Is Now The Time To Put Axiom Properties (ASX:AXI) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Axiom Properties (ASX:AXI), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Axiom Properties

Axiom Properties's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Axiom Properties has grown EPS by 13% per year. That's a good rate of growth, if it can be sustained.

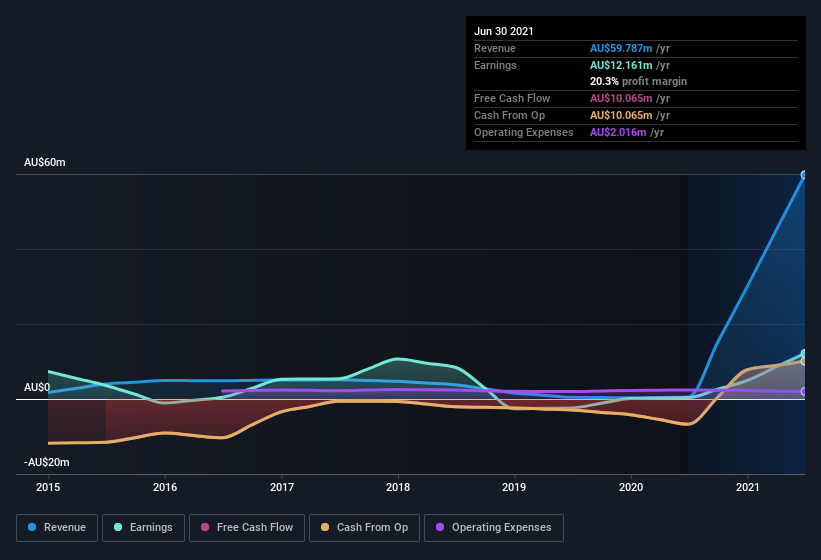

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Axiom Properties shareholders can take confidence from the fact that EBIT margins are up from 3.9% to 18%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Axiom Properties isn't a huge company, given its market capitalization of AU$41m. That makes it extra important to check on its balance sheet strength.

Are Axiom Properties Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Axiom Properties top brass are certainly in sync, not having sold any shares, over the last year. But my excitement comes from the AU$70k that MD & Executive Director Benjamin Laurance spent buying shares (at an average price of about AU$0.07).

Does Axiom Properties Deserve A Spot On Your Watchlist?

As I already mentioned, Axiom Properties is a growing business, which is what I like to see. While some companies are struggling to grow EPS, Axiom Properties seems free from that morose affliction. The cherry on top is that we have an insider buying shares. That encourages me further to keep an eye on this stock. However, before you get too excited we've discovered 4 warning signs for Axiom Properties (1 shouldn't be ignored!) that you should be aware of.

The good news is that Axiom Properties is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.