California insurance commissioner announces agreement on wildfire coverage

- Oops!Something went wrong.Please try again later.

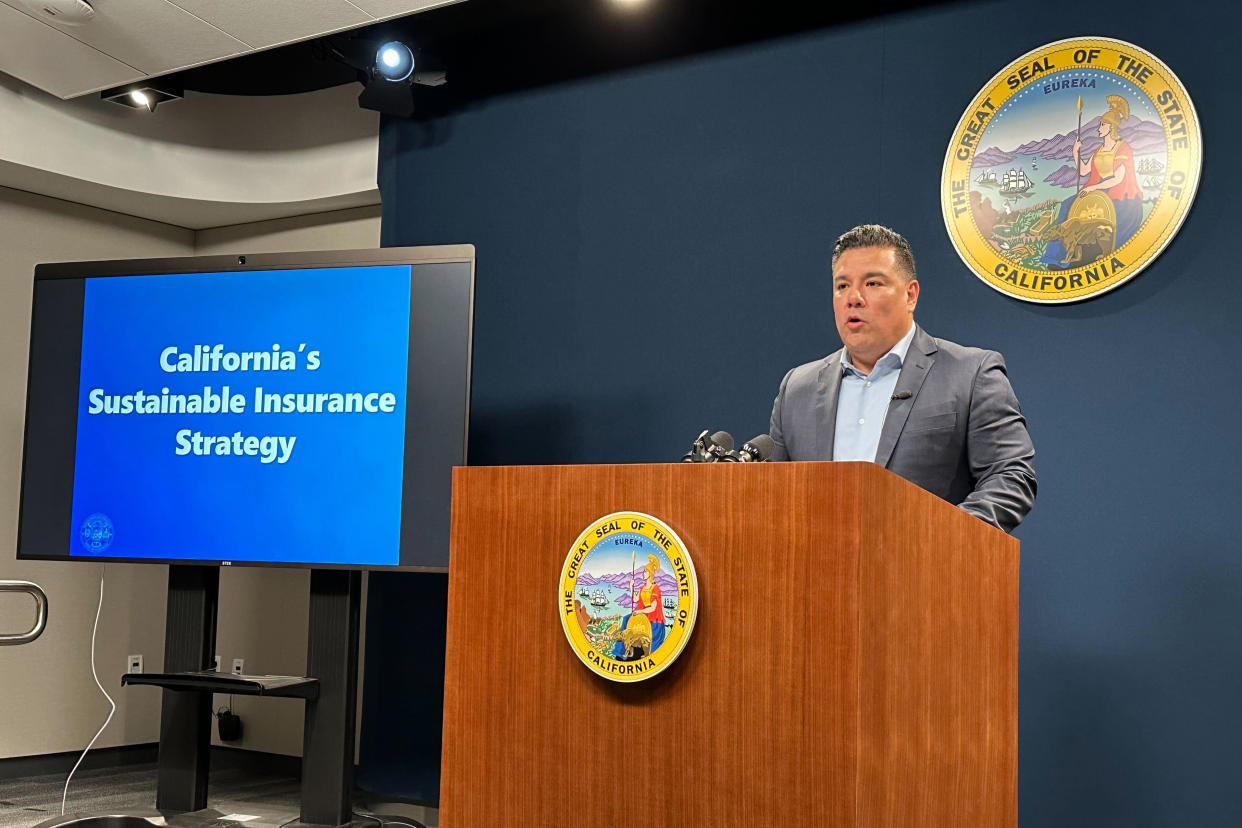

SACRAMENTO, Calif. — California Insurance Commissioner Ricardo Lara announced Thursday afternoon that the state has reached an agreement with wildfire insurance companies geared toward issuing new policies in disaster-prone areas of California again.

Under the terms of the agreement, insurance companies that want to operate in California will be required to increase their presence in disaster-prone areas to at least 85 percent of their market share elsewhere in the state when they file to update their rates. They will also have to bring on policyholders from the state’s FAIR Plan, the insurance plan of last resort, that has been taking on an increasing share of the riskiest policies in the state, thus skirting insolvency.

In exchange, companies will be allowed to use forward-looking catastrophe modeling when they set their rates, models that consumer advocates have objected to in prior negotiations on the grounds that they will lead to higher insurance costs tied to increasing wildfire risk. Companies may also be allowed to incorporate the costs they pay for reinsurance in California, to hedge against their own risk, in the rates they charge.

The insurance commissioner’s office is currently in the process of developing regulations for how exactly the new models can be used for rate setting. Lara expects to have all the new rules in place by December 2024.

“We are in really uncharted territory, and we must make difficult choices,” said Lara, who did not provide a direct answer on whether the new models would lead to sharp rate increases.

“It’s going to allow us to modernize the way we look at risk,” he said, adding that the advanced models, which he previously resisted, will reflect a more accurate picture of risk and incorporate steps that homeowners have taken to harden their homes against fire. “It works both ways.”

Lara was also not able to guarantee the return of insurance companies that have stopped issuing policies in the state. He emphasized the industry has agreed to this plan and he is working to get the modeling regulations in place so companies can refile under the new rules.

The announcement comes as wildfire insurance companies have been pulling out of the state at a rapid pace. This summer State Farm and Allstate stopped issuing new policies in California and five other of the twelve top insurers put restrictions and limitations on new policies. The companies have said wildfire risk and rising costs due to inflation make it uneconomical to write new policies. California currently has some of the lowest wildfire insurance rates in the nation because of a 1988 law that requires companies to have prior approval from the California Department of Insurance before implementing property and insurance rates.

A legislative deal to get wildfire insurers to remain in the state failed to materialize as the California legislative session came to a close last week. Lawmakers shied away from the politically unpopular move of allowing companies to raise prices and the problem was left to Commissioner Lara, who has broad authority to pass new rules.

Gov. Gavin Newsom issued an executive order right before Lara’s announcement Thursday afternoon urging the commissioner “to take swift action to address issues with the insurance market and expand coverage options for consumers, while maintaining strong consumer protections and keeping plans affordable.”

Lara said the order will allow his office to move faster and with a sense of urgency in setting regulations.

The plan will also streamline the rate review process and increase the coverage limit of the state’s FAIR Plan for commercial buildings like homeowners associations and affordable housing developments.