Is Now The Time To Put Bell Financial Group (ASX:BFG) On Your Watchlist?

- Oops!Something went wrong.Please try again later.

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Bell Financial Group (ASX:BFG). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Bell Financial Group

How Fast Is Bell Financial Group Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. As a tree reaches steadily for the sky, Bell Financial Group's EPS has grown 18% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

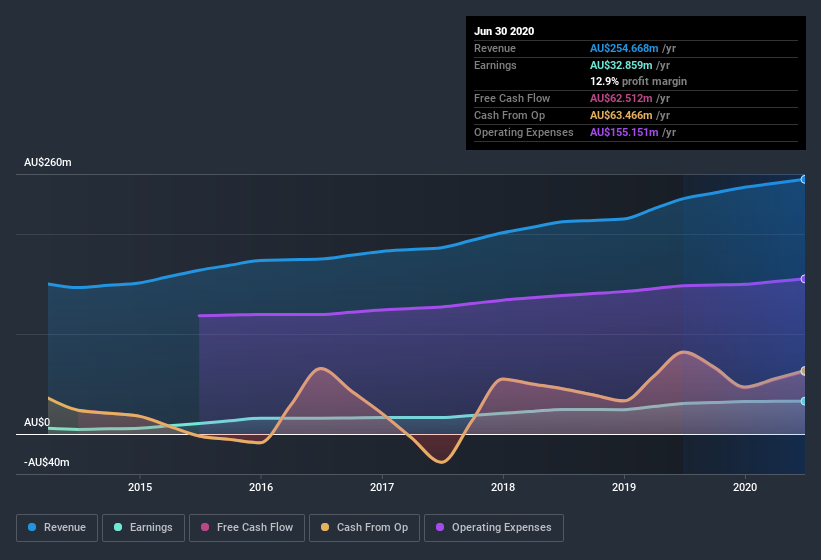

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Bell Financial Group's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Bell Financial Group maintained stable EBIT margins over the last year, all while growing revenue 8.2% to AU$255m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Bell Financial Group's balance sheet strength, before getting too excited.

Are Bell Financial Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The first bit of good news is that no Bell Financial Group insiders reported share sales in the last twelve months. But the really good news is that Executive Chairman & MD Alastair Provan spent AU$368k buying stock stock, at an average price of around AU$1.23. Big buys like that give me a sense of opportunity; actions speak louder than words.

Along with the insider buying, another encouraging sign for Bell Financial Group is that insiders, as a group, have a considerable shareholding. To be specific, they have AU$61m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 10% of the company; visible skin in the game.

Is Bell Financial Group Worth Keeping An Eye On?

You can't deny that Bell Financial Group has grown its earnings per share at a very impressive rate. That's attractive. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. Still, you should learn about the 2 warning signs we've spotted with Bell Financial Group .

As a growth investor I do like to see insider buying. But Bell Financial Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.