Is Nexam Chemical Holding (STO:NEXAM) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Nexam Chemical Holding AB (publ) (STO:NEXAM) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Nexam Chemical Holding

How Much Debt Does Nexam Chemical Holding Carry?

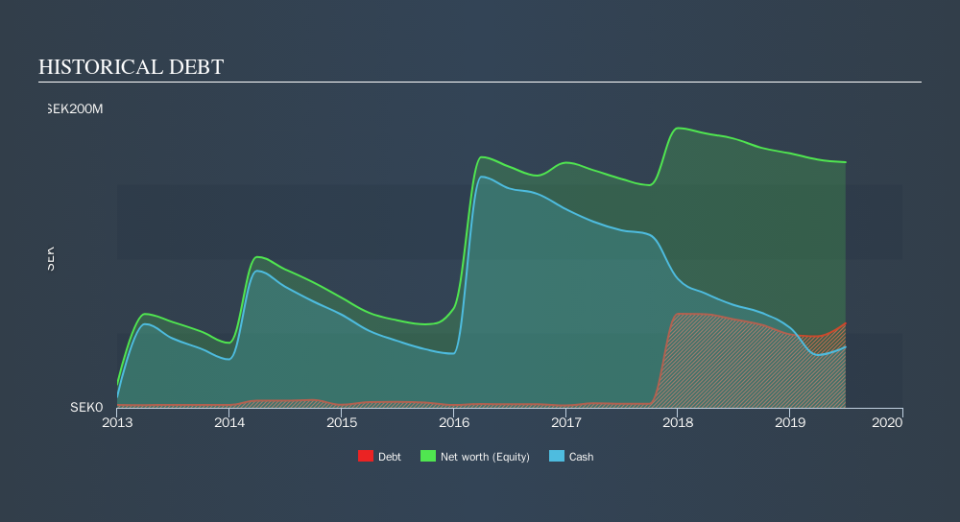

As you can see below, Nexam Chemical Holding had kr54.9m of debt at June 2019, down from kr59.3m a year prior. However, because it has a cash reserve of kr40.8m, its net debt is less, at about kr14.2m.

A Look At Nexam Chemical Holding's Liabilities

The latest balance sheet data shows that Nexam Chemical Holding had liabilities of kr36.4m due within a year, and liabilities of kr47.4m falling due after that. On the other hand, it had cash of kr40.8m and kr26.6m worth of receivables due within a year. So it has liabilities totalling kr16.5m more than its cash and near-term receivables, combined.

Given Nexam Chemical Holding has a market capitalization of kr594.2m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Nexam Chemical Holding will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Nexam Chemical Holding reported revenue of kr122m, which is a gain of 84%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Despite the top line growth, Nexam Chemical Holding still had negative earnings before interest and tax (EBIT), over the last year. To be specific the EBIT loss came in at kr17m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through kr28m of cash over the last year. So to be blunt we think it is risky. For riskier companies like Nexam Chemical Holding I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.