Is Now The Time To Put Fortescue Metals Group (ASX:FMG) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Fortescue Metals Group (ASX:FMG). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Fortescue Metals Group

Fortescue Metals Group's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud Fortescue Metals Group's stratospheric annual EPS growth of 48%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

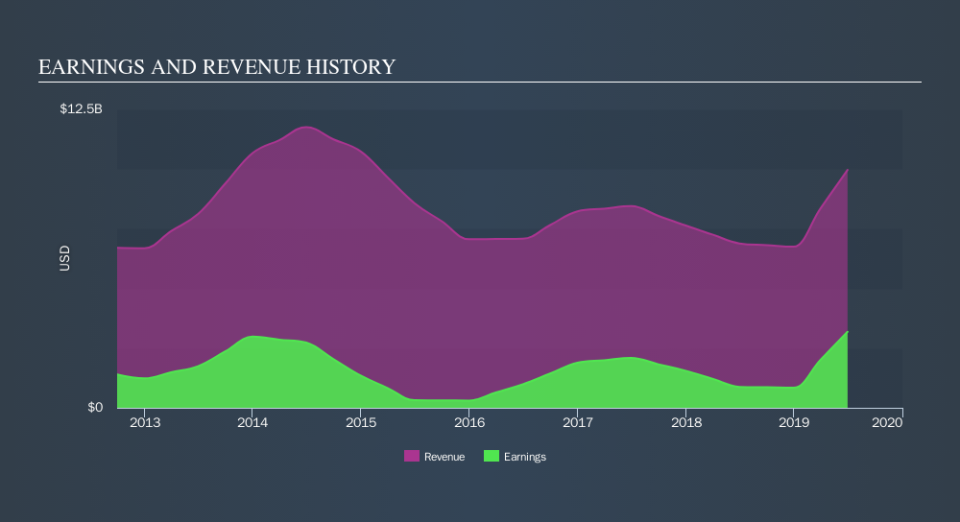

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Fortescue Metals Group is growing revenues, and EBIT margins improved by 20.5 percentage points to 47%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Fortescue Metals Group?

Are Fortescue Metals Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for Fortescue Metals Group is the serious outlay one insider has made to buy shares, in the last year. In one fell swoop, Founder & Chairman of the Board John Andrew Forrest, spent AU$23m, at a price of AU$3.95 per share. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

The good news, alongside the insider buying, for Fortescue Metals Group bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enormous stake in the company, worth US$254m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Elizabeth Gaines is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations over AU$12b, like Fortescue Metals Group, the median CEO pay is around AU$5.6m.

The Fortescue Metals Group CEO received US$5.0m in compensation for the year ending June 2019. That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Fortescue Metals Group To Your Watchlist?

Fortescue Metals Group's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Fortescue Metals Group deserves timely attention. If you think Fortescue Metals Group might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

The good news is that Fortescue Metals Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.