Oak Street Health (NYSE:OSH) Is In A Strong Position To Grow Its Business

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Oak Street Health (NYSE:OSH) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Oak Street Health

How Long Is Oak Street Health's Cash Runway?

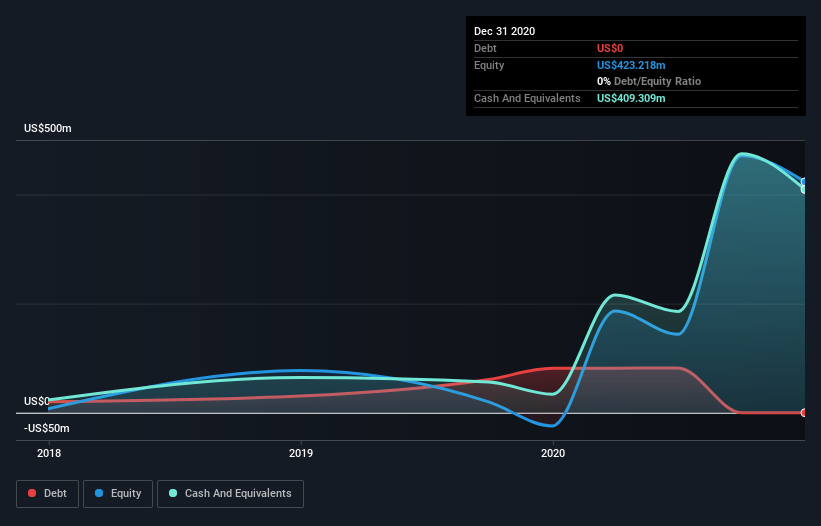

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at December 2020, Oak Street Health had cash of US$409m and no debt. Importantly, its cash burn was US$98m over the trailing twelve months. Therefore, from December 2020 it had 4.2 years of cash runway. Importantly, though, analysts think that Oak Street Health will reach cashflow breakeven before then. In that case, it may never reach the end of its cash runway. The image below shows how its cash balance has been changing over the last few years.

How Well Is Oak Street Health Growing?

At first glance it's a bit worrying to see that Oak Street Health actually boosted its cash burn by 18%, year on year. But looking on the bright side, its revenue gained by 59%, lending some credence to the growth narrative. Of course, with spend going up shareholders will want to see fast growth continue. It seems to be growing nicely. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Oak Street Health To Raise More Cash For Growth?

While Oak Street Health seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Oak Street Health's cash burn of US$98m is about 0.7% of its US$14b market capitalisation. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

So, Should We Worry About Oak Street Health's Cash Burn?

As you can probably tell by now, we're not too worried about Oak Street Health's cash burn. For example, we think its revenue growth suggests that the company is on a good path. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. Taking a deeper dive, we've spotted 3 warning signs for Oak Street Health you should be aware of, and 1 of them is significant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.