The next recession will hit black and Hispanic families the hardest

The yield curve inverted further this week, stoking more fears that a recession will soon hit the United States. But after 10 years of economic growth, a tight labor market, and a stock market that has reached record highs, who will bear the brunt during a recession?

If history were to repeat itself, minorities will be the hardest hit during a recession, thanks to its impact on housing and the job market, according to data and studies gathered during the Great Recession a decade ago. The net worth of the typical household dropped by a staggering 40% (roughly $50,000), erasing some two decades of gains for each household in just three years. But the recession did not impact everyone equally, hitting blacks and Hispanics harder than other groups.

A silent economic depression

A 2011 Pew Research report found that by the time the Great Recession ended in 2009, that median wealth fell by 66% for Hispanics and 53% for black households. That’s compared to just 16% among white families. “As a result of these declines,” the report noted, “the typical black household had just $5,677 in wealth (assets minus debts) in 2009; the typical Hispanic household had $6,325 in wealth; and the typical white household had $113,149.”

Minorities were also hit hard when the housing bubble burst, which eventually triggered the recession in 2007. Homeownership rate for Hispanics fell, hitting 47% in 2009 from 51% in 2005. The study notes that this might be due to the “disproportionate share” of Hispanics who live in California, Florida, Nevada, and Arizona — some of the states that saw the steepest declines in housing values since the real estate market bubble in the 1990s. According to the National Association of Realtors, by 2009, the black homeownership rate was 44.5%, down from 49% in 2004. The white homeownership rate by the end of the recession was 71%, down from 76% just 5 years prior.

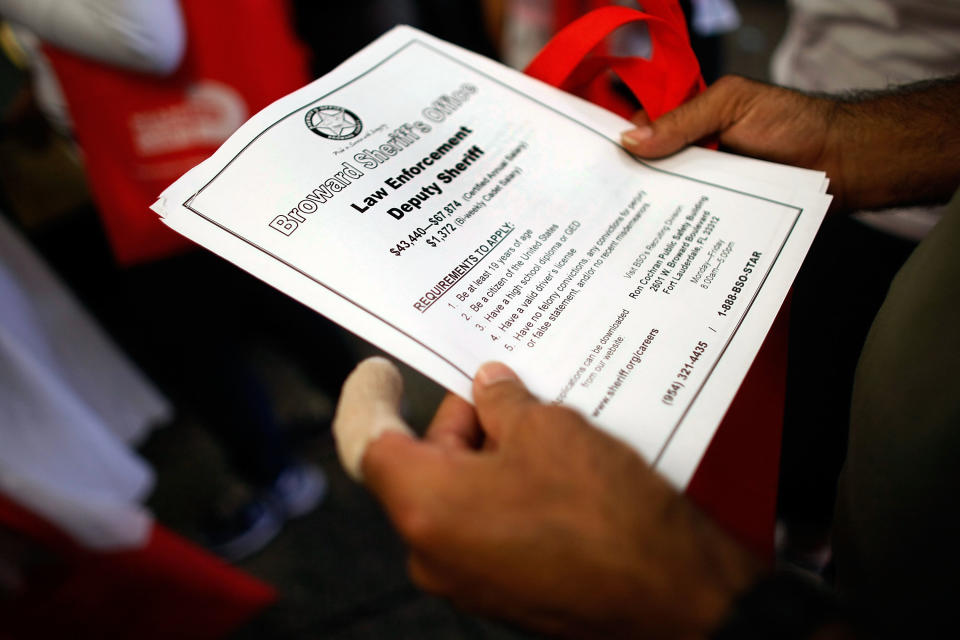

Minorities also suffered the most when the economic downturn caused the unemployment rate to soar. According to a 2010 study from the Institute of Government & Public Affairs at the University of Illinois, some 8.1 million jobs were lost since the start of the recession in December 2007. By October 2009, the unemployment rate for whites was 9.5%. It was 15.7% for blacks, and 13.1% for Hispanics. “Many American Blacks today are already experiencing a silent economic depression that, in terms of unemployment, equals or exceeds the Great Depression of 1929,” states the 2009 report “The Silent Depression,” from the nonpartisan organization United for a Fair Economy.

Shut out from recovery

Despite the gains made in the economy over the last decade, blacks and Latinos have not made as large strides during this economic recovery as their white counterparts. Simply put, minorities haven’t made enough gains to weather a new impending storm.

On a national level across all races, the top 1% captured 85% of post-recession income growth from 2009 to 2013, according to an Economic Policy Institute study on income inequality. In some states, they recovered 100% of those gains. But when broken down by race, blacks and Hispanics haven’t fared as well as their white counterparts.

In 2016, according to Pew Research, the U.S. median wealth — or the total of all assets — for white families was $171,000, compared to the national median wealth of $97,300. In 2016, the median figure for African Americans was 10 times lower than their white counterparts, at roughly $17,100. That’s less than half the median black wealth 35 years ago. Hispanics fared slightly better, with a median wealth of close to $21,000.

Unsurprisingly, this racial wealth inequality means that minority communities are disproportionately impacted by poverty. In 2016, roughly 31% of black and 27% of Hispanic children lived in poverty. That’s compared to 11% of white children.

Though the current labor market continues to be hot, unemployment rates for African Americans are twice as high as that of white workers. Meanwhile, adult black poverty rates are more than double that of their white counterparts. According to the EPI, the black poverty rate was 22% in 2016; the same year, it was 8.8% for white Americans. The national poverty rate, by contrast, was 12.7%.

Homeownership rates for black Americans have continued to decline through the years — currently, white homeownership rates sit at roughly 73%, according to the Census Bureau. By contrast, the homeownership rate for Hispanics is just under 47%. Blacks fare the worst of all the races, with a homeownership rate of under 41% — lower than during the Great Recession.

The next recession

This news may be troubling, but it’s largely expected that the next recession won’t be as bad as the last one. Moreover, analysts are undecided whether the inverted yield curve indicates an upcoming recession.

President Donald Trump’s trade war with China has plunged markets into chaos, while GDP growth and hiring is starting to slow, and global economies have started to weaken. Yet consumer confidence remains high, and the U.S. economy continues to be strong by many measures.

But no matter when a recession hits — either within the next two years, or longer, it will be minorities who will struggle the most.

Kristin Myers is a reporter at Yahoo Finance. Follow her on Twitter.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Read the latest financial and business news from Yahoo Finance