funding seems like a big task, so I hope we can make progress toward that goal one step at a time,” Hughes said in a text. “If we can find an extra $1 billion this special session I will be very pleased.”

Hughes has led the charge to increase taxes on vaping, and the governor has set his sights on increasing other “sin” taxes for liquor and cigarettes.

Pillen on Wednesday floated changing how personal property is taxed so it could be done through sales taxes and suggested a two-tiered tax rate for certain goods or services. Beyond medicine and groceries, he said, all other sales tax exemptions are in play.

A previous review of sales tax exemptions by the Examiner showed at least $6.5 billion is annually not collected from taxpayers for services and certain goods — services are exempt unless taxed, and many services are not estimated for potential tax revenue.

Multiple senators have said taxing business or agricultural inputs is a non-starter, but Pillen, a hog farmer and veterinarian, has countered that a two-tiered sales tax rate could be created. The specifics — such as enforcement and tracking details — have not been outlined.

“I’ve had the suggestion of taxing our inputs 2% for putting a corn and a soybean crop in,” Pillen explained. “For easy math, you put a corn crop in or seed corn or chemicals and our fertilizer — $400. You tax at 2 [%], that’s $8. If property tax goes down 60%, you come back $8, it’s an extraordinary tax decrease.”

Pillen also pointed to pop and candy to illustrate that Nebraskans might not notice the change: Self-serve soft drinks as gas stations are taxed, for example, but bottled soft drinks are not.

“Does anybody know that?” Pillen asked the audience Wednesday. “Nobody does, because nobody pays attention to sales tax. It has the least impact on our economy.”

Gambling and marijuana

Asked by an audience member whether Pillen would look at gambling for revenue, whether by legalizing mobile betting or setting skill games and casinos at a similar tax rate, he said it could be another piece of the puzzle.

“I don’t like sports betting,” Pillen said, “but the hardcore reality is … whoever wants to do online sports betting in Nebraska is doing it and … we’re giving it [the revenue] to our neighbors.”

Another potential revenue source that senators have floated, however, is a nonstarter with Pillen: recreational marijuana.

“I’m going to protect kids,” Pillen said. “Legalizing marijuana, trying to have it for sales tax, I’ll veto it.”

Should legislation be filibustered, it would need 33 votes to end the filibuster. A veto override requires 30 votes. It’s uncertain whether Pillen will have the votes needed for his proposal by the special session, but he told reporters Wednesday he will talk to all 49 senators by the time the session convenes. He has six more town halls scheduled this week. No events have been scheduled in the two most populous cities: Omaha and Lincoln.

“I believe that with your help, we will have bipartisan support, and we won’t have to worry about counting 33,” Pillen said at the town hall. “But we got a lot of work to do between now and when the session starts.”

The post Questions remain as Gov. Pillen doubles down on taking over K-12 public school funding appeared first on Nebraska Examiner.