Norfolk Southern (NSC) Launches Operating Plan to Foster Growth

Norfolk Southern Corporation NSC has launched a new operating plan — TOP|SPG — aimed at improving service, productivity and growth. The plan, which is an extension of the company’s previous operating plan — TOP21 — caters to the movement of trains and shipments through NSC’s network.

The TOP|SPG plan stands for Thoroughbred Operating Plan|Service Productivity Growth. The operating plan is expected to better serve the evolving needs of customers and meet customer demand.

One of the primary objectives of NSC in developing the TOP|SPG operating plan was to provide consistent service. Under the operating plan, shipments will be transported more directly across NSC’s network, i.e, one-market origin to one-market termination. Thanks to a balanced network flow, shipments are less likely to face hindrances at choke points. This new operating plan aims to effectively serve customers while being nimble to cater to volume growth in future.

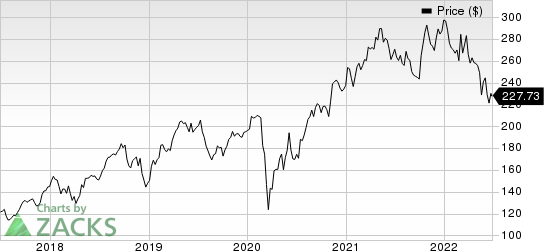

Norfolk Southern Corporation Price

Norfolk Southern Corporation price | Norfolk Southern Corporation Quote

While Norfolk Southern’s TOP21 operating plan was focused on Merchandise and Bulk segments, the TOP|SPG plan is focused on the Intermodal unit.

NSC’s CEO and president, Alan H. Shaw said, "Our robust hiring efforts, coupled with TOP|SPG, will enhance our overall service recovery. Everyone at Norfolk Southern is focused on bringing our service product to a level our customers expect, and TOP|SPG gives us additional alignment, while boosting productivity and creating a pathway for future growth.”

Zacks Rank & Other Key Picks

Norfolk Southern carries a Zacks Rank #2 (Buy).

Some other stocks within the broader Transportation sector that investors can consider are as follows:

Eagle Bulk Shipping EGLE sports a Zacks Rank #1 (Strong Buy). The company has a pleasant earnings surprise history, having outperformed the Zacks Consensus Estimate in two of the preceding four quarters while missing in the other two. You can see the complete list of today's Zacks #1 stocks here.

Shares of Eagle Bulk have gained more than 4% in the year-to-date period.

Capital Product Partners CPLP carries a Zacks Rank #1. The company has an impressive earnings surprise history, having outperformed the Zacks Consensus Estimate in three of the preceding four quarters while missing in one.

Shares of Capital Product Partners have rallied more than 27% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Norfolk Southern Corporation (NSC) : Free Stock Analysis Report

Eagle Bulk Shipping Inc. (EGLE) : Free Stock Analysis Report

Capital Product Partners L.P. (CPLP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research