NRG Energy (NRG) Posts Q4 Loss Against Earnings Estimates

NRG Energy, Inc. NRG posts fourth-quarter 2020 loss of 53 cents per share from continuing operations against the Zacks Consensus Estimate of earnings of 37 cents. Also, the bottom line compares unfavorably with earnings of 54 cents in the year-ago quarter.

Revenues

NRG Energy’s quarterly revenues came in at $2,027 million, down 7.7% year over year. Also, its 2020 revenues amounted to $9,093 million, down 7.4% from the prior year’s figure.

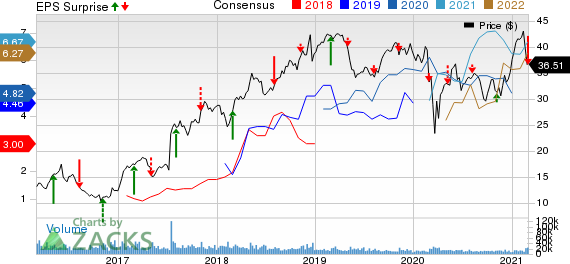

NRG Energy, Inc. Price, Consensus and EPS Surprise

NRG Energy, Inc. price-consensus-eps-surprise-chart | NRG Energy, Inc. Quote

Highlights of the Release

Fourth-quarter adjusted EBITDA was $330 million compared with $384 million in the year-ago quarter.

The company’s total operating costs and expenses in 2020 amounted to $7,991 million, down 6.4% from $8,538 million in 2019. The upside can be attributed to lower cost of operations.

Operating income in 2020 was $1,105 million, down 14.3% from $1,290 million in 2019. Interest expenses of $401 million dropped 2.9% from prior year’s tally of $413 million.

Financial Highlights

As of Dec 31, 2020, the company had cash and cash equivalents worth $3,905 million compared with $345 million as of Dec 31, 2019.

As of Dec 31, 2020, the company’s long-term debt amounted to $8,691 million compared with $5,803 million as of Dec 31, 2019.

The company’s cash provided by continuing operations in 2020 was $1,837 million compared with $1,405 million generated in 2019.

Capital expenditures in 2020 were $230 million compared with $228 million in 2019.

Guidance

The company maintained 2021 adjusted EBITDA view in the range of $2,400-$2,600 million. It expects 2021 free cash flow before growth investments in the band of $1,440-$1,640 million.

Zacks Rank

NRG Energy has a Zacks Rank #3 (Hold), currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Utility Releases

NextEra Energy, Inc. NEE reported fourth-quarter 2020 adjusted earnings of 40 cents per share, which beat the Zacks Consensus Estimate of 39 cents by 2.6%.

Xcel Energy Inc. XEL posted fourth-quarter 2020 operating earnings of 54 cents per share, inline with the Zacks Consensus Estimate.

WEC Energy Group WEC delivered fourth-quarter 2020 earnings per share of 76 cents, which surpassed the Zacks Consensus Estimate of 74 cents by 2.7%.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

NRG Energy, Inc. (NRG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research