Is Now The Time To Put Everyman Media Group (LON:EMAN) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Everyman Media Group (LON:EMAN). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for Everyman Media Group

Everyman Media Group's Improving Profits

Over the last three years, Everyman Media Group has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, Everyman Media Group's EPS soared from UK£0.021 to UK£0.029, in just one year. That's a impressive gain of 41%.

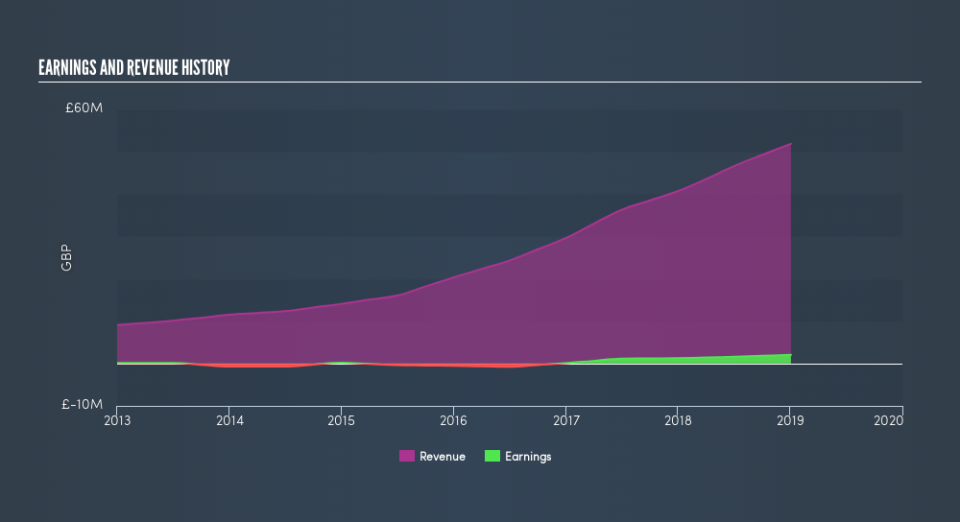

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Everyman Media Group's EBIT margins were flat over the last year, revenue grew by a solid 27% to UK£52m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Everyman Media Group isn't a huge company, given its market capitalization of UK£138m. That makes it extra important to check on its balance sheet strength.

Are Everyman Media Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While Everyman Media Group insiders did net -UK£1.1m selling stock over the last year, they invested UK£1.3m, a much higher figure. On balance, to me, this signals their optimism. Zooming in, we can see that the biggest insider purchase was by Non-Executive Director Charles Dorfman for UK£889k worth of shares, at about UK£2.02 per share.

The good news, alongside the insider buying, for Everyman Media Group bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a small fortune of shares, currently valued at UK£45m, they have plenty of motivation to push the business to succeed. At 33% of the company, the co-investment by insiders gives me confidence that management will make long-term focussed decisions.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Crispin Lilly, is paid less than the median for similar sized companies. For companies with market capitalizations between UK£79m and UK£314m, like Everyman Media Group, the median CEO pay is around UK£517k.

The Everyman Media Group CEO received UK£343k in compensation for the year ending January 2019. That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Everyman Media Group To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Everyman Media Group's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing Everyman Media Group's ROE with industry peers (and the market at large).

As a growth investor I do like to see insider buying. But Everyman Media Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.