NoVA Housing Forecast: Will 2022 Bring Another Sellers' Market?

VIRGINIA — Prices of homes in Northern Virginia and Washington, D.C., will continue to rise in 2022, but at a slower pace than in the past 18 months, according to real estate market experts.

The D.C. area’s economy is expected to continue to perform well — even if the COVID-19 pandemic remains a concern deep into 2022 — bolstered by its built-in competitive advantages such as its well-entrenched technology sector and new spending programs by the federal government that will benefit many workers in the region.

Since the start of the pandemic in March 2020, the residential real estate market in Northern Virginia has defied expectations, according to Ryan McLaughlin, CEO of the Northern Virginia Association of Realtors.

“Who would have imagined that in the midst of pandemic conditions that brought the economy to a near standstill, the housing market would not just survive, but it would thrive,” McLaughlin said during a Dec. 16 online briefing with reporters to announce the release of the association’s 2022 market forecast.

Amazon’s growing presence at its second headquarters campus in Arlington also will help to keep the region’s economy from slipping into a slump. “The influx of new jobs provided, and still to come, by Amazon has created a ripple effect that benefits the region,” he said.

With high-wage sectors of the economy continuing to have more openings than workers, many households will gain confidence in making major purchases such as homes, according to the 2022 market forecast, released by NVAR in conjunction with the Center for Regional Analysis at George Mason University.

Upward pressure on mortgage rates in 2022, though, could make the market too expensive for some potential buyers. And inflation pressures during the first half of 2022 could make it even harder for many to afford homes in the region, according to the forecast.

Rob Traister, a Realtor and Associate Broker with RE/MAX 100, who is licensed in Virginia and Maryland, recalls that when the pandemic hit in March 2020, some real estate agents assumed the residential market would tank.

“Those of us who hung in there to serve our clients had a good year. I did more than twice as much business in 2020 as I did in 2019, and I’ve done 30 percent more in 2021 than in 2020,” Traister said in an interview with Patch.

Many people were doing everything — work, school, recreation — from home and if their house wasn't meeting their needs, they went looking for a new place to live, Traister said.

Get Ready For A Competitive 2022

For the buyers he worked with in 2020 and 2021, Traister said he prepared them to lose out on a few offers before getting a home under contract.

"With so much competition, that was almost inevitable. The lenders I work with know that a quick closing is key in this market, so my offers usually emphasize a quick closing — 21 days or fewer — with as few contingencies as possible,” he said. “When we can, I recommend buyers have pre-offer inspections done, so there’s no need for a home inspection contingency with the offer.”

With demand for homes still higher than the supply, it will continue to be a sellers’ market in 2022, according to Traister, although the region probably will not see prices rising as much or as fast as they have the past two years.

"In 2022 things will level off a bit as inventory starts catching up with demand, but home prices are still expected to increase about 5.5 percent," he said. "That’s assuming nothing unexpected occurs over the course of the next year, and if the past two years have taught us anything, it’s to be prepared for the unexpected."

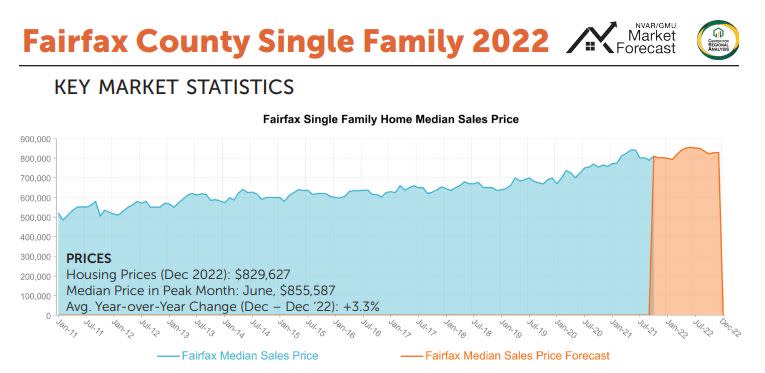

Looking at the largest jurisdiction in the region, sale prices for single family homes in Fairfax County are expected to continue to rise in 2022. The number of homes in the county put up for sale will drop from 2021 to a new 10-year low, according to the NVAR forecast.

In Arlington County, the number of sales is expected to rise slightly, despite a smaller inventory of houses for sale than in 2020. And sellers are likely to get their asking price, unless the home is far overpriced.

Statewide, buyer demand remains high. In total, there were 12,134 home sales in Virginia in November, which is up 3.7 percent from the same time in 2020.

“The housing market remains very resilient in Virginia,” said Virginia Realtors Chief Economist Lisa Sturtevant. “There are some headwinds — including the rise in omicron cases and the potential for interest rate hikes — but most signs point to continued strong demand in the months to come.”

The statewide average sold-to-list price ratio in November was 100.6 percent across Virginia. This means that on average, homes that sold in Virginia closed at a price that was 0.6 percent higher than the asking price. Also, the November statewide average days on market was 26 days, five days faster than this time last year.

Be Ready To Jump, But Avoid Bad Deals

For first-time homebuyers, 2022 will be a struggle to find an affordable home in many parts of the nation. The limited number of homes for sale and rising mortgage rates are pushing costs higher across the nation, according to Realtor.com's "2022 Housing Market Forecast and Predictions: A Whirlwind Year."

"Homeowners who are ready to sell in 2022 are in a good position," Realtor.com said in its forecast. "Even as for-sale inventory begins to grow ... well-priced homes in good condition will continue to sell quickly in many markets. And for sellers who have owned their homes for a while, this will likely mean that they walk away from the transaction with a healthy amount of cash."

For the D.C. metropolitan region, the number of home sales is expected to increase by 5.6 percent over 2021 and home sale prices are forecast to rise by 3.8 percent, according to Realtor.com's forecast.

"If you want to buy a home, you’re going to have to compete for it,” Dr. Terry Clower, professor of public policy at George Mason University and director of the GMU Center for Regional Analysis, said about the Fairfax, Arlington and Alexandria residential real estate markets during the Dec. 16 NVAR briefing. “If you want to sell a home, you’ll get everything you are asking for it.”

In 2022, first-time homebuyers should be looking as early as possible to avoid the likely rise in interest rates as the year progresses, Clower said.

"But be patient, too," he cautioned. "Don't jump at a bad deal."

For sellers, the timing of when to put their homes on the market depends on their needs.

Traister said he has clients planning to list their homes right after the holidays. "I expect those homes to sell quickly at above listing price," he said. "Other clients are planning moves in the spring and summer, so we’ll continue to monitor market conditions and list those homes at a time that works for the sellers."

"If we’re just talking hypotheticals, I wouldn’t hesitate to list in January," Traister added. "Interest rates may tick up a little as we get into the new year, but even then they’re still historically low."

This article originally appeared on the Falls Church Patch