NJ needs a simpler approach to school funding. Here's how it could work | Ciattarelli

- Oops!Something went wrong.Please try again later.

Why are our property taxes the highest in the nation? It’s primarily because of New Jersey’s inequitable distribution of state aid to schools, which helps offset local school property taxes.

New Jersey’s complex formula for calculating state aid is arbitrary and nefarious. On a per-pupil basis, there is no equity in the formula, which, among other things, poorly calculates a community’s ability to fund its own schools —i.e., “local fair share.”

New Jersey desperately needs a simple and more equitable approach.

While never leaving any child or community behind, the reform we need is the state paying 100% of special education costs while providing aid equal to “X” for every English-speaking student and “Y” for every English-language learner. The reform should also include a reasonable cost per pupil range.

Who would oppose students across the state all being within a reasonable cost range for their constitutionally required “thorough and efficient” education? Certainly not our Supreme Court, lest they be in violation of our constitution’s equal benefit clause.

More Ciattarelli:Phil Murphy did little more than a victory dance. What about NJ's problems?

In the current state budget, more than $12 billion in taxpayer dollars will be distributed, inequitably, to local school districts. As required by our state constitution, the aid comes from our income taxes. And so, for nearly 50 years, most New Jersey residents have been paying twice for schools — property taxes for their local schools and income taxes for someone else’s schools.

Starting to get the picture on why New Jersey’s overall tax burden is the highest in the nation?

Some are requesting more aid in order to keep New Jersey’s school system “the best in the nation.” The request is specious considering the schools currently receiving the greatest amount of aid are failing. As for our system being the best in the nation, our top 30 districts skew the data significantly. Given the number of failing districts, we’re doing a great many students and families a huge disservice in making “the best” claim.

Two states whose demographics match up well with New Jersey are Maryland and Massachusetts. Like New Jersey, both states rank in the top five nationally in K-12 performance. Here’s the difference: according to the Education Data Initiative, each state spends $3,000 less per student in state aid than New Jersey. If our aid was on par with Maryland and Massachusetts, the savings would be $4 billion.

The reform we need must also address transparency and accountability. What’s happened in Newark since Gov. Phil Murphy gave back control to the local school board demonstrates why. Mind you, state aid to Newark schools exceeds $1 billion, which is 83% of that district's $1.2 billion budget (state aid is usually 10% to 20% of a local district’s budget). For Newark’s 38,000 students, that’s $26,000 per, which is significantly more than districts across the state.

Recently, the Newark School Board approved sending district employees to conferences in Las Vegas, New Orleans, Orlando, Atlanta, Palm Springs, Puerto Rico and Honolulu. School board members also attended conferences in San Diego and Miami. The board failed to provide any detail or educational justification for the trips.

In January, the school board secretly approved a new five-year contract for the superintendent. There was no opportunity whatsoever for public comment. Newark parents are rightfully upset, especially considering that only 13% of the district’s students are on grade level for math and just 27% for reading.

Sadly, Newark is not an outlier, just the most recent example of how the state doles out taxpayer money with no requirement or expectation for transparency, accountability, or, for that matter, results.

For these reasons and more, there is great demand for school choice in Newark, where the few charter schools are among the best performing in the nation. In fact, whenever a charter has opened or expanded in Newark, applications far exceed capacity, sadly sending some families home without a choice.

The most significant collateral damage of Murphy’s pandering to the teachers union, which fervently opposes charters, are the students and families in failing districts. While the governor has finally shown signs of relenting in his opposition to charters, during his first five years in office he has approved only one new charter school in Paterson. Perhaps the governor should speak with the Democratic governors of New York and Pennsylvania, both of whom wholly support school choice.

When it comes to school funding, what’s happening in New Jersey is unconstitutional and terribly unfair to thousands of students and families. If we’re going to spend $4 billion more in state aid than comparable states, let’s turn around failing districts by investing in charters and providing school choice.

Murphy’s fifth budget address is coming up. It provides yet another opportunity to do right by students and families in failing school districts. Yet another opportunity to reform a broken school funding system and, in so doing, lower our tax burden over the long term.

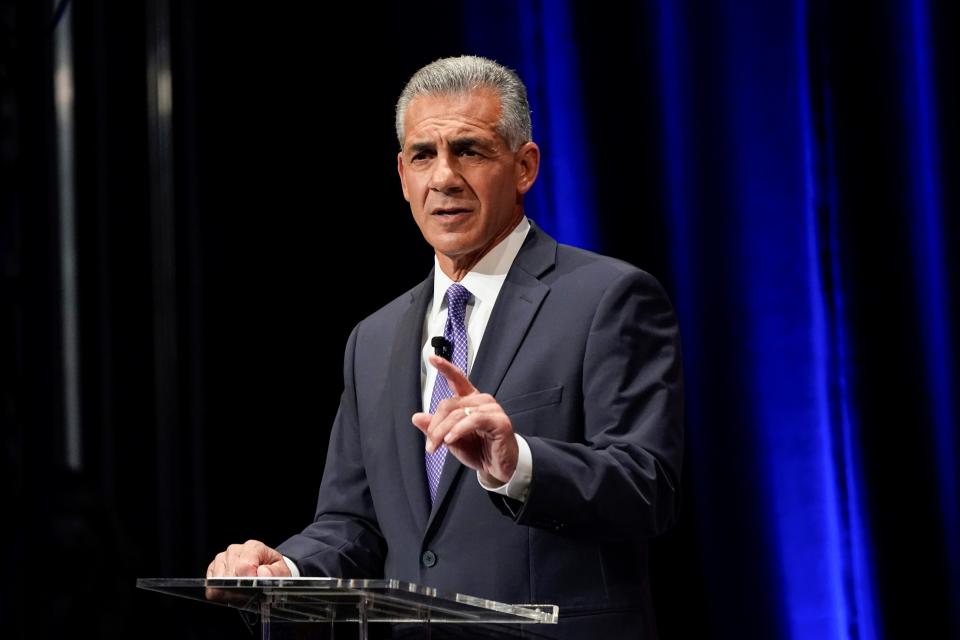

Jack Ciattarelli, the 2021 Republican nominee for New Jersey governor and a likely 2025 gubernatorial candidate, is a regular contributor to the opinion pages of USA TODAY Network New Jersey publications.

This article originally appeared on NorthJersey.com: NJ property taxes school funding formula