The next federal debt crisis is looming. Here's why

- Oops!Something went wrong.Please try again later.

Each day another presidential contender is throwing his or her hat into the ring. Whether Republican or Democrat, they will share their views on a host of topics, but no one focuses on our nation’s most severe problem — the national debt crisis. It is a bubble waiting to pop, and when it does, all Americans will suffer. In 2010, the Chairman of the Joint Chiefs of Staff, Admiral Mike Mullen said, "The most significant threat to our national security is our national debt." It was true then and more so today.

A few inconvenient facts to ponder:

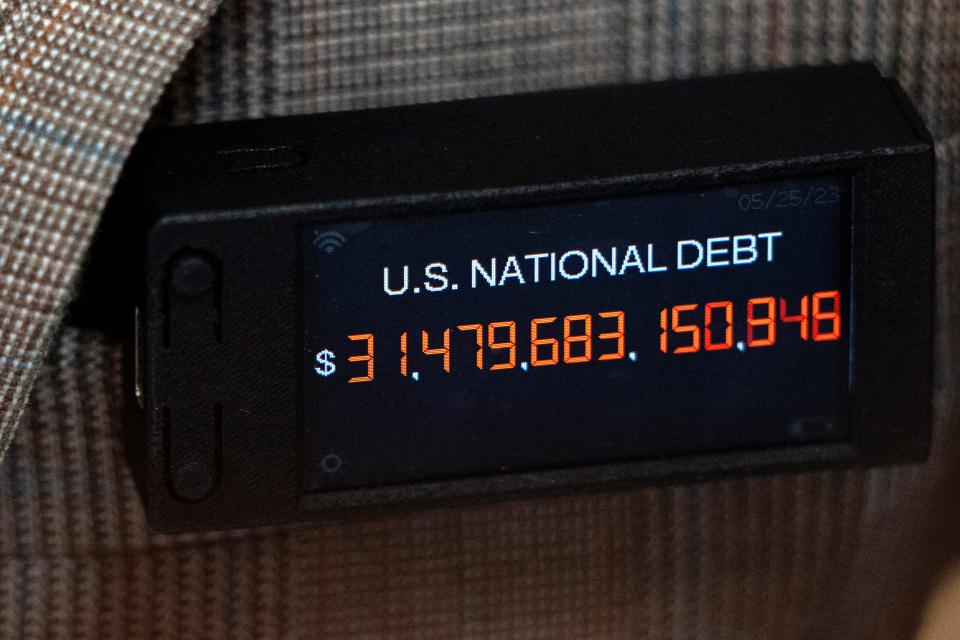

Our current interest-bearing debt is $32.5 trillion — and growing daily. According to the Treasury Department’s statement published on Sept. 30, 2022, our total financial obligations are $122 trillion (including unfunded obligations). The Congressional Budget Office projects our interest-bearing debt in 10 years to surpass $51 trillion without any new programs, and, in 30 years, will surpass $150 trillion. The interest our national debt currently accrues is $880 billion annually — and rising steadily. The Trust Funds for Social Security and Medicare Part A will be exhausted in 10 and five years, respectively, and by law, the benefits must then be cut with current estimations likely to be 26% and 10%, respectively.

In summary, as the Treasury Department wrote in its executive summary of the September 2022 report: “The current fiscal path is unsustainable.”

The total obligations are $369,000 for every man, woman and child.

The debt ceiling is not the issue. The only way the government can currently pay its debt is by borrowing more. That is nothing but a giant Ponzi scheme. It works until it doesn’t. At some point, investors will lose confidence and stop lending. If our credit card is closed, we will be unable to pay our expenses and debt service. That default would be catastrophic to the U.S. and the whole world.

I don’t know when that day will come, but come it will, unless our government stops spending extraordinary sums of money we do not have. It is the responsibility of every American to let our politicians know that the current rate of spending and adding debt must stop.

More: Fitch downgrades U.S. credit rating. How could it impact the economy and you?

Throughout the debt crisis in Greece, a few lonely and ignored voices warned their government about its problems, which ultimately led to the failure of the country’s economy. Without the European Union stepping in, the country would have experienced even further devastation. Unlike Greece, which could rely on the EU’s support, who can the United States rely on?

Do you get it yet? America, we have a problem, a very big problem.

But it does not have to be that way — the problem can be fixed if we show our elected officials, both Republican and Democrat alike, that the debt crisis is our priority. We want it fixed. However, their first objective is to get reelected, and that is accomplished by appeasing the public with goodies and great-sounding programs that often do not work. While in the moment it may sound great and win them votes one, two or even four years down the road, they are contributing to the destruction of our future.

Our debt has been growing more and more out of control since 2001 through administrations and congresses controlled by both parties. Our politicians have created a system where every term is focused on buying votes through more and more spending.

Even reduced Social Security and Medicare become irrelevant if our system collapses.

Folks, our Ship of State is headed for the proverbial iceberg. We cannot rely on the politicians to bring about a change of course without each of us holding their feet to the fire to compel them to address this awful problem. Voters will be the ones to drive change in this environment — it will not come from politicians.

For the past four years, Main Street Economics has been working to educate the voting public. Through videos, white papers and articles, we are trying to educate the public with the facts, because we believe that when voters understand how serious this problem is, they will be responsible and will lead the call for change.

Abraham Lincoln illustrated it best when he said, “With public support, anything can be accomplished.”

We must stand up and demand that our elected representatives take the necessary steps to balance our economy. And we must leverage the truth -- that if they won’t listen to the needs of their would-be constituents, we will vote for someone who will. That will get their attention.

Leslie A. Rubin, CPA, is a real estate developer and the founder and CEO of Main Street Economics, a nonprofit educating Americans about the seriousness of the nation’s debt crisis. Under his leadership, the organization has helped to educate Americans about the unsustainable fiscal path the United States is currently on and the urgency of stabilizing the debt before we crash into the iceberg.

This article originally appeared on NorthJersey.com: U.S. national debt: The next federal debt crisis looms