All the Numbers You Need To Know for Your 2020 Taxes

Everybody knows when Tax Day lands in April. But the 15th is hardly the only number that matters when you’re figuring out how much money you owe the government or, hopefully, how much money the government owes you back. Taxes are all about numbers. How much income did you earn? What percentage of that income can be taxed? At what rate? How much have you already paid? How much is still owed or needs to be refunded?

Related: What Are the 2020-2021 Federal Tax Brackets and Tax Rates?

In order to answer those questions and more, people need to consider and calculate all kinds of numbers when tax season rolls around. The following is a list of 10 of the most important numbers that you’ll need to know now that it’s officially that time of year again. Understanding them is the key to maximizing the only two numbers that really matter: how much of your money you get to keep and how much you have to turn over to the taxman.

Last updated: Jan. 20, 2021

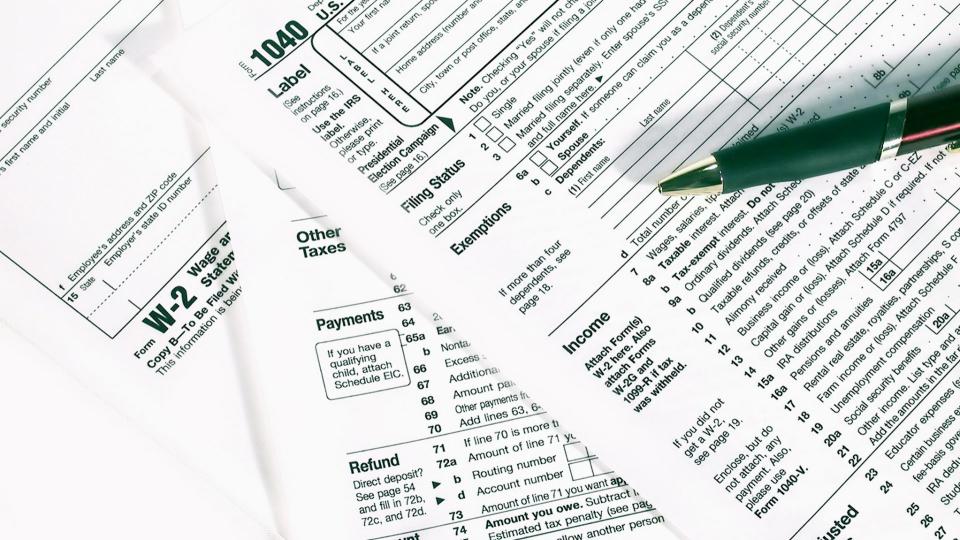

5: Number of Filing Statuses

Just like last year, you’ll fall into one of five filing status categories no matter your income and no matter your tax bracket. That classification will determine the rate you’ll pay depending on your income. The five statuses are:

Single

Married filing jointly

Married filing separately

Head of household

Qualifying widow(er) with dependent child

Find Out: Tax Year Deadline Dates You Need To Know

7: Number of Tax Brackets

Your specific tax bracket also figures into the rate you’ll pay based on your income. The more money you earn, the greater percentage is taxed. There are seven tax brackets this year, the same as there were in 2020 when filing for tax year 2019. The single/joint 2020 tax brackets are:

12% for incomes over $9,875/$19,750

22% for incomes over $40,125/$80,250

24% for incomes over $85,525/$171,050

32% for incomes over $163,300/$326,600

35% for incomes over $207,350/$414,700

37% for incomes over $518,400/$622,050

Read More: 8 New or Improved Tax Credits and Breaks for Your 2020 Return

21: Number of Days Until Refunds Arrive

The IRS issues more than 90% of all refunds within 21 days of accepting a taxpayer’s returns. Direct deposit is the fastest and safest way to get your money — the IRS urges everyone to sign up, which about 80% of American taxpayers already have. If three weeks pass without your refund arriving, use the IRS’ “Where’s My Refund?” tool to check the status.

Related: All the New Numbers You Need To Know for Planning Ahead on Taxes

$2,874: Amount of the Average Refund

In 2020, the average tax refund was just a few dollars less than the $2,888 average refund from 2019. The IRS issued nearly 103 million refunds in total, about 85.33 million of which were via direct deposit. In total, the IRS refunded more than $245 billion to its rightful owners.

Find Out: The Answers to Top Questions During Tax Season

$2,000: Maximum Child Tax Credit

You can take up to $2,000 for the Child Tax Credit for each qualifying child through age 17. Up to $1,400 of it is refundable, meaning you can receive that amount even if you don’t owe any tax. Dependents who don’t qualify can still get up to $500 each from the credit, which is fazed out at individual incomes over $200,000 or joint incomes over $400,000. Unlike a deduction, which reduces taxable income, the credit directly lowers your tax bill or increases your refund.

Read: What Can I Write Off on My Taxes?

$6,000: Maximum Earned Income Tax Credit

The Earned Income Tax Credit subsidizes low- and moderate-income taxpayers, particularly those with children. In 2020, the maximum credit for those who meet the income requirements but don’t have any qualifying children is $538. For those with three children, it goes all the way up to $6,660. The credit increases with each child and gets smaller gradually as incomes rise until the credit runs out altogether at each tier’s maximum income.

In the News: IRS Pushes Back Start of Tax Filing Season – Will It Delay Your Refund?

$12,400: Standard Deduction

Unlike tax credits that reduce your tax bill directly on a dollar-for-dollar basis, the standard deduction lowers the amount of your income that can be taxed in the first place. For individual filers, the standard deduction is $12,400 for tax year 2020, up $200 from last year. For married couples filing jointly, it’s $24,800, which is an increase of $400 over last year. You must choose between the standard deduction and itemized deductions.

Find Out: This Is Where Your Tax Dollars Actually Go

$300: Special 2020 Charity Deduction

One of the rare times you can take the standard deduction and still itemize is through a program new for 2020 that was designed to encourage charitable giving during COVID-19. Even those who took the standard deduction can write off up to $300 in cash donations made to charity before Dec. 31, 2020.

Read: 8 Stress-Free Ways To Meet the Tax Deadline

15.3%: Self-Employment Tax

Sole proprietors pay handsomely for the privilege of working for themselves. Payroll taxes fund Social Security and Medicare, with the employer and the worker each paying 6.2% and 1.45% toward those programs, respectively. Freelancers, independent contractors and other self-employed people have to contribute as both the employer and the employee, which doubles the rate. What’s known as the self-employment tax, therefore, is a bruising 15.3% tribute that must be paid to earn the right to work for yourself.

Did You Know: These Red Flags on Your 2020 Tax Return Could Spark Interest From the IRS

$72,900: Alternative Minimum Tax Threshold

The Alternative Minimum Tax exists to make sure that wealthier taxpayers kick in their fair share and aren’t able to use credits and deductions to lower their tax obligations below a certain threshold. For tax year 2020, that threshold is $113,400 for married couples filing jointly or $72,900 for single filers.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: All the Numbers You Need To Know for Your 2020 Taxes