Would Northern Bitcoin (FRA:NB2) Be Better Off With Less Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Northern Bitcoin AG (FRA:NB2) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Northern Bitcoin

What Is Northern Bitcoin's Debt?

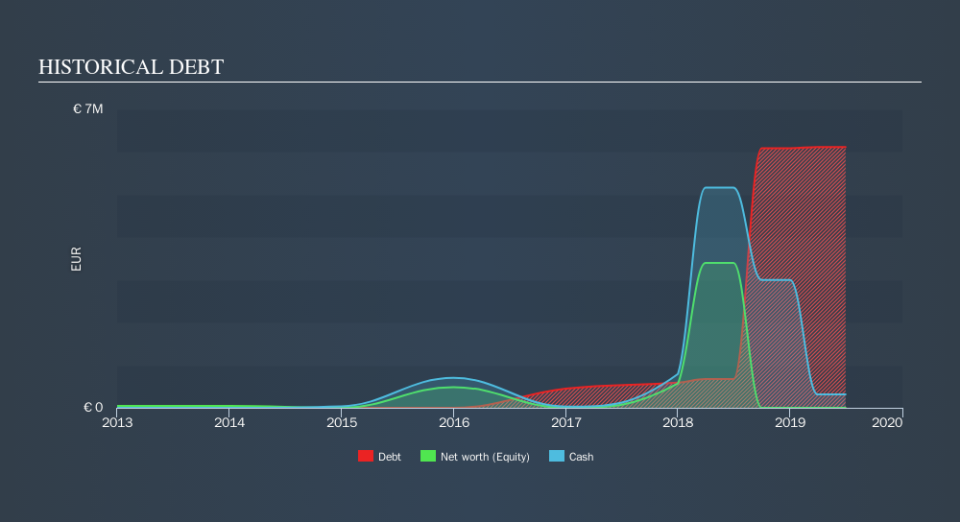

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Northern Bitcoin had €6.12m of debt, an increase on €673.1k, over one year. On the flip side, it has €313.3k in cash leading to net debt of about €5.80m.

How Strong Is Northern Bitcoin's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Northern Bitcoin had liabilities of €3.73m due within 12 months and liabilities of €6.12m due beyond that. Offsetting these obligations, it had cash of €313.3k as well as receivables valued at €10.8k due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €9.53m.

Of course, Northern Bitcoin has a market capitalization of €84.8m, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Northern Bitcoin's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Northern Bitcoin reported revenue of €2.9m, which is a gain of 159%, although it did not report any earnings before interest and tax. So there's no doubt that shareholders are cheering for growth

Caveat Emptor

While we can certainly savour Northern Bitcoin's tasty revenue growth, its negative earnings before interest and tax (EBIT) leaves a bitter aftertaste. To be specific the EBIT loss came in at €7.6m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. We would feel better if it turned its trailing twelve month loss of €7.7m into a profit. So to be blunt we do think it is risky. For riskier companies like Northern Bitcoin I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.