Is Now The Time To Put Harvey Norman Holdings (ASX:HVN) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Harvey Norman Holdings (ASX:HVN). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Harvey Norman Holdings

How Fast Is Harvey Norman Holdings Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Harvey Norman Holdings has managed to grow EPS by 18% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

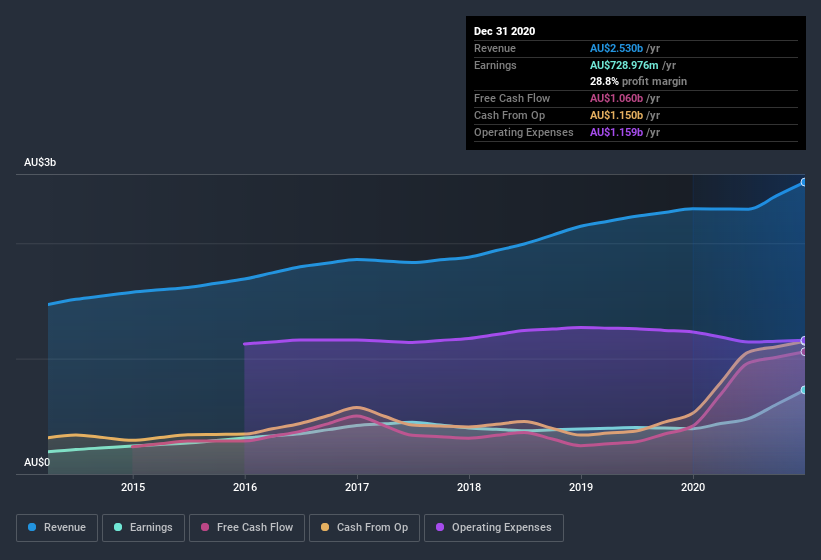

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Harvey Norman Holdings shareholders can take confidence from the fact that EBIT margins are up from 23% to 41%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Harvey Norman Holdings's future profits.

Are Harvey Norman Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's a pleasure to note that insiders spent AU$3.1m buying Harvey Norman Holdings shares, over the last year, without reporting any share sales whatsoever. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the Co-Founder, Gerald Harvey, who made the biggest single acquisition, paying AU$1.0m for shares at about AU$4.45 each.

On top of the insider buying, we can also see that Harvey Norman Holdings insiders own a large chunk of the company. In fact, they own 41% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. At the current share price, that insider holding is worth a whopping AU$2.7b. Now that's what I call some serious skin in the game!

Is Harvey Norman Holdings Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Harvey Norman Holdings's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. We should say that we've discovered 2 warning signs for Harvey Norman Holdings (1 shouldn't be ignored!) that you should be aware of before investing here.

The good news is that Harvey Norman Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.