Oakmark International's Buys for the 3rd Quarter

On Dec. 6, David Herro (Trades, Portfolio)'s Oakmark International Fund released its portfolio update for the third quarter. During the quarter, the fund established new positions in Prosus NV (XAMS:PRX), UPM-Kymmene Oyj (OHEL:UPM), Open Text Corp. (TSX:OTEX) and Henkel AG & Co. KGaA (XTER:HEN) (XTER:HEN3). Major reductions to existing positions included Naspers Ltd. (JSE:NPN) and Bayer AG (XTER:BAYN), while major additions included Glencore PLC (LSE:GLEN) and Rolls-Royce Holdings PLC (LSE:RR.).

The Oakmark International Fund is a Chicago, Illinois-based global investment fund that holds a diversified portfolio of stocks in companies outside of the U.S. Managed by Herro, the fund is a subset of Harris Associates, an investment company with over $118 billion in assets under management. The Oakmark International Fund employs a focused approach of investing in relatively few individual securities that the fund managers have researched extensively by applying a consistent investment philosophy and process.

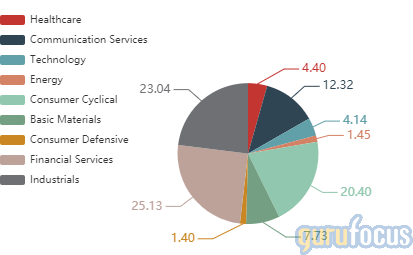

As of the quarter's end, the Oakmark International Fund was valued at $29.71 billion and held shares of 65 stocks. Its top holdings were Glencore at 4.17%, BNP Paribas (XPAR:BNP) at 4.16% and Intesa Sanpaolo (MIL:ISP) at 4.03%. In terms of sector weighting, the fund is most heavily invest in financial services (25.13%), industrials (23.02%) and consumer cyclical (20.4%).

Prosus

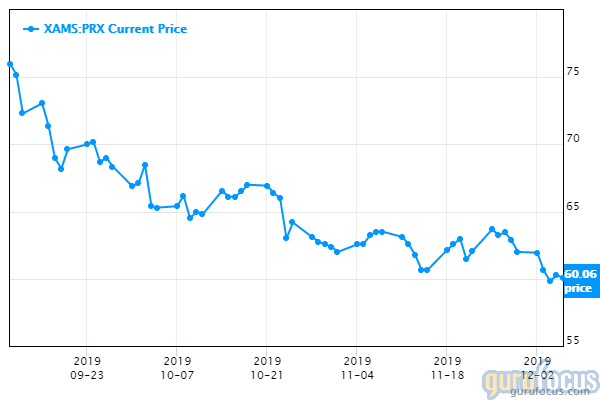

The Oakmark International Fund gained a new stake of 3,174,000 shares in Prosus NV as a result of its spinoff from parent company Naspers Ltd., impacting the equity portfolio by 0.78%. Shares were trading at an average price of 69.72 euros ($77.15) during the quarter.

Naspers is a multinational internet group based in South Africa that operates and invests in markets around the world. In mid-September, it opted to spin off the internet consumer technology investing division into Prosus, though it maintained a 73% stake. At the time of the spinoff, Prosus was valued at 100 billion euros, though its market cap has decreased to 97.7 billion euros as of Dec. 9.

Although Prosus has less than a quarter of independent history as of December 2019, it looks good on paper. The company has a price-earnings ratio of 18.73, a current ratio of 4.16 and a return on capital of 4077.53%, beating 98.97% of industry competitors.

In early December, Prosus entered a bidding war with Dutch online food delivery company Takeaway.com for control of U.K. food delivery company Just Eat. If it is successful, the acquisition will be the largest in Prosus' list of food delivery company holdings; it already has holdings in Germany's DeliveryHero (XTER:DHER), as well as India's Swiggy and Latin America's ifood.

In his third-quarter letter to shareholders, Herro wrote, "Similar to our investment thesis with Naspers, we are attracted to Prosus due to its valuable internet holdings, management's strong capital allocation track record and the stock's attractive valuation."

UPM-Kymmene

The fund established a new position of 7,864,000 shares in UPM-Kymmene, impacting the portfolio by 0.78%. Shares were trading at an average price of 24.22 euros during the quarter.

UPM-Kymmene is a Finland-based forest industry company formed from the 1996 merger of United Paper Mills LTD with Kymmene Corp. to form a leader in renewable and biodegradable paper materials, fuels and chemicals. Its areas of research have also expanded to the biomedical field, in which its has made innovations in natural alternatives to synthetic would dressing gels. As of Dec. 9, the company has a market cap of 16.12 billion euros.

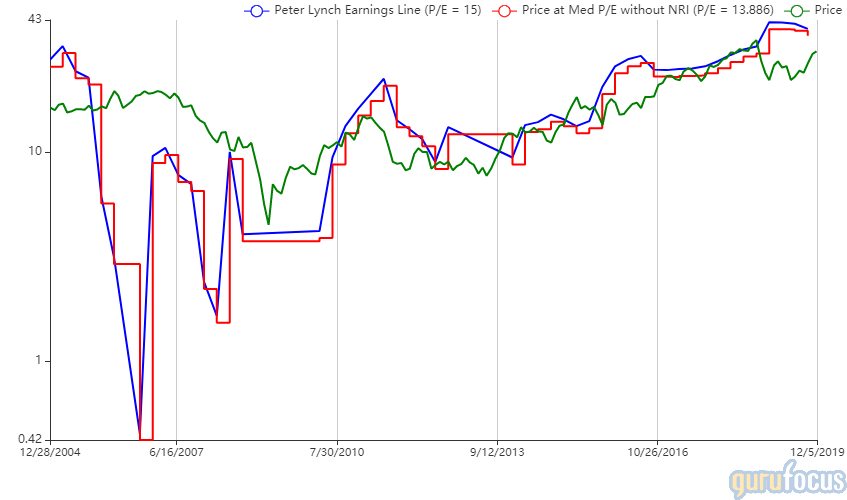

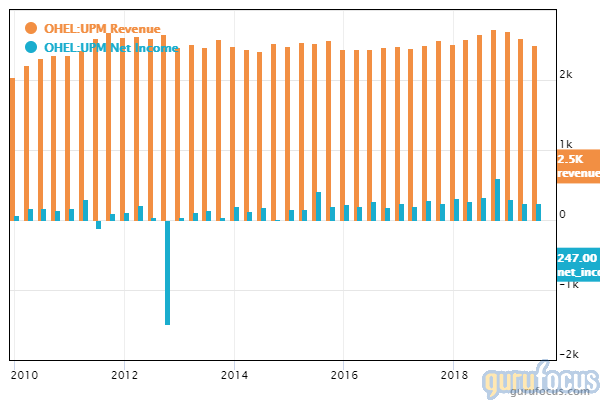

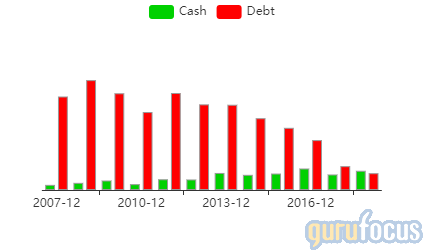

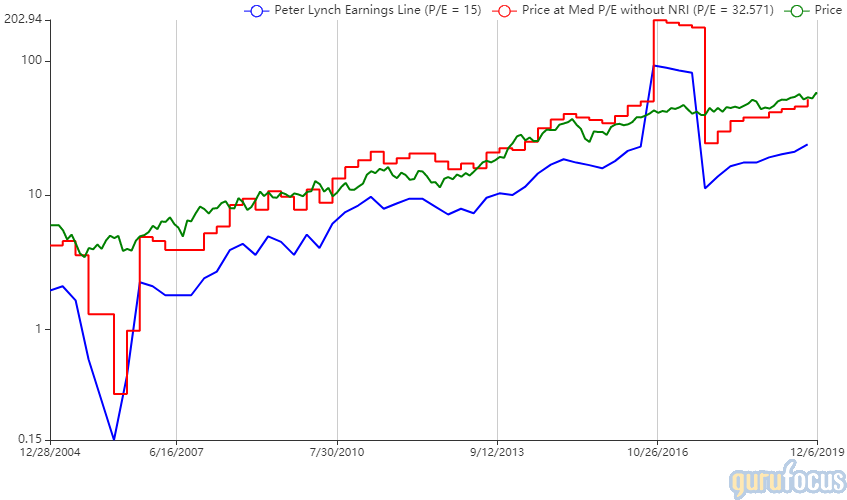

GuruFocus has assigned UPM-Kymmen a financial strength score of 7 out of 10 and a profitability score of 6 out of 10. The company has a price-earnings ratio of 11.62, a cash-debt ratio of 0.69 and a three-year earnings per share without non-recurring items growth rate of 17.6%. According to the Peter Lynch chart below, the stock is currently undervalued.

Despite slight decreases in revenue and net income in the short term, UPM-Kymmene has been decreasing its debt and increasing its cash on hand, both of which are positive signs for growth.

In the wake of decreasing profitability for the paper industry, Wall Street analysts expect UPM-Kymmene's revenue to decline in the next few years. However, the company's most promising growth potential comes not from paper, but from its steady transition to the research and development of wood-based biochemical and biomedical products, including its nanocellulose hydrogel, which serves as a storage and transport medium for promising alternatives to antibiotics.

Open Text

The fund bought 2,746,000 shares of Open Text, impacting the portfolio by 0.38%. Shares traded at an average price of 53.92 Canadian dollars ($40.73) during the quarter.

OpenText is Canada's largest software company and serves as a leader in enterprise information management. Its main purpose is to digitize processes and supply chains using a variety of analytics and artificial intelligence software. As of Dec. 9, it has a market cap of CA$15.3 billion.

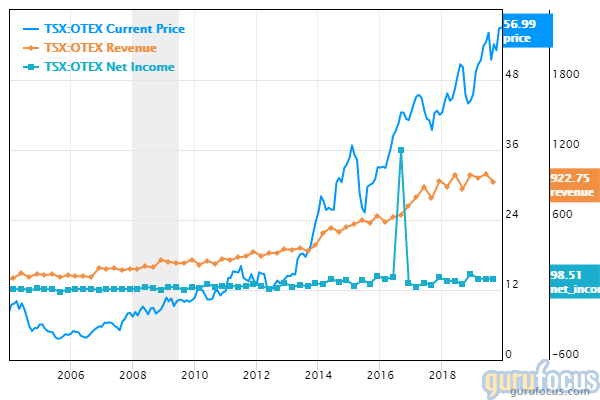

OpenText has a GuruFocus financial strength score of 5 out of 10 and a profitability score of 9 out of 10. It has a price-earnings ratio of 35.37, a cash-debt ratio of 0.35 and a return on capital of 216.17%. According to the Peter Lynch chart, the stock is slightly overvalued.

Although OpenText's stock price suffered slightly from lower revenue in the recent quarter, the company's mid-November acquisition of Carbonite Inc. (CARB), a global leader in cybersecurity, more than made up for it, as you can see in the chart below.

Henkel

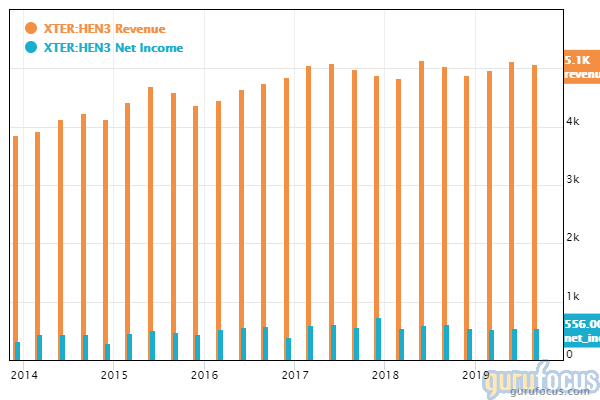

The Oakmark International Fund established a new position in Henkel, consisting of 212,000 shares of common stock (0.07% portfolio impact) and 776,000 shares of preferred stock (0.26% portfolio impact). Shares of common stock traded at an average price of 86.65 euros during the quarter, while shares of preferred stock traded at an average of 94.80 euros.

Henkel is a German manufacturer of chemical and consumer goods that is most famous for its adhesives and home and beauty care products, including Dial soaps and Loctite adhesives. As of Dec. 9, the company has a market cap of 38.61 billion euros. The majority of ordinary shares (61.2%) are held by members of the Henkel family according to a share-pooling agreement.

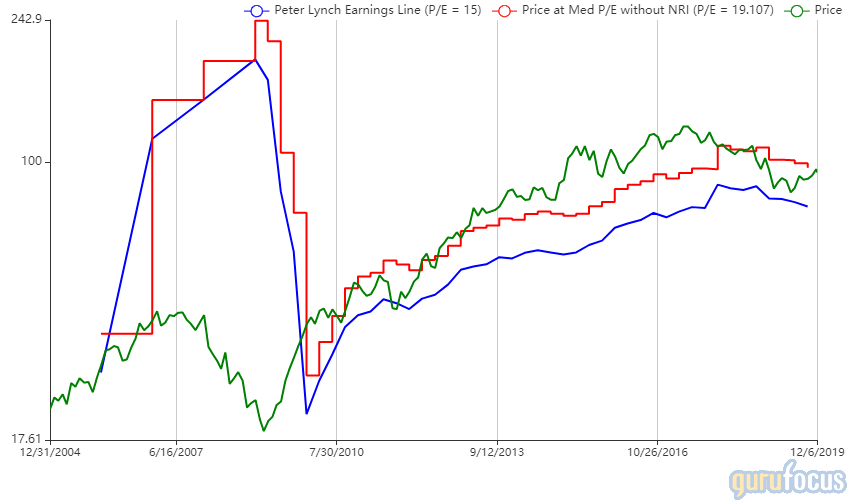

GuruFocus has assigned Henkel a financial strength score of 7 out of 10 and a profitability score of 8 out of 10. The company has a price-earnings ratio of 18.64, a cash-debt ratio of 0.71 and a return on capital of 75.99%. According to the Peter Lynch chart, the stock is fairly valued.

Henkel's third-quarter results showed a decline in sales and revenue compared to the previous quarter and the prior-year quarter, which the company attributes to an increasingly difficult competitive environment. The beauty care and adhesives businesses both saw reduced sales, with the laundry and home care businesses showing positive developments. Along with the release of its third-quarter results, Henkel confirmed positive guidance overall for fiscal year 2019, expecting organic sales growth of 0% to 2% and adjusted earnings per share in the mid-to-high single digits.

Disclosure: Author owns no shares in any of the stocks mentioned.

Read more here:

Charles Schwab and TD Ameritrade: Does the Deal Really Break Buffett's Rule on Acquisitions?

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.