Nu Skin (NUS) Down More Than 10% in 6 Months: Here's Why

Nu Skin Enterprises, Inc. NUS has been bearing the brunt of global uncertainties like rising pandemic-related factors, unfavorable currency rates and geopolitical conflicts. The developer and distributor of beauty and wellness products lowered its guidance for 2022 when it reported first-quarter results. Also, its view for the second quarter suggests a year-over-year decline in the top and bottom lines.

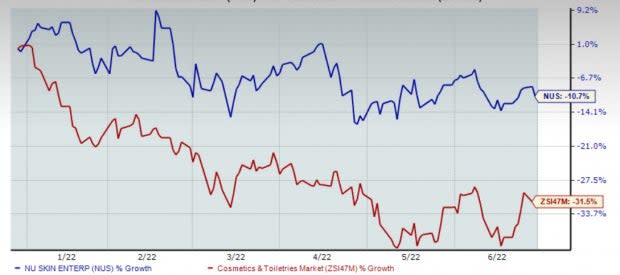

Shares of this Zacks Rank #4 (Sell) company have dropped 10.7% in the past six months compared with the industry’s decline of 31.5%. Let’s take a closer look at the factors marring Nu Skin’s performance.

Image Source: Zacks Investment Research

Nu Skin Not in Great Shape

Nu Skin delivered first-quarter 2022 results, wherein the top and the bottom line declined year over year. Revenues of $604.9 million fell 11% year over year on a reported basis. Revenues included a negative impact of 3% from foreign currency fluctuations. On a constant-currency (cc) basis, revenues declined 8%. NUS reported quarterly earnings of 76 cents per share, down 16% from the 91 cents per share reported in the year-ago quarter. Sales leaders were down 22% year over year to 52,462. Nu Skin’s customer base dropped 13% to 1,321,451. The company’s paid affiliates were down 14% to 251,436.

Nu Skin highlighted that the quarterly performance was hurt by pandemic-led lockdowns and other factors across Mainland China. The situation in Ukraine hampered the company’s performance in the EMEA. The company suspended its operations in Russia and Ukraine. In the Americas, strength in U.S. operations was countered by macroeconomic headwinds in Latin America.

In the first quarter, the gross profit of $443.4 million declined from the $506.5 million reported in the year-ago period. The gross margin contracted year over year from 74.8% to 73.3%. The downside can be attributed to a product mix and promotions. Nu Skin business’ gross margin contracted to 76.5% from 77.8%. The operating income of $52.1 million declined from $62.9 million in the year-ago quarter. The operating margin was 8.6%, down from the 9.3% reported in the year-ago quarter.

Nu Skin’s strong international presence exposes it to the risk of volatile currency movements. Any adverse currency fluctuation is likely to weigh on the company’s operating performance. In the first quarter of 2022, revenues included a negative impact of 3% from foreign currency fluctuations. NUS envisions an unfavorable currency impact of 3-4% on revenues in 2022.

Nu Skin Enterprises, Inc. Price, Consensus and EPS Surprise

Nu Skin Enterprises, Inc. price-consensus-eps-surprise-chart | Nu Skin Enterprises, Inc. Quote

Unimpressive View

Management revised its 2022 revenue and earnings guidance downward considering global uncertainties like rising pandemic-related factors, unfavorable currency rates and geopolitical conflicts. The company now anticipates 2022 revenues in the range of $2.51-$2.62 billion, calling for a 3-7% decline from the year-ago period’s reported figure. The company had earlier anticipated revenues in the range of $2.66-$2.77 billion, calling for a 1% decline to 3% growth from the year-ago period’s reported figure. Management now expects 2022 earnings per share (EPS) in the range of $3.60-$3.90, indicating an increase of 26-36% on a reported basis. The metric is expected to fall 6-13% on an adjusted basis. Earlier, management expected the EPS in the range of $4.05-$4.45.

For the second quarter of 2022, the company projects revenues in the band of $590-$620 million, which suggests a 12-16% decline from the year-ago quarter’s level. The company’s quarterly EPS is anticipated between 75 and 85 cents, indicating a 26-35% slump from the year-ago quarter’s levels.

While a focus on product launches, investments in the digital platform and the empowerment of sales leaders have been upsides, we cannot ignore the abovementioned factors for the near term. The Zacks Consensus Estimate for the 2022 EPS has declined from $4.29 per share to $3.80 over the past 60 days.

3 Solid Staple Stocks

Some better-ranked stocks are Sysco Corporation SYY, Pilgrim’s Pride PPC and Campbell Soup CPB.

Sysco, which engages in marketing and distributing various food and related products, sports a Zacks Rank #1 (Strong Buy). Sysco has a trailing four-quarter earnings surprise of 9.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for SYY’s current financial-year sales and EPS suggests growth of 32.6% and 124.3%, respectively, from the year-ago reported number.

Pilgrim’s Pride, which produces, processes, markets and distributes fresh, frozen and value-added chicken and pork products, carries a Zacks Rank #2 (Buy). Pilgrim’s Pride has a trailing four-quarter earnings surprise of 31.4%, on average.

The Zacks Consensus Estimate for PPC’s current financial-year EPS suggests growth of almost 43% from the year-ago reported number.

Campbell Soup, which manufactures and markets food and beverage products, currently carries a Zacks Rank #2. Campbell Soup has a trailing four-quarter earnings surprise of 10.8%, on average.

The Zacks Consensus Estimate for CPB’s current financial-year sales suggests growth of 0.5% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC) : Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research