‘Why is it so hard to spend a £10 note in central London?’

I have a confession to make. Despite writing regularly about how important cash is for many, I rarely use notes and coins.

I’ve become so accustomed to paying by card or my phone app, I don’t even carry “emergency” cash with me. My idea of an emergency backstop is the debit card buried somewhere at the bottom of my bag.

I’m certainly not alone in this. Cash now accounts for just 12pc of all payments, according to UK Finance, and will make up just 6pc by 2033. More than 6,000 bank branches have closed since 2015.

Jana Mackintosh, managing director of payments, innovations and resilience, at industry body UK Finance said of the figures: “This doesn’t mean we are on our way to becoming a cashless society… although we are using it less, and more people are leading largely cashless lives.”

Londoners in particular have embraced cashless lives. In 2019, residents of the capital withdrew £300m weekly from its 6,559 ATMs – but in 2024, just £210m is taken out every week, from 4,824 ATMs.

Many major chains have scrapped cash payments entirely – as they are allowed to do – as customers demand to be able to pay by card instead.

So when my editor sent me out to buy lunch for £10 in cash in the mean streets near Bank in the City of London, I was expecting it to be difficult. It is the heart of the financial district, where decisions about the future of cash are made. But the office workers on their break aren’t carrying notes with them.

The first ATM I try is out of service. The average Londoner lives just 350 meters from a cash machine, much closer than the three miles mandated for those living in rural areas.

So there’s another one a short walk away.

Determined to be more adventurous than my typical meal deal (a caesar wrap, sausage roll from the Sainsbury’s hot counter and a smoothie for nutrition), I eschew the supermarkets, which have long promised to continue to accept cash.

But searching for a more upmarket sandwich that I can buy with cash is no easy feat. Joe and the Juice, Blank Street Coffee and Black Sheep Coffee only have card readers, with the former sporting a slightly tattered pink sticker on its front door advertising this fact.

For a healthy alternative, I could have chosen Garbanzos, a falafel and salad bar with its glitzy self-checkouts. It is full of banker-types, many of whom are staring at their phones while waiting for their food, headphones firmly in.

A katsu with edamame at Itsu is off the menu, as the chain doesn’t take cash. I’m not in the mood for a Pret (although the one on East Cheap does take cash, when I ask inside).

Down the road is sandwich shop Cheese & Peppers. It is old-fashioned and no-frills, and behind the counter is a traditional till. The owner says he keeps taking cash as payment because “not everybody can pay with card”. But, as is the common refrain from small business owners in the capital, he adds that less than 5pc of his customers want to.

There’s a big queue, so I let him get back to the lunch rush.

Around the corner, nestled under the monument to the Great Fire of London, is a collection of street food stands. Big chalk boards advertise their wares, from South American dumplings to burritos.

All of the stands take cards, as do most food stalls across the capital, because not having a card reader is essentially a kiss of death for a small business.

One stall holder, scraping a jollof rice pan clean, says that while they do accept cash: “Most of the time we don’t have change, we don’t bring change.”

I’ve finally spotted what I want for lunch. My heart drops when I see the now ubiquitous little white card reader – but my fears are assuaged when the tourists in front of me pay with a crisp note.

My chicken and halloumi souvlaki sets me back £9 and is filled with well-salted chips and crispy lettuce. I get a £1 coin (which I will probably lose before spending) in change.

‘Balancing innovation with inclusivity’

While my search was only slightly frantic, much more serious worries about how an increasingly cashless society have been raised.

The Crowdstrike outage caused problems with some payment systems and more importantly revealed how fragile online networks can be.

My not keeping even an emergency tenner in my bag won’t be a problem until it very suddenly is. I’ll know about it if the supermarkets experience more outages, as Tesco and Sainsbury’s did in March.

Eamon O’Hearn, of the union GMB, said: “When you take cash out of the system, it means people have nothing to fall back on, impacting on how they do the everyday basics – even buying food.

“[The outage] needs to be the start of a new conversation at a local and national level of how we keep cash in our society.”

There are other problems with consumers becoming too accustomed to cards. And not just for coin collectors, who might be upset if coppers are scrapped.

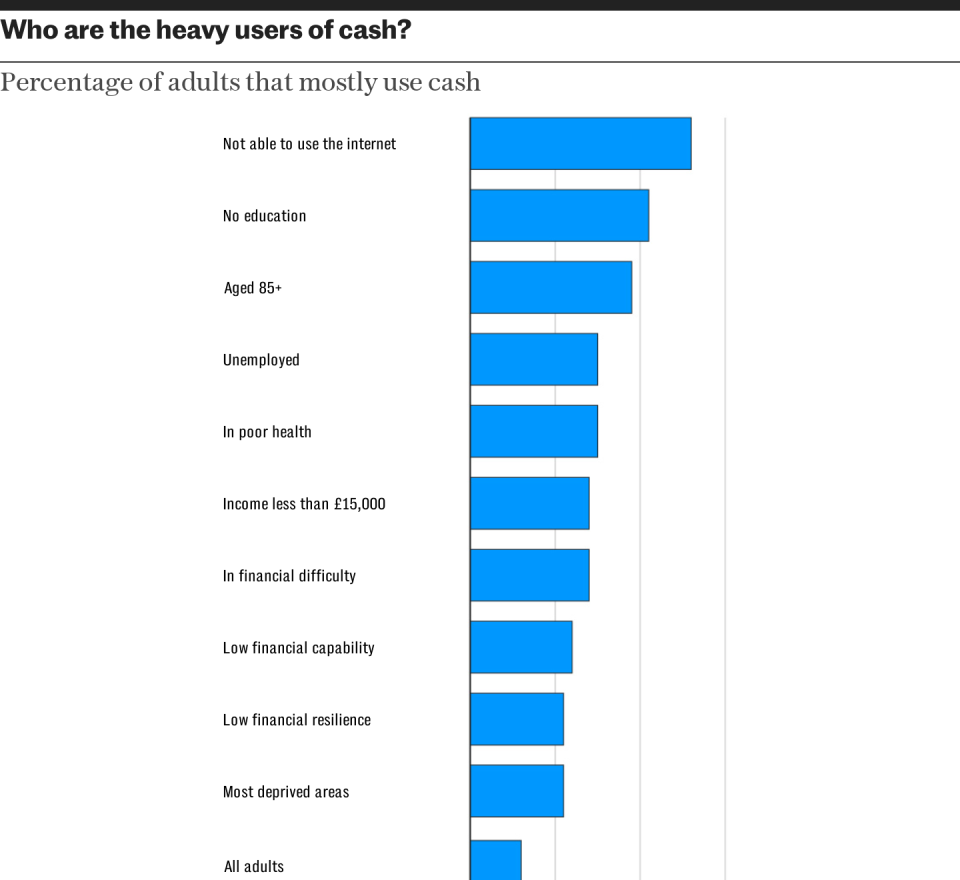

It’s well-established that it is the more elderly and more vulnerable who are most reliant on cash. There are 1.5 million consumers who still mainly use cash, UK Finance found, 2.6pc of adults in the UK. Other analyses put this number higher.

Chris Pond, chairman of the Financial Inclusion Commission, says the drive towards digital could leave behind those who are most vulnerable.

He says: “Going cashless might seem convenient, but we risk leaving behind the most vulnerable in our society. The shift towards digital payments must be carefully managed to ensure it doesn’t increase financial exclusion.

Mr Pond adds: “London businesses embracing cashless payments need to balance innovation with inclusivity, ensuring everyone can participate in the economy.”

The concerns about vulnerable consumers have driven a renewed interest in protecting access to cash. But policymakers can only do so much to stem the cashless tide.

While the 100th “banking hub” was opened late last year, and Labour has promised to install 350 of them, progress has been slow and even the more ambitious proposals are well under the number of closed branches.

The financial regulator, the Financial Conduct Authority (FCA), finalised its new rules to protect consumers’ access to cash. Where there are significant gaps, banks and building societies will have to improve services.

Local groups and community organisations will be able to demand assessments of services, and facilities will have to be kept open until alternatives are provided.

But the new rules will not stop bank closures, and are unlikely to encourage more consumers to put cash back into their pockets. Although periods of financial hardship are thought to increase cash use as a budgetary tool, the impact is small and short-lasting.

No number of stark warnings are going to turn back the clock for cash. As for me, next time I’ll buy lunch with my phone. It’ll be easier.