'No clue how it works': Little-understood property tax rule can save homebuyers thousands

South Florida’s housing market is at a stalemate caused, in part, by would-be home sellers who are loath to give up their low interest rates, and have an aversion to upsizing a property tax bill that has been capped by a homestead exemption.

That’s left fewer homes on the market for sale, lofty prices and a building pent-up demand.

But a little known, and even less understood, statewide canon approved 15 years ago could assuage some monetary concerns by reducing one of the market barriers — the real estate tax burden of buying a new home.

Florida’s Save Our Homes rule allows a homeowner with a homesteaded property to transfer some, or all, of their tax benefit to a new home that also qualifies for a homestead exemption.

How high can they go?: June home sales break another price record as Palm Beach County housing inventory is choked

The benefit is called “portability,” and it can save a homebuyer thousands of dollars in property taxes by reducing the assessed value of the newly purchased house.

“We get more questions about portability than anything else. It’s one of the more complicated property tax benefits,” said Palm Beach County Property Appraiser Dorothy Jacks. “People have heard of it, but don’t know exactly how it works.”

How does portability work?

Portability only applies to homesteaded properties, which are considered a person’s primary permanent residence. Because a homesteaded property’s taxes cannot increase more than 3% each year, a difference builds up over time between the market value of a home and its assessed value.

A home's market value is the property appraiser’s estimate of what it would sell for. The assessed value is what is capped at 3% and what taxes are based on.

Instead of paying taxes on the full value of a new home, a buyer can transfer some of the lower assessed value to their new home, reducing their tax bill. The reduction in value is capped at $500,000.

“It’s a complicated formula that you need Albert Einstein to explain,” said Jeff Lichtenstein, president of the Palm Beach Gardens-based Echo Fine Properties. “But it’s a big deal, and it lets people move.”

The amount of portability a buyer can transfer is simple math ― the market value of the home being sold minus its assessed value.

Can't touch this: Top 5 priciest home sales last month in Palm Beach County's luxury real estate market

For example, if the market value of your previous home was $450,000, but the assessed value was $250,000, then the assessed value of your new home will be reduced by $200,000. The 3% cap would continue from that reduced assessed value.

“For many of our buyers, it’s the first time they’ve heard about it," said Keller Williams Realtor Steve Shepherd about portability. “We make sure they know about it, but I have no clue how it works.”

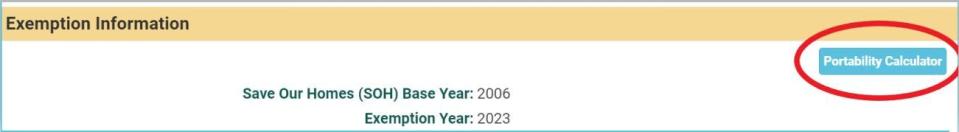

There is a portability calculator on the Palm Beach County Property Appraiser’s website. It can be found on the individual property detail page under "exemption information." (For more help, contact the property appraiser's portability office at 561-355-2866.)

Can savings from using portability offset an interest rate increase?

It’s unlikely the money saved from using portability will offset the increases in borrowing rates, which have jumped from 2.8% on a 30-year-fixed mortgage in early September 2021 to 7.1% on Sept. 7, 2023, according to Freddie Mac.

In 2022, the average portability savings in Palm Beach County was $76,178. That means the average tax savings per property was $1,392, according to the property appraiser's office.

Florida Realtors Chief Economist Brad O'Connor estimated that the average potential portability benefit for all currently homesteaded properties could be as high as $4,800 a year, depending on the local millage rate.

"That’s not going to offset the recent rise in mortgage rates, but it’s nothing to sneeze at, either," said O'Connor.

Want to get The Dirt?

Stay up to date on South Florida's sizzling real estate market and sign up for The Dirt weekly newsletter, delivered every Tuesday! Exclusively for Palm Beach Post subscribers.

Florida Atlantic University housing economist Ken H. Johnson said there would be more gains in getting the market moving from insurance reforms, but that portability is still an incentive that removes one barrier.

“A lot of people would be more willing to sell if they knew they wouldn’t be paying as much in taxes,” Johnson said. “Most people move up, and that provides starter homes for first-time homebuyers.”

Why Florida started allowing for portability

In 1992, an amendment to the state constitution capped the increase in the taxable value of a homesteaded property at 3% a year.

By the early 2000s, a real-estate boom skyrocketed home values. Homeowners felt trapped because if they sold their home to buy a new one, they would lose their lower assessed value and pay taxes on the full value of a new property.

“People weren’t moving,” Jacks said. “Even if you were downsizing, your taxes were going to go through the roof compared to what you were paying.”

In 2008, voters approved a new amendment allowing for portability. It went into effect in 2009.

At about the same time, lax lending standards and excess inventory led to a massive crash in the housing market.

“The tax values plummeted, everyone was moving, and portability didn’t mean anything then,” Lichtenstein said.

Jacks said people began using it again around 2012. During the 2023 tax year, the portability provision was used in nearly 11,000 transactions by people moving into, out of, or within Palm Beach County. Because it’s statewide, it can be used in any county.

Should the $500,000 portability cap be increased?

The value reduction limit of $500,000 has not changed since the portability rule was approved.

John McDonald, owner of the Palm Beach Gardens-based Property Tax Professionals, is in favor of increasing the cap because it's become more frequent for people to hit the $500,000 limit with the fast appreciation in values over the past few years.

But increasing the cap isn't a local issue, and would have to be addressed at the state level.

He’s also concerned that it’s difficult for people to lobby for a higher market value on the home they are selling so as to maximize their portability. To do that, they have to continue to own the property or get the buyer's permission to argue up the value.

“As these difficulties are not on a local county level, I feel there is needed work to be done with the state Legislature in working toward a fair resolution for taxpayers," McDonald said.

Shrinkage: Palm Beach County developer offers smaller, cheaper homes after interest rates dent budgets

When should you file for portability?

Homeowners should file for their portability benefit when they file for their new homestead exemption. Owners have technically three tax years — two calendar years — to claim their benefit.

"We make sure when people file for homestead that we ask them if they've owned a home in Florida before," Jacks said. "If you say yes, we have you sign the portability application right there and then we do the back-end work."

Kimberly Miller is a veteran journalist for The Palm Beach Post, part of the USA Today Network of Florida. She covers real estate and how growth affects South Florida's environment. Subscribe to The Dirt for a weekly real estate roundup. If you have news tips, please send them to kmiller@pbpost.com. Help support our local journalism, subscribe today.

This article originally appeared on Palm Beach Post: 'Portability' tax exemption can save Florida homeowners big money