NY's COVID unemployment fraud topped $11B, partly due to system failures. What happened?

State labor officials’ failure to replace New York’s long-troubled unemployment insurance system contributed to at least $11 billion in payments lost to fraud amid the COVID-19 pandemic’s first year.

That is among the striking findings of a state audit that slammed state Labor Department officials for leaving New York vulnerable to an historic wave of unemployment fraud from April 2020 to March 2021.

Among the findings:

The state made about 218 million traditional and temporary unemployment payments totaling over $76.3 billion, an increase of nearly 3,140% from the prior fiscal year.

Federal fraud rate estimates suggest at least $11 billion of those payments were lost to fraud, but the true amount is likely higher due to the systemic failures.

State officials did not heed warnings as far back as 2010 that the system was out of date, nor did they address issues identified in a 2015 state audit.

New York officials clashed over COVID unemployment audit

State labor officials refused to provide data that would have enabled auditors to calculate the precise amount of improper unemployment payments, Comptroller Thomas DiNapoli said in a statement.

Still, the audit findings show the agency’s antiquated system was ill-equipped to prevent pandemic fraud, he added.

“The agency resorted to stop-gap measures to paper over problems, and this proved to be costly to the state, businesses, and New Yorkers,” he said. “The department needs to recoup fraudulent payments and correct its mistakes.”

Meanwhile, the Labor Department asserted it prevented about $36 billion in fraudulent unemployment claims during the pandemic, but the agency “was unable to provide supporting documentation” to back up the estimate, DiNapoli noted.

USA TODAY Network reporting: Off the COVID unemployment backlog: Patience, and plenty of it, paid off

Business: NY businesses seek state help to cover rising costs from unemployment claims

How New York unemployment fraud impacts taxpayers

Taxpayers will assuredly be harmed by the massive unemployment fraud because the state borrowed from the federal government to support the pandemic-related surge in claims, DiNapoli noted.

New York had a loan balance that averaged $9.3 billion from September 2021 through April 2022. It now stands at about $8 billion, and the loan must be paid back with interest at the expense of New York’s employers, he added.

How New York unemployment fraud unfolded

One element of the fraud surge involved temporary unemployment programs created by the federal Coronavirus Aid, Relief, and Economic Security Act, or CARES Act.

These temporary federal benefits, with less stringent eligibility requirements, contributed to a dramatic increase in unemployment claims.

Labor officials repeatedly pointed to identity theft as the primary cause of fraud within the unemployment program, especially the temporary programs, the auditors noted.

But officials did not implement a critical system to stop identity theft, a program called ID.me, until February 2021, nearly a year after the temporary programs launched and after about 80% of UI claims had already been made, auditors added.

What the New York unemployment audit found

As pandemic job losses exploded, Labor Department officials compensated for the outdated unemployment system by overriding existing controls designed to prevent improper payments, the audit found.

This “pay and chase” approach increased the risk of overpayments, payments charged to the wrong funding source, and fraud.

Among the findings:

In a sample of 53 claimants, selected for various risk factors, a total of 18, or one-third, potentially received payments that exceeded the maximum allowed amount.

In a related look at an additional 100 claimants, 96 were improperly paid nearly $2.8 million through the state’s traditional program instead of the temporary federal CARES Act.

Another $41.2 million was paid to 8,798 claimants, whose payments appeared to be more than the maximum allowed amounts.

While labor officials said they identified this issue and adjusted claims on the state system, adjustments to federal reports have not occurred and these claims were incorrectly paid with state funds.

Further, the outdated system, in part, left state labor officials unable to provide information to support their management and response to fraudulent claims.

Officials could not account for the following:

The number of claims that were paid to fraudulent claimants before being detected.

The length of time from when claims were filed to when they were identified as fraudulent (to determine the number of weeks that payments were made).

How the claims were identified as fraudulent (for example, whether through departmental procedures or based on complaints from individuals whose identities were used by imposters to file false claims.)

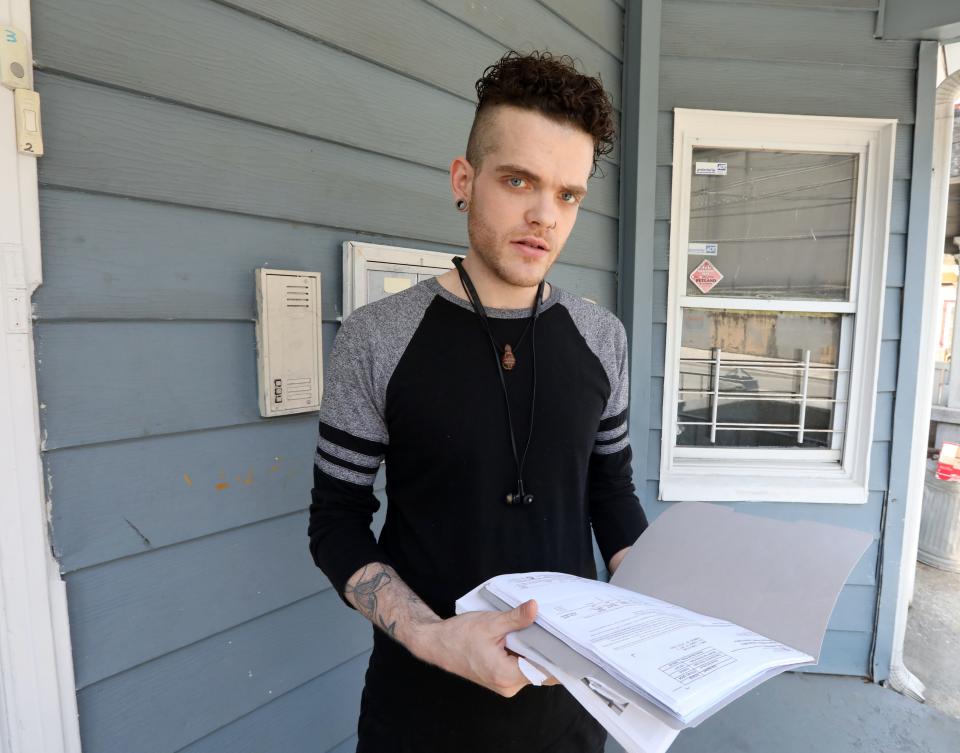

Addressing the audit, Justin Wilcox, executive director of advocacy group Upstate United, urged Gov. Kathy Hochul to refund $159 million that employers were forced to pay through an interest-assessment surcharge in September. The surcharge was related to the federal loan connected to the pandemic-era unemployment payments.

He also called on Hochul and state officials to take additional steps to resolve the unemployment system crisis detailed in the audit.

"This stunning incompetence demands immediate accountability and action," he said in a statement.

This article originally appeared on New York State Team: Why NY unemployment fraud during COVID topped $11 billion